Section

Alternative Investing

728 posts

Bold, Confident & WRONG: Why You Should Ignore Expert Forecasts

Bold, Confident & WRONG: Why You Should Ignore Expert Forecasts by Adam Butler, Michael Philbrick, Rodrigo Gordillo, ReSolve…

May 3, 2016

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

Forget “Active vs. Passive”: It’s All About Factors

Forget “Active vs. Passive”: It’s All About Factors by Adam Butler, Michael Philbrick, Rodrigo Gordillo, ReSolve Asset Management,…

October 3, 2015

The Observation Model is the Best Defense

by Dan Varadi, Blue Sky Asset Management Sometimes the decisions we make in everyday life are good case…

July 20, 2015

Forget Active vs. Passive – It's All About Factors

by Adam Butler, GestaltU We just love a good debate, and there seems to be quite a heated…

October 6, 2014

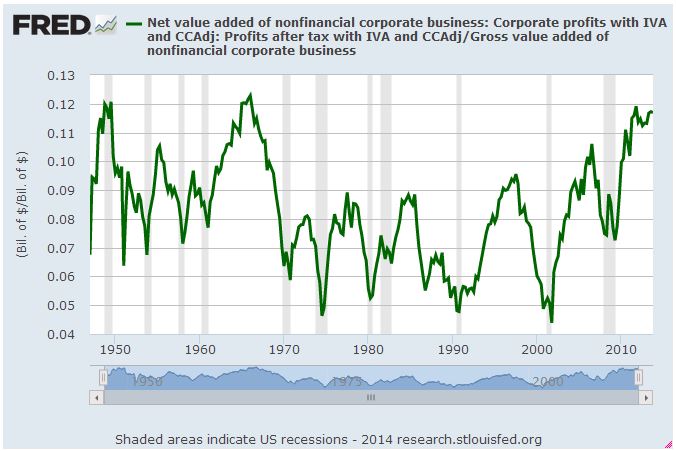

Valuation Based Equity Market Forecasts: Q2 2014

by Adam Butler, http://gestaltu.com Any analysis that relies on the past to offer guidance about the future makes…

July 19, 2014

A Look at 'Cluster Shrinkage' as a Portfolio Management Concept (GestaltU)

by Adam Butler, GestaltU At GestaltU we see ourselves as incrementalists. We aren’t so much prone to true…

April 8, 2014

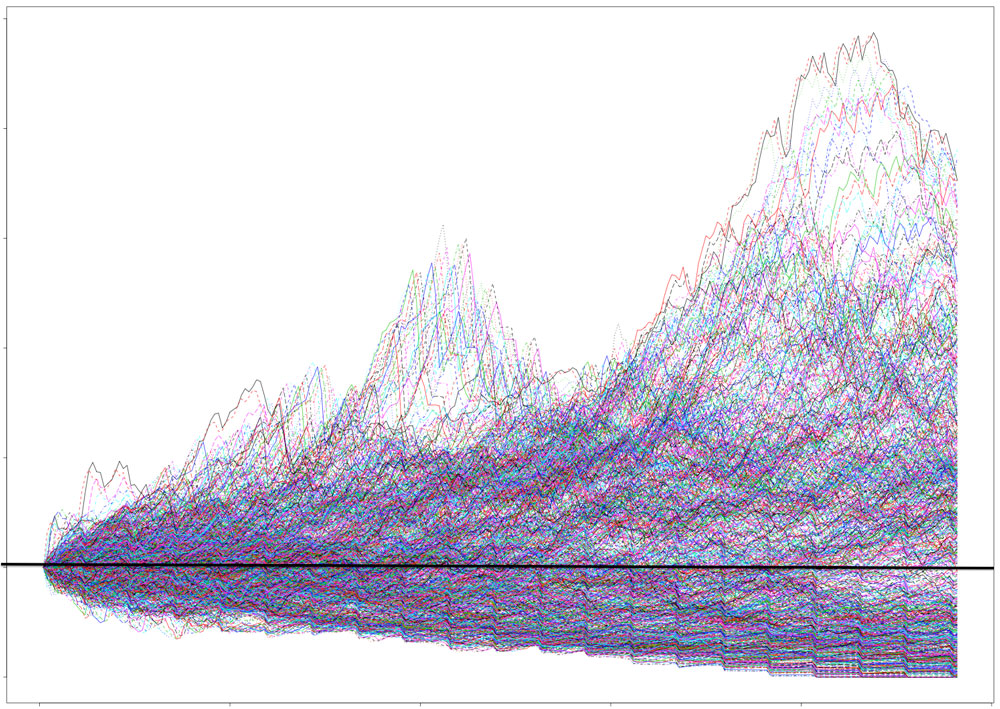

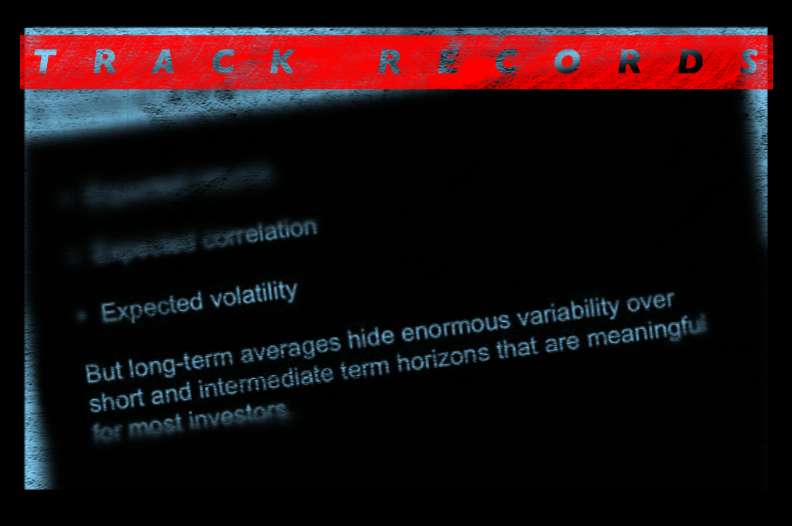

Can Investors Make Meaningful Decisions Using Track Records? (GestaltU)

NFL Parity, Sample Size and Manager Selection by Adam Butler, GestaltU We’ve been discussing issues around statistical significance…

February 25, 2014

Faber’s Ivy Portfolio: As Simple as Possible, But No Simpler (GestaltU)

by Adam Butler, GestaltU We’ve been discussing sources of performance decay, degrees of freedom, and the implied statistical…

February 20, 2014