Section

USD

133 posts

The Return of the Gold Standard

by Hubert Marleau, Market Economist, Palos Management September 5, 2025 John Maynard Keynes, the famous British economist, referred…

September 7, 2025

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Debasement: What It Is And Isn’t.

by Lance Roberts, RIA Over the past year, financial headlines continue to flood investors with doomsday predictions about…

August 6, 2025

Stablecoins: Uncle Sam’s New Best Friend... or Riskiest Gamble?

In the face of rising national debt, growing ‘fiscal dominance' shrinking foreign appetite for U.S. Treasuries, and growing geopolitical headwinds, Washington has turned to an unlikely financial ally: stablecoins.

July 28, 2025

Midyear Fixed Income, Currency, and Commodity Markets Outlook: Higher for Longer

LPL Research provides its midyear bond and commodity market outlook on interest rates, Federal Reserve rate cuts, gold, the U.S. dollar, and much more.

July 28, 2025

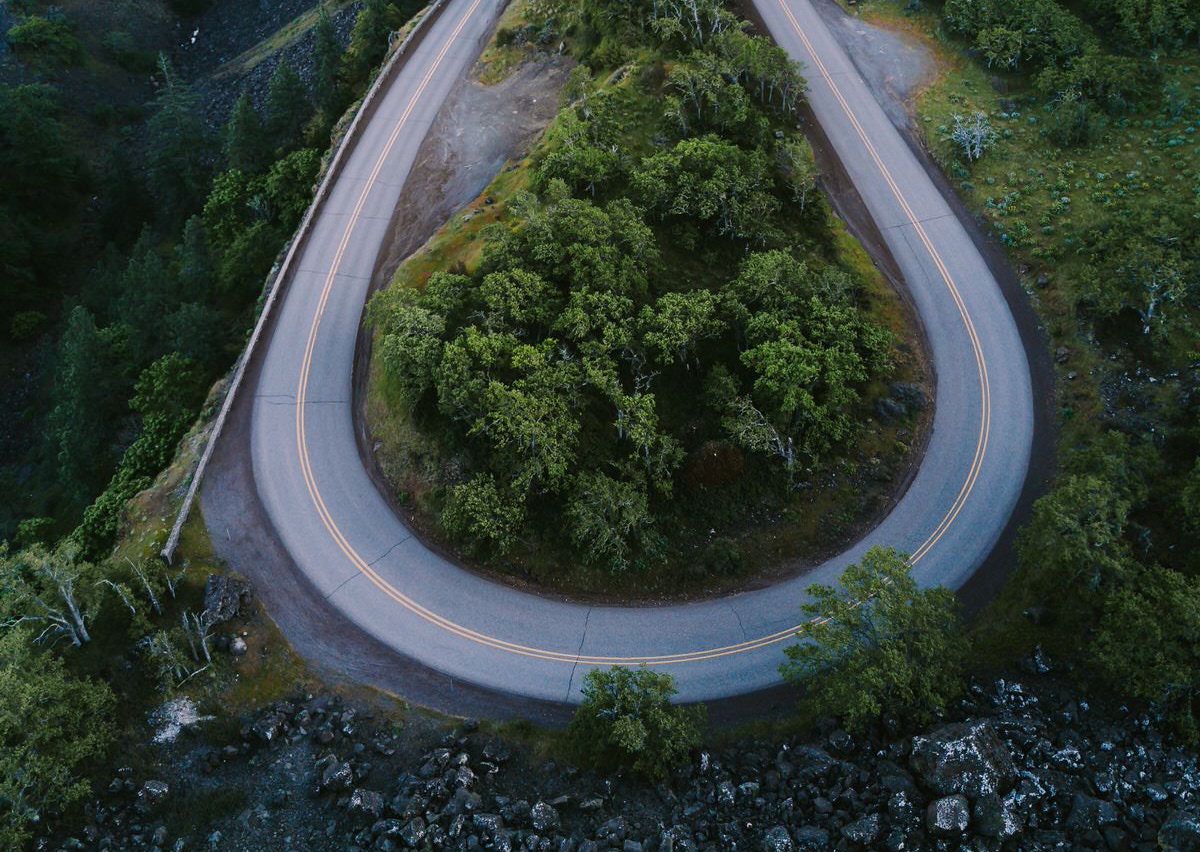

JP Morgan’s 2025 Mid-Year Outlook: A Changing Landscape Calls for Sharper Navigation

As we round the corner into the second half of 2025, the economic road may look smooth—but make…

July 18, 2025

Debt, Defense, and Denial: Why the U.S. Can’t Afford to Ignore the Fiscal Warning Signs

There’s no shortage of people warning about America’s debt problem. The real question is—why now? Why is this…

July 13, 2025

Midway Through 2025, WisdomTree Says It’s Time to Tune Out the Noise and Get Back to Basics

With so many headlines flying around—wars, tariffs, political drama—it’d be easy to lose track of what really matters.…

July 10, 2025

Midyear Outlook 2025: Pragmatic Optimism, Measured Expectations

by LPL Research Recently, the LPL Research team published the 2025 Midyear Outlook: Pragmatic Optimism, Measured Expectations. A…

July 10, 2025

Five trends to watch as US stocks hit a new high

by Invesco Global Market Strategy Office Key takeaways US stocks - The S&P 500 Index closed last week…

July 6, 2025

Sadiq Adatia’s Big Shift: Betting on What’s Been Left Behind

When you’re the Chief Investment Officer overseeing $75 billion in assets, every move matters. Sadiq Adatia of BMO…

July 5, 2025

Expand Your Mind and Your Commodity Universe

by Ben Chen, Jim Masturzo, Research Affiliates Key Points Expanding the commodity universe beyond the traditional index constituents…

July 2, 2025

The Dollar’s Death Is Greatly Exaggerated

by Lance Roberts, RIA The narrative surrounding the “dollar’s death” as the world’s reserve currency has been on…

June 25, 2025

To Hedge or Not to Hedge

by Craig Basinger, David Benedet, & Brett Gustafson, Purpose Investments The U.S. dollar (USD) has lost about 5%…

June 24, 2025

"Surreal" Market Signals and the Road Ahead: Gundlach's Mid-Year Macro Dissection

Jeffrey Gundlach, the ever-skeptical maestro of macro at DoubleLine Capital, titled his June 10, 2025 webcast1 "Surreal"—a fitting…

June 23, 2025