by Adam Butler, GestaltU

We just love a good debate, and there seems to be quite a heated debate at the moment about the relative utility of passive versus active investing. Perhaps this debate is as timeless as investment management itself, but a flurry of recent studies may have finally armed passive advocates with enough ammunition to settle the argument once and for all.

The Passive Posse

First, some background on ‘passive’ investing. The progenitor of contemporary passive investing is almost certainly Bill Sharpe, who demonstrated in 1964 that, when markets are at equilibrium, the most efficient portfolio is the Global Market Portfolio. This portfolio holds all global financial assets in proportion to their market capitalization (see our article A Global Passive Benchmark with ETFs and Factor Tilts for more background on the Global Market Portfolio and implementation options). Fundamentally, Sharpe’s conclusion is based on that fact that the market cap weighted portfolio represents the current aggregate of all investor bets in the market. This is why ‘passive’ investing is often used interchangeably with market cap weighted indexing.

Market capitalization based indexing has several advantages. First, it is the only portfolio that is consistent with a belief in efficient markets. It is also definitionally the lowest turnover portfolio, as position weights in the portfolio automatically rise and fall in response to changes in relative market capitalization as constituent assets go up and down in price. (Note: This is not precisely true, as stock retirement and issuance will alter ratios through time, but this is small in proportion to total value). In addition, it is the only truly ‘neutral’ portfolio, as it is possible for every investor in the market to own this portfolio in precisely the same weight.

Despite these benefits, and the theoretical case for a passive approach, most investors do not choose to go this route. Granted, most investors are constrained by externalities such as income taxes, estate taxes, regulations, access to alternative products, higher costs, and currency preferences which prohibit passive investment in the Global Market Portfolio. These realities are augmented by behavioural biases such as overconfidence, lottery preferences, and the availability heuristic, which make it difficult for many investors to stick to a passive approach.

Instead, clients and advisors have traditionally adopted an enormous home market bias by setting a policy portfolio with majority allocations to domestic stock and bond sleeves. Then they proceed to compete on the basis of who can pick the best stocks and bonds within their home market. The fact that this represents an active approach because of the pursuit of active security selection is uncontested. But many investors may not realize that, as a result of deviating quite dramatically from the Global Market Portfolio, this methodology also represents a profound, but ultimately implicit, active bet on asset allocation.

Given that most investors default to active management for the reasons described above, among others, let’s spend a moment exploring this approach.

Active Anticlimax

Overwhelmingly, investors pursue active management with the goal of outperforming a passive index by way of astute selection of individual stocks and bonds. The defining characteristic of active management is typically ‘manager as irreplaceable expert’. Ostensibly, the manager possesses certain qualities or unique talents that allow him or her to identify superior investments. Presumably, the manager’s process can not be replicated with simple rules. Typically, active management involves detailed analysis of micro- and macro-economics, industry dynamics, themes, financial statements, and idiosyncratic value drivers of companies. In the end, the manager forms a narrative about why an investment has strong prospects, often with price targets, and monitors the investment to ensure it stays true to this narrative.

This all sounds like complicated and noble work, and it is. Unfortunately however, the track record for traditional discretionary active management leaves much to be desired. Two firm conclusions can readily be drawn from the most up-to-date literature:

- Even the best active equity mutual funds deliver no discernible alpha relative to well specified benchmarks after controlling for luck and fees, and most active managers underperform index funds before fees.

- While it’s easy to identify which managers have done well in the past, this carries no meaningful information about which managers are likely to deliver alpha going forward. In fact, there is compelling evidence that strong performance over the past 3 to 5 years negatively predicts performance over the next 3 to 5 years.

(See Blake here and here, Crane and Crotter here, Fama here, Ferri and Benke here, Vanguard here, SPIVA here, etc.)

This may be difficult to swallow, especially when your manager seems to be blowing the doors off. It’s exciting to hitch a ride on a ‘hot hand’, and self attribution bias causes us to believe that our success is a direct result of our own refined intelligence, process and efforts. The grim reality is that any intermediate term outperformance you may be experiencing is more likely due to some combination of beta (sensitivity to the overall direction of the market), and/or a series of lucky bets. In all probability, you are vulnerable to an equivalent magnitude of laggardly performance down the road.

