Section

Strategy

2535 posts

A Deep Dive on AI: AGF Leaders Weigh In on Market Disruptions and Opportunities

Navigating AI’s Impact on Markets “We’re still in the early innings.” That’s the assessment from AGF Portfolio Manager…

April 2, 2025

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Capitalism’s Chemical Crisis Creeps Closer, Quietly

Why Jeremy Grantham Thinks We’re Poisoning Ourselves Out of Capitalism – and What Investors Must Do Next By…

April 1, 2025

The Ergodic Gambler: Why Your Portfolio is Not What You Think It Is

"[Ray] Dalio tends to say you can have 16 uncorrelated return streams. That’s just categorically untrue." Mutiny Fund's…

April 1, 2025

Trade: The Most Beautiful Word in the Dictionary

by Ben Inker Co-Head, Asset Allocation, and John Pease, Asset Allocation Team, GMO LLC The global trade situation…

March 27, 2025

Unlocking Opportunities in Ontario Real Estate

In this webinar replay, RiverRock MIC’s Nick Kyprianou offers his 30-year perspective on the factors driving the MIC investing opportunity.

March 27, 2025

Return Stacking: Diversification Without Sacrifice

Listen on The Move Is it possible to enhance diversification without sacrificing returns? In this episode of…

March 27, 2025

Denise Chisholm: Extreme Moves, Rare Signals & What's Next?

by Denise Chisholm, Director of Quantitative Market Strategy, Fidelity Investments Markets are built on uncertainty, but some weeks…

March 26, 2025

ETF Views: Factors, Alts, Derivative Onions & Bugs

Listen on The Move In this episode Pierre Daillie sits down with Tony Dong, founder of ETF…

March 25, 2025

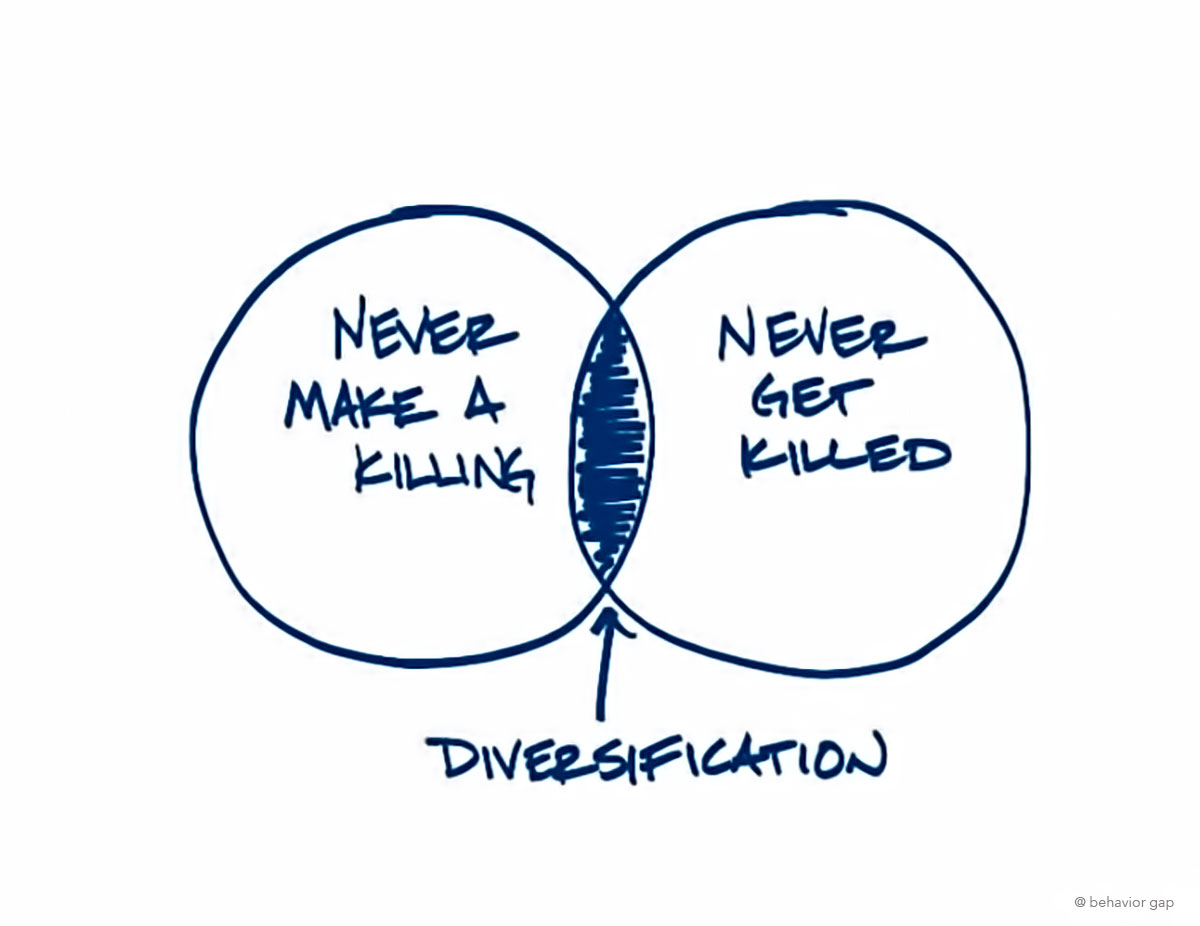

Rethinking Diversification: Navigating Correlation, Concentration, and Crisis in Modern Portfolios

Long revered as the only free lunch in finance, diversification now finds itself on trial, its once-unquestioned wisdom…

March 23, 2025

Stupidity And The 5-Laws Not To Follow

by Lance Roberts, RIA Human stupidity is the one thing you can rely on in financial markets. I…

March 20, 2025

Harnessing the Power of Private Equity in a Diversified Portfolio

In the world of investing, diversification remains a cornerstone strategy for minimizing risk while maximizing potential returns. While…

March 20, 2025

The ETF Industry's Hidden Risks with Dave Nadig

Listen on The Move Is Wall Street turning investing into a casino? Dave Nadig reveals the hidden…

March 20, 2025

The Liquidity Myth: Why the Future of Investing is Private

The landscape of wealth management is undergoing a profound shift. As traditional 60/40 portfolios come under scrutiny and…

March 18, 2025

Riding the Edge of Chaos: Why Advisors Must Embrace the New Era of Diversification

There’s an old saying in investing: past performance is no guarantee of future results. It’s a phrase so…

March 18, 2025

Simplify's Paisley Nardini: Market Outlook—Time for Tail-Risk Protection?

Listen on The Move 🔹 Is your portfolio riding the edge of chaos? - Discover why diversification…

March 18, 2025