Section

Portfolio Construction

109 posts

Walking the Tightrope: Trend Following’s Tricky Tradeoffs

by Jim Masturzo, Partner, Chief Investment Officer, Multi-Asset Strategies, Research Affilates Key Points Trend-following strategies can offer attractive,…

May 7, 2025

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

Return Stacking: Diversification Without Sacrifice

Listen on The Move Is it possible to enhance diversification without sacrificing returns? In this episode of…

March 27, 2025

ETF Views: Factors, Alts, Derivative Onions & Bugs

Listen on The Move In this episode Pierre Daillie sits down with Tony Dong, founder of ETF…

March 25, 2025

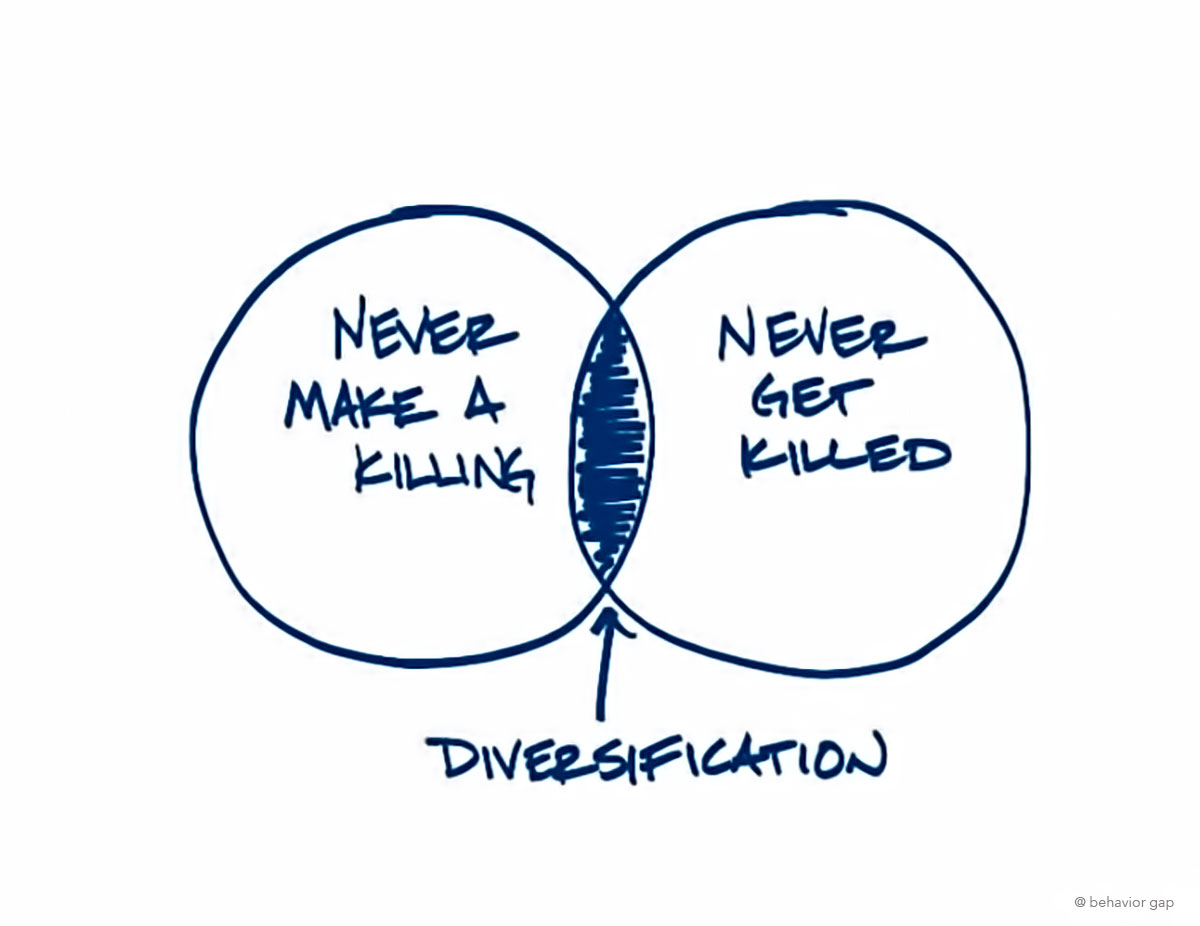

Rethinking Diversification: Navigating Correlation, Concentration, and Crisis in Modern Portfolios

Long revered as the only free lunch in finance, diversification now finds itself on trial, its once-unquestioned wisdom…

March 23, 2025

Harnessing the Power of Private Equity in a Diversified Portfolio

In the world of investing, diversification remains a cornerstone strategy for minimizing risk while maximizing potential returns. While…

March 20, 2025

Riding the Edge of Chaos: Why Advisors Must Embrace the New Era of Diversification

There’s an old saying in investing: past performance is no guarantee of future results. It’s a phrase so…

March 18, 2025

The World is Evolving. So Too Must Portfolio Construction.

Rethinking Portfolio Construction: Why 40/30/30 is the Key to Balance Since 1950, the investment portfolio has remained largely…

March 10, 2025

Beyond 60/40: How the RGBM ETF Helps Investors Keep Their Core and Expand Returns

For decades, investors have faced a fundamental challenge: how to effectively diversify their portfolios without sacrificing returns. The…

February 12, 2025

Pressing Investment Questions into 2025 with Ilan Kolet

Listen on The Move Market uncertainty, rate cuts, U.S. exceptionalism, and a potential Canadian dollar shock—are we…

February 5, 2025

Prometheus Research: Are Markets overestimating 2025 Investment Opportunities?

Listen on The Move What does 2025 have in store for investors? Join us as we…

January 17, 2025

The Seven Pillars of Resilient Portfolios – Revisiting Picton Mahoney’s BARBELL Framework

In a rapidly evolving investment landscape, where traditional stock and bond strategies often falter under the weight of…

January 2, 2025

JPM's David Kelly–Navigating 2025: Out of the Storm, Into the Fog

The 2025 Investment Outlook from J.P. Morgan Asset Management, led by Chief Global Strategist David Kelly, provides a…

December 30, 2024

UBS Unpacks the Economic and Investment Outlook for 2025

The UBS Chief Investment Office report, helmed by Paul Hsiao and Jason Draho, Ph.D., offers a comprehensive macroeconomic…

December 30, 2024

Torsten Sløk: 2025 Economic Outlook–Resilience Amid Challenges

As we approach 2025, the U.S. economy continues to defy historical norms and confound expectations. Apollo Global Management's…

December 29, 2024

How advisors can help future-proof their clients’ portfolios

Backtesting portfolios is so yesterday. After all, past performance is no guarantee of future performance. That’s why Ninepoint Partners LP, one of Canada’s leading alternative asset managers, offers advisors a novel way to test their investment strategies for what may come next. It’s happening through software called PRISM, short for Portfolio Risk Management.

November 1, 2024