We acknowledge that there may be a role for some types of active managers in certain portfolios, particularly managers with high levels of ‘active share’, because they may represent complimentary sources of idiosyncratic risk. However, identifying managers on this basis involves a deep understanding of existing portfolio exposures and a sophisticated understanding of how active share might deliver outperformance. Exposure to managers with high levels of active share will also result in high levels of tracking error, which many investors find difficult to tolerate.

Investors may also find sporadic active management opportunities in narrow segments of the market, like complex products or industries which require highly specialized knowledge. But this isn’t particularly helpful for most investors, because the really hard part is identifying when dislocations have occurred in a segment which might allow specialized managers to thrive. For example, even if we identify a superbly proficient manager in the small-cap gold miner space, the manager is unlikely to outperform the broader market during multi-year periods when the gold stock sector is out of favour.

In short, there is no reason for most investors to seek outperformance from traditional discretionary active stock picking in regulated mutual funds or separately managed accounts. Even the most optimistic fan of active management would struggle to find evidence of outperformance in a comprehensive survey of contemporary literature. The logical next step is to conclude that, if active managers can’t beat the benchmarks, investors should invest in the benchmarks. But what are the benchmarks anyway?

Are Benchmarks Passive?

In the 1990s the venerable Paul Kaplan at Morningstar came up with the concept of ‘Style Boxes’ to differentiate between different styles of equity managers. Style boxes were rooted in the seminal research of Fama and French (1992) which demonstrated that companies of different size and valuations represented meaningfully different sources of risk in markets. Thus the style boxes divided managers in terms of the size and value/growth characteristics of their holdings into 9 quadrants as described in Figure 1.

Figure 1. Morningstar Style Boxes

The style box framework dominated institutional and retail portfolio construction for two decades, though it was never proposed as a way to structure passive portfolios. Rather, investors typically applied the concept in an effort to ‘diversify’ active equity portfolios with investments in managers across several style boxes. The hunt was on for the best ‘large cap growth’ managers or ‘small cap core’ managers. Of course, soon after advisors and investors began seeking out managers to fit into these style boxes, they realized there were no relevant benchmarks against which they could evaluate managers in each style.

Russell investments solved the problem by creating tracking indexes for each of the Morningstar style boxes. Eventually, fund companies launched index funds to track these benchmarks, and in the early 1990s investors were offered exposure to these benchmarks with Exchange Traded Funds.

Interestingly, while benchmark strategies like ‘small cap value’, ‘mid-cap core’, and ‘large cap growth’ clearly are not ‘passive’ in the classical sense, they have come to be perceived as passive over time. After all, they represented cheap, investable, systematic alternative to active managers in each style. This was the first step in the process of broadening investors’ perceptions of passive versus active. Fortunately however, the investment management industry didn’t stop there.

Factors

Russel’s invention of tracking portfolios for Morningstar’s style boxes caused a subtle shift in investors’ understanding of ‘passive’. Suddenly there were quasi-passive options which allowed investors to take advantage of known sources of outperformance in markets. Style index products inserted themselves firmly in the middle between pure passive methods at one end of the spectrum, and discretionary active management at the other end. Even better, these approaches were simple and rules-based, making them easy for even unsophisticated advisors to utilize. That meant they could be relatively cheap. And when it became clear that managers could not be counted on to beat their style benchmarks, investors began to perceive their investable indexes as attractive alternatives.

As discussed above, the style concept grew out of the identification of systematic sources of risk and reward from the academic literature. But in reality, style boxes were a rather strange way to harness these anomalies. After all, ‘growth’ stocks under this framework were simply defined by the fact that they weren’t ‘value’ stocks. Why would investors deliberately allocate to expensive stocks instead of cheap stocks when the literature clearly demonstrated that expensive stocks persistently underperform.

