Section

portfolio management

301 posts

Using Systematic Equity Strategies

Using Systematic Equity Strategies by Dimitris Melas, Global Head of Equity Research, MSCI Top-down managers assess the economic…

June 8, 2016

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Diversification: Full of trade-offs, just like life

Diversification: Full of trade-offs, just like life by Brian Jacobsen, CFA, CFP®, Wells Fargo Diversification is supposed to…

June 8, 2016

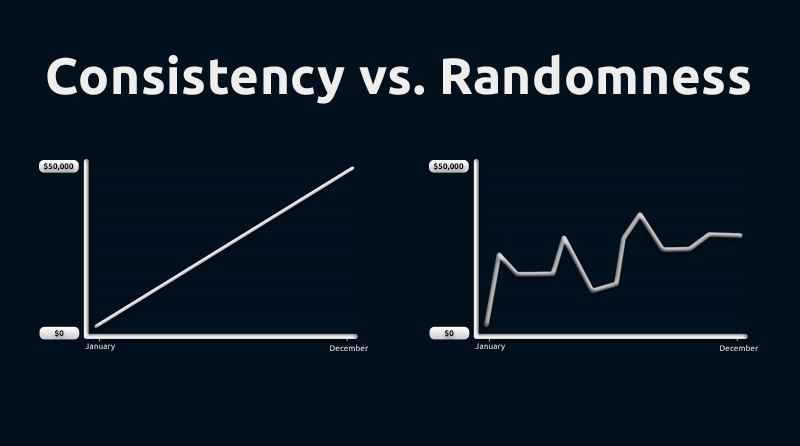

Why investors should focus on maximizing consistency in returns

Why investors should focus on maximizing consistency in returns by Colin Moore, Global CIO, Columbia Threadneedle Investments Global…

May 20, 2016

The Appropriate Portfolio vs the Optimal Portfolio

The Appropriate Portfolio vs the Optimal Portfolio by Cullen Roche, Pragmatic Capitalism “Perfect is the enemy of the…

May 12, 2016

Does the Buffett Bet Signal the End of Active Management?

Does the Buffett Bet Signal the End of Active Management? by Larry Cao, CFA, CFA Institute I bet…

May 10, 2016

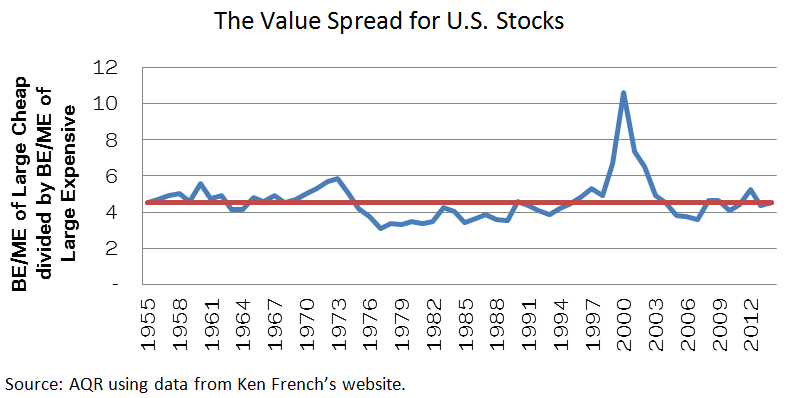

How Can a Strategy Everyone Knows About Still Work?

How Can a Strategy Everyone Knows About Still Work? by Clifford Asness, Ph. D. AQR Capital Management, Inc.…

April 24, 2016

The Huddle: Strategies for Range Bound Markets

The Huddle: Strategies for Range Bound Markets by Bob Simpson, Synchronicity Performance Consultants Managing investment portfolios, when markets…

April 12, 2016

Is Alpha Getting Choked by Philosophy Mismatches?

Is Alpha Getting Choked by Philosophy Mismatches? by Jason Voss, CFA, CFA Institute My entire series on Alpha…

April 8, 2016

When Process and Performance Disagree

When Process and Performance Disagree by Corey Hoffstein, Newfound Research Summary Due diligence often focuses on the three…

March 22, 2016

Buy and Hold is Great – It's the Hold Part That's Difficult

Buy and Hold is Great – It's the Hold Part That's Difficult by James Picerno, The Capital Spectator…

March 16, 2016

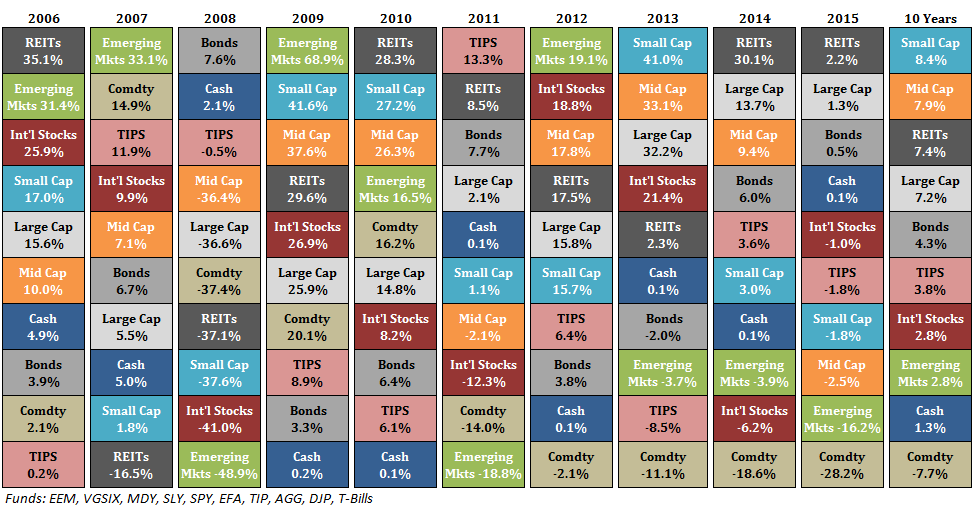

The Callan Periodic Table of Investment Returns

The Callan Periodic Table of Investment Returns by The Alts Team, Attain Capital The so called Periodic Table…

March 16, 2016

A Walk Down Risk Road with Jim Hall

A Walk Down Risk Road with Jim Hall by Cameron Webster, Institutional Portfolio Manager, Mawer Investment Management Deflation…

February 19, 2016

Cutting through the Noise of Volatile Markets

Cutting through the Noise of Volatile Markets by Colin McLean, FSIP, via CFA Institute Turbulent markets put behavioral…

February 18, 2016

Ryan Lewenza: Technically Speaking (02/17/2016)

Ryan Lewenza: Technically Speaking (02/17/2016) by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James Highlights • In…

February 18, 2016

Why “Best of Breed” Often Fails

Why “Best of Breed” Often Fails by Seth Masters and Joseph Paul, CIO, AllianceBernstein Many investors seek “best…

February 18, 2016