Section

Strategy

2535 posts

The Fog Is Lifting: National Bank Investments' CIO Spots Brighter Skies—But Keeps the Umbrella Handy

After a chaotic start to Q2, financial markets seem to be catching their breath—and so is the investment…

June 27, 2025

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Flying Cars, AI Storylines, and the Future of Investing: TDAM’s Big and Bold Outlook for 2035

Let’s be honest—predicting where investing is headed ten years from now feels a bit like guessing what the…

June 26, 2025

Diversification Reimagined: Building Resilient Portfolios with NEPC’s Playbook

In the investing world, diversification is often treated as a checkbox—something to do, but not deeply understood. Yet,…

June 26, 2025

Oil moves on Middle East tensions, but other markets stay the course

by Invesco Global Market Strategy Office Key takeaways Middle East - Tensions remain high, but a sustained rise in…

June 26, 2025

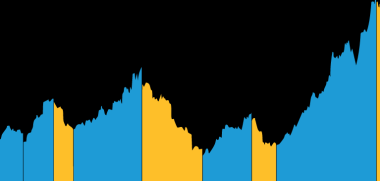

Why Long-Term Investing Beats Selling in Volatile Times

by George Smith, Portfolio Strategist, LPL Research During times like these when geopolitical headlines can be unsettling for…

June 25, 2025

How Market Concentration Shapes Passive and Active Equity Returns

by John Fogarty, Matthew Whitehurst, AllianceBernstein Over the last decade, the 10 largest stocks in the Russell 1000…

June 25, 2025

To Hedge or Not to Hedge

by Craig Basinger, David Benedet, & Brett Gustafson, Purpose Investments The U.S. dollar (USD) has lost about 5%…

June 24, 2025

Resilient Markets, Resource Rethinks, and the New Relevance of Canada

AGF's Mike Archibald, Portfolio Manager, John Christofilos, Chief Trading Officer, Pulkit Sabharwal, Research Analyst, and David Pett, Producer, weigh in on oil, commodities, geopolitics, and Canada's evolving role in global capital flows.

June 23, 2025

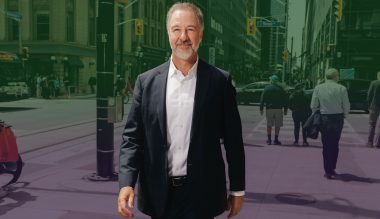

From Theory to Trillions: How DFA's David Booth Transformed Investing by Trusting the Science

Opening the Data Vault: The Birth of Modern Finance When David Booth walked the halls of the University…

June 21, 2025

"Impossible but Inevitable": What the 'One Big Beautiful Bill' Means for Markets and Foreign Investment

In the latest episode of The Open Outcry1, BMO Global Asset Management's Head of ETF & Alternatives Strategy,…

June 21, 2025

Why It’s Time to Rethink Portfolios—From the Bear Up, says Picton

When markets get messy, David Picton doesn’t just feel it—he wears it. “The bags under your eyes grow,”…

June 20, 2025

When Managed Futures Stumble, History Says: Stick Around

2025 hasn’t been an easy year for trend followers. In fact, it’s been downright brutal. According to Virtus…

June 19, 2025

Craig Basinger: Small, Medium, or Large?

by Craig Basinger, David Benedet, & Brett Gustafson, Purpose Investments One recurring discussion topic over the past few…

June 17, 2025

Independent Power Producers in an Electricity Bull Market

by Thomas Shipp, Head of Equity Research, LPL Research Rising Utility: Independent Power Producers in an Electricity Bull…

June 15, 2025

Where the Real AI Gold Lies: Investing in the Ripples, Not the Splash

by AdvisorAnalyst.com Everyone’s buzzing about GPUs, ChatGPT, and the AI arms race—but Morgan Stanley’s Counterpoint Global team is…

June 15, 2025