Eventually investors began to adhere more closely to the academic literature by abandoning ‘growth’ tilts and adding other academically identified sources of systematic outperformance, or ‘factors’. Common factor tilts include biasing portfolios toward value metrics like book to market or price to cash-flow; momentum; or low volatility. Each of these factors has deep fundamental roots. For example, it is intuitive that investors should require (and receive) excess returns for bearing the risk of investing in companies which are neglected by other investors (value stocks). Momentum has been explained by theories related to information dispersion, informational cascades (herding), and prospect theory. The low beta effect has been linked to investors’ aversion to the use leverage to achieve return targets, and the so-called ‘lottery’ and/or ‘story’ stock effect.

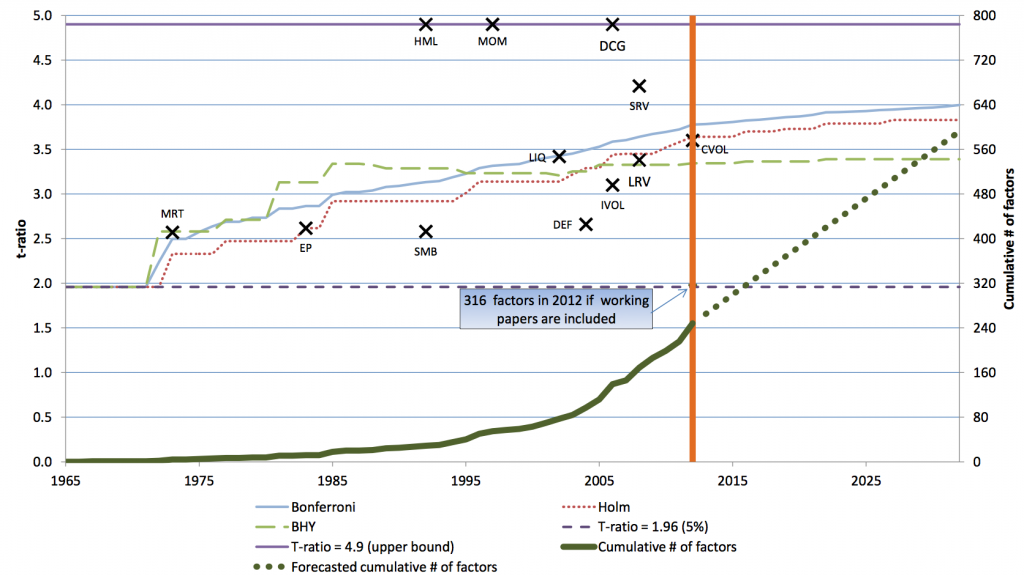

In addition to strong theoretical roots, systematic equity factors like value, momentum, and low beta have evidenced a high degree of statistical significance over very long horizons. In fact, these factors appear to be even more significant than the ‘equity premium’, which captures the excess required return on stocks relative to risk free assets as a function of stocks’ higher volatility. In other words, there is greater statistical evidence that value, momentum and low beta factors outperform the market capitalization weighted index, than there is evidence that the market cap weighted index outperforms t-bills. This is illustrated in Figure 2, extracted from Harvey, Liu and Zhu.

Figure 2. Published T-scores and statistical significance of select equity market factors at time of publication adjusted for data-mining bias.

Source: Harvey, Liu and Zhu, 2014

In Figure 2 anomalies are marked with a two or three letter code. For example, MRT is the original ‘equity risk premium’ factor first described by Fama and MacBeth in 1973. Each factor’s position along the x-axis identifies the factor’s year of discovery, while the y-axis captures the t-score, or statistical significance of the factor from the seminal paper. MRT demonstrates a T-score of about 2.6, which is of course statistically significant at the standard 5th percentile threshold (t-score of ~2.0), so we can be confident that stocks in fact do deliver higher returns than t-bills. The small cap anomaly (SMB), which posits that smaller capitalization companies outperform larger capitalization companies, is also statistically significant (for U.S. stocks, though this has since been discredited: Shumway and Warther, 1999). Note that HML, representing the value factor, is significant above a T-score threshold of 4.9, as is the momentum premium, indicating a confidence level in excess of 0.9999%. We leave it to the reader to explore some of the more obscure but robust alternative premia on the chart.

