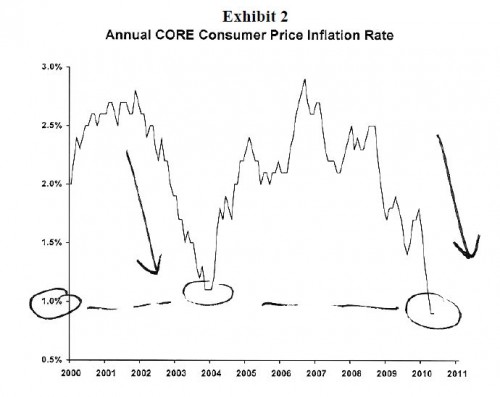

Exhibit 2 illustrates the annual core consumer price inflation rate since 2000. The aftermath of the dot-com recession forced the core consumer inflation rate to about 1 percent in 2003, nearly identical to the drop in core inflation this year. A significant and even prolonged decline in core consumer inflation rates is not at all uncommon in the early part of economic recoveries. However, as in 2003, what has captured the attention of the bond market this year is not the post-recession decline in the inflation rate, but rather just how close the inflation rate is to zero—that is, to deflation!

Real Growth... Not Inflation... Will Rule??!

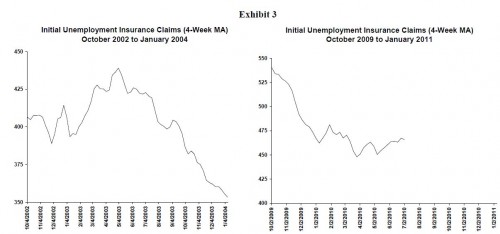

Exhibit 3 illustrates the movement in initial weekly unemployment claims in both the 2003 recovery and in the contemporary recovery. As illustrated by these charts, “deflation scares” in 2003 and today are not simply the product of a very low and declining core consumer price inflation rate, but also result from a perceived stall in the economic recovery. After hovering around 400,000 in late 2002 and early 2003, initial unemployment claims rose significantly toward 450,000 by early spring. The “combination” of a very close-to-zero and falling core inflation rate with a “perceived stall” in the pace of the recovery is what touched off the bond yield collapse (and deflation scare) in the spring of 2003. Likewise, the 2010 stall in the improving trend of unemployment claims evident during the last half of 2009 in “combination” with a 1 percent core inflation rate has produced another bond market rout this year.

Initial Unemployment Insurance Claims (4-Week MA) Initial Unemployment Insurance Claims (4-Week MA)

Ultimately, the intensity and duration of the current deflation scare will likely be determined less by how low the core consumer price inflation rate declines than by the perception of “real” economic growth. As long as the current soft patch persists, deflation fears in the bond market will linger. Should perceived real economic momentum weaken even further, deflation fright will intensify and bond yields could collapse further. Most likely, in our view, however, is an outcome similar to the 2003 recovery. The current soft patch in the economic recovery will likely improve during the balance of this year, quelling imminent deflation fears and making current bond yields appear inappropriately low.