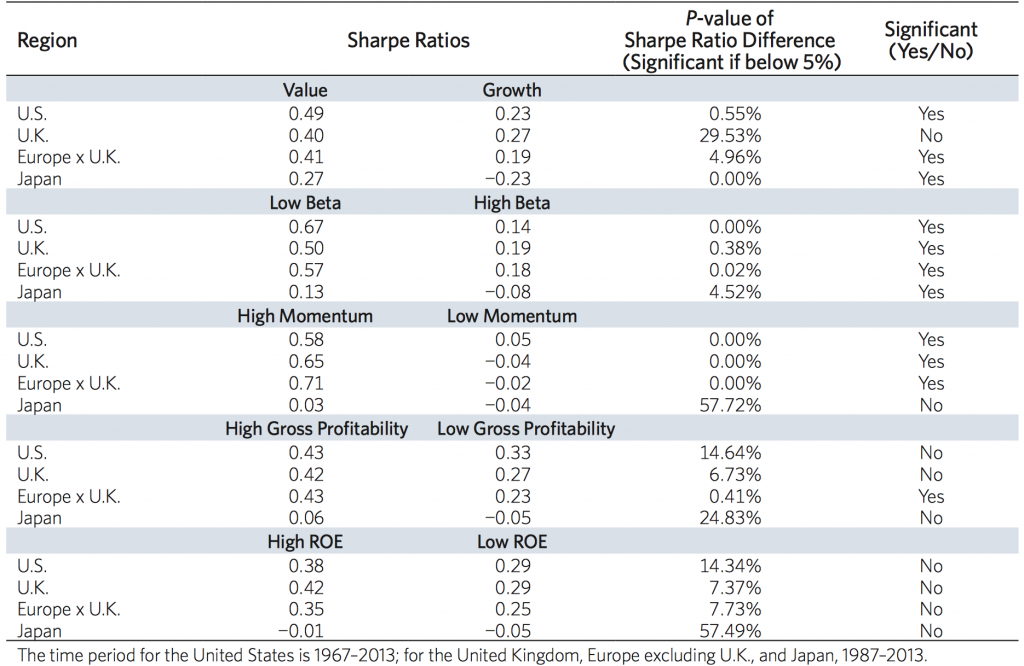

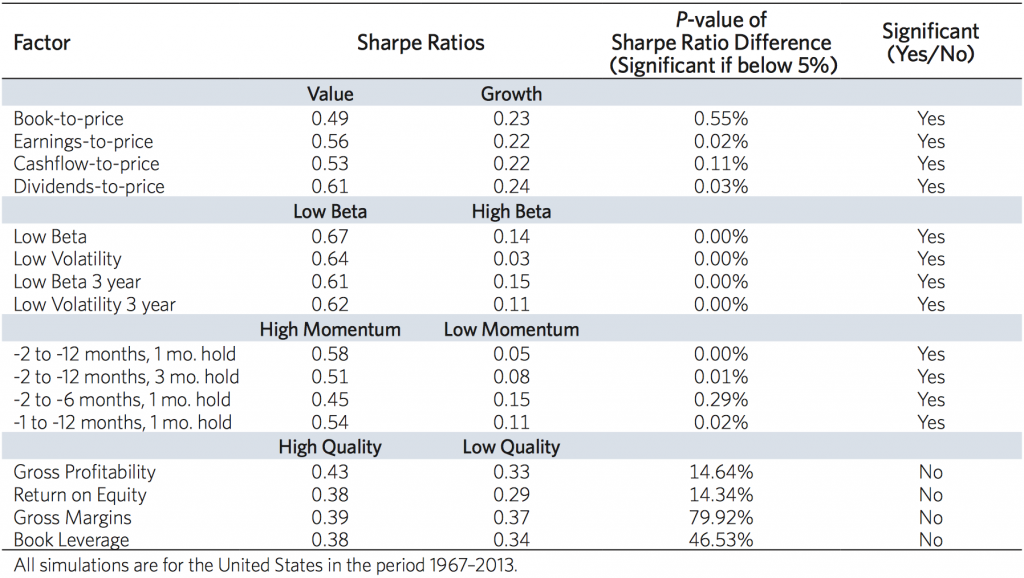

The ubiquitous Jason Hsu and Vitali Kalesnik at Research Affiliates recently published their own audit of the most often cited equity factor anomalies, including value, low beta, momentum, and quality factors (proxied by profitability and ROE). Not content to rely on published literature, they performed their own sorts using CRSP/Compustat and Worldscope/Datastream data for four major geographic regions: US, UK, Europe ex-UK, and Japan. The goal was to explore the persistence of these factors across regions as a test of robustness. They also tested alternative formulations of each factor to ensure the observed phenomena were not data-mined noise. Their results are in Figures 3 a) and b).

Figure 3a. Tests of equity factor significance across geographic markets

Figure 3b. Tests of equity factor significance across factor formulations

Source: Finding Smart Beta in the Factor Zoo, Hsu and Kelsnik, 2014

Clearly the value, low beta and momentum factors are highly robust to tests across markets and formulation, while the quality type factors do not stand up to either kind of perturbation. Interestingly, while both value and momentum effects are each not observed in one geographic market (UK and Japanese stocks respectively), value and momentum effects are observed across virtually all markets and asset classes, so we (and the authors) suspect these are outliers. Low beta stocks, on the other hand, are highly significant across all the markets studied.

Implications for Asset Allocation

So far we have largely discussed the active vs. passive debate in the context of equity market investments. However, as we’ve explored at length in previous articles (see Tactical Alpha, Adaptive Asset Allocation, Global Passive Benchmark with ETFs and Factor Tilts), this misses the forest for the trees. The asset allocation decision dominates portfolio outcomes, and therefore deserves attention.

Remember, the EMH specifies that the only truly passive approach to asset allocation is the Global Market Portfolio (GMP). So if we deviate from this portfolio, we are definitionally taking active bets against the EMH. Black and Litterman acknowledged this explicitly in formulating their Black-Litterman model, which uses the weights from the Global Market Portfolio to reverse engineer implied average estimates for asset returns and covariances.

However, there is reason to believe that, if there is any inefficiency in the investment process, it is more likely to manifest across large asset classes rather than between individual stocks or bonds. In other words, we are more likely to observe dramatic mispricings of a stock market index vs. a bond market index, or two different global stock or bond market indices, than we are to observe mispricings among individual stocks in a given market. After all, there are significant structural impediments to arbitrage away asset class level anomalies, because institutions and private investors have traditionally stuck tightly to established strategic asset allocations with very little dispersion (see Brinson (1991).

We are not alone in espousing this view. Nobel Laureate Paul Samuelson also made the case that markets were likely to be inefficient across asset classes, but efficient within them, in a letter to fellow Nobel Laureate Robert Shiller:

Modern markets show considerable micro efficiency (for the reason that the minority who spot aberrations from micro efficiency can make money from those occurrences and, in doing so, they tend to wipe out any persistent inefficiencies). In no contradiction to the previous sentence, I had hypothesized considerable macro inefficiency, in the sense of long waves in the time series of aggregate indexes of security prices below and above various definitions of fundamental values.

If it is true that investors drive asset classes far from equilibrium, then it may be dangerous to embrace the Global Market Portfolio as a passive approach to asset allocation.

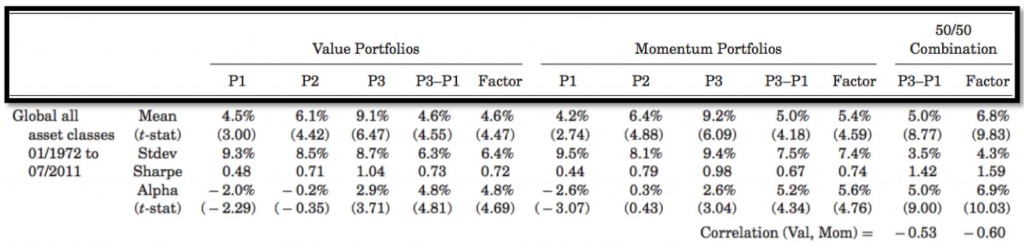

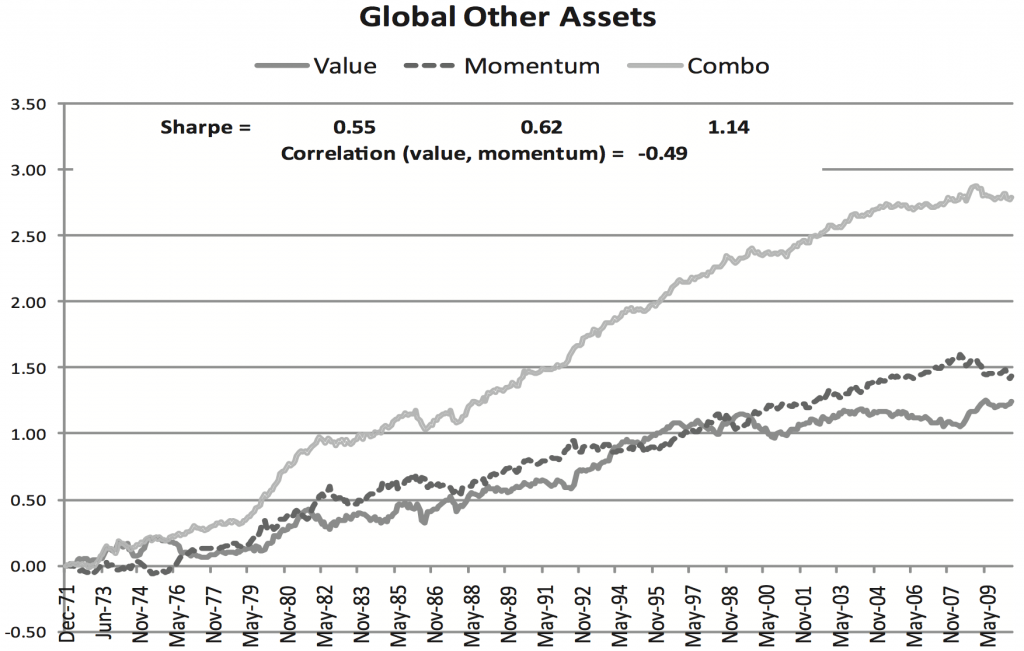

It would be helpful to apply asset level factors to systematically tilt policy portfolios toward assets with higher expected returns in the same way we might tilt individual equity portfolios. Fortunately, the same value, momentum and low beta factors that are observed in equities are also observed across asset classes. For example, Asness, Moskowitz and Pedersen observed value and momentum effects across equity markets, bond markets, commodities and futures. Figure 4 a) and b) illustrate the economic and statistical significance of these effects across all global asset classes.

Figure 4a. Global Tactical Asset Allocation Momentum and Value Return Premia

Figure 4b. Cumulative returns to global value and momentum based asset allocation strategy

Source: Asness, Moskowitz and Pedersen, Value and Momentum Everywhere (2013)

We would highlight two data points in particular in Figure 4a. First, notice the alpha T-stats for the value and momentum factors are 4.69 and 4.76 respectively, which are highly significant, and consistent with the sizes of these factor anomalies in equities. Clearly there are universal phenomena at work across global markets (and in fact this is validated by the paper). Just as interesting, the correlation between the momentum factor and the value factor is -0.6 over the 40 year period studied. Not only do you achieve higher excess returns, but the factor portfolios are substantially better in combination, with a combined zero-cost alpha of 6.9% and a T-stat of 10(!!).

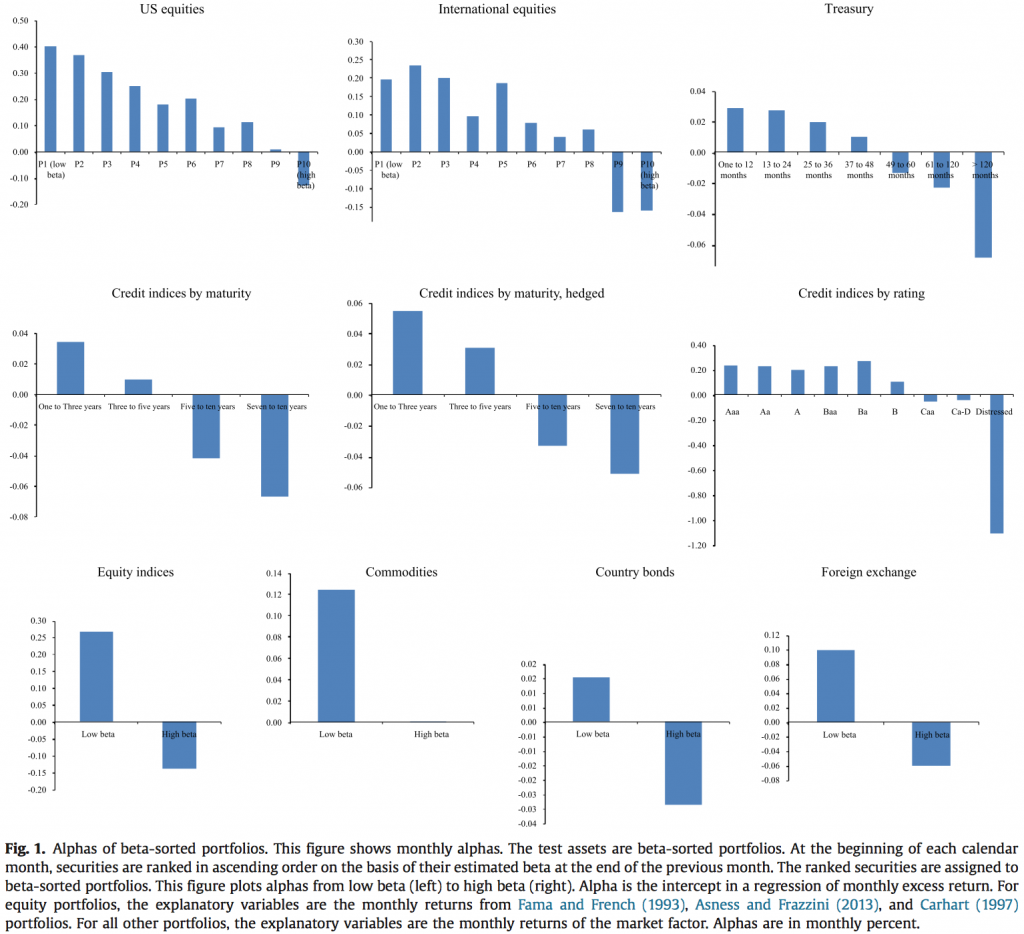

In addition to value and momentum, Frazzini and Pedersen (2014) performed a wide reaching analysis of the low beta factor across global stocks and asset classes and observed a similarly statistically significant effect in virtually every corner of the market. Figure 5 shows the performance of global asset portfolios ranked by beta. Note a nearly universal phenomenon.

Figure 5.

Source: Frazzini and Pedersen, Betting against beta (2014)

Value, momentum and low beta (low volatility) premia exist across individual securities in a market, and across global asset classes. They are observed with greater statistical and economic significance as the universally recognized ‘equity premium’. Empirically minded investors might therefore consider seeking methods of integrating any or all of these factor premia into their investment process to improve long-term results.

Putting it all together

It should be evident by now that the investment management process can not be fully captured by sorting strategies or products into active or passive buckets. While there is a strict passive portfolio, the Global Market Portfolio, virtually no single investor actually holds this portfolio in practice. By extension then, there are no truly passive investors. Rather, investors try to balance off competing objectives related to taxes, time horizon, currency risk, home market bias, and a host of other qualities to find a compromise solution. Unfortunately, there is no standard method to optimize these competing objectives, leaving many investors with hodgepodge portfolios which are unintentionally exposed to myriad concentrated and unintentional risks.

While this is clearly a suboptimal solution, investors can be forgiven for not looking toward active management for better options. Some of the most up-to-date papers suggest active mutual fund managers, despite the enormous resources at their disposal, fail to beat simple benchmarks even before fees. After fees, it’s a slaughter.

Factor tilt portfolios are consistent with the systematic, rules-based nature of passive indexing, but are constructed to take advantage of well-known and intuitive market inefficiencies to yield excess returns over time. These excess returns are highly significant; more significant even than the equity risk premium itself. Factors appear to exist because of universal behavioural or risk based phenomena across global markets, and have persisted since the dawn of markets.

It is not obvious how to allocate across global factors in a coherent manner. There are a variety of credible sources of exposure to equity factor ’tilt’ portfolios from several providers. We describe some of our favoured ETFs in our previous post on the Global Market Portfolio with Factor Tilts. These funds will generate most of their returns as a function of being exposed to equity markets in general, with factors exerting a relatively minor, but incrementally positive impact. In contrast, QuantShares manages pure market-neutral factor ETFs for US equities, but it is not obvious how to use these in traditional portfolios.

It has gotten a lot easier to gain access to asset level factors over the past few years as several firms have built promising track records with dynamic asset allocation strategies. However, many of these managers implement ‘discretionary’ approaches which are analogous to traditional active strategies. Which is to say, these managers are not systematically leveraging asset level factors, but are rather executing a more opaque idiosyncratic process which may be very difficult to analyze. In contrast, some approaches such as Adaptive Asset Allocation systematically tilt portfolios toward assets with high momentum and low beta, and can therefore be extensively tested and analyzed.

As with any investment, it pays to do your own homework and have a clear grasp of objectives, risk tolerance, and constraints. That said, some decisions are easy. For example, it’s hard to justify the use of traditional active managers. If you choose to go that route, have a very clear and quantifiable understanding about why your chosen manager(s) have an economically significant edge in their space. On the other hand, many investors would probably benefit from some exposure to systematic factors or tilts in portfolios as an excellent compromise between active and passive.

Copyright © Adam Butler, GestaltU

Disclaimer

Butler Philbrick Gordillo and Associates is part of Dundee Goodman Private Wealth, a division of Dundee Securities Ltd.

This opinions expressed are solely the work of Butler|Philbrick|Gordillo and Associates and although the authors are registered Portfolio Managers with Dundee Goodman Private Wealth, a division of Dundee Securities Ltd., this is not an official publication of Dundee Securities Ltd. and the authors are not Dundee Securities Ltd. research analysts. The views (including any recommendations) expressed in this material are those of the authors alone, and they have not been approved by, and are not necessarily those of, Dundee Securities Ltd. Assumptions, opinions and estimates constitute the authors’ judgment as of the date of this material and are subject to change without notice. The information contained in this presentation has been compiled from sources believed to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information’s accuracy or completeness.

Before acting on any recommendation, you should review the detail disclosure in this presentation and consider whether it is suitable for your particular circumstances. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this presentation, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed in this presentation. Past performance is not indicative of future results and no returns are guaranteed. Investment return and principal value may fluctuate so that an investor’s shares may be worth more or less than their original cost when sold.

This presentation is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. This presentation is intended only for persons resident and located in the provinces and territories of Canada, where Dundee Goodman Private Wealth ‘s services and products may lawfully be offered for sale, and therein only to clients of Dundee Goodman Private Wealth. This presentation is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Dundee Goodman Private Wealth to any registration requirement within such jurisdiction or country. Please note that, the individuals responsible for this presentation or their associates may hold securities, directly or through derivatives, in issuers that may now or in the future be selected through the Darwin Core Diversified Strategy.

No part of this publication may be reproduced without the express written consent of Dundee Goodman Private Wealth. Dundee Goodman Private Wealth, a division of Dundee Securities Ltd, is a Member-Canadian Investor Protection Fund. Dundee Goodman Private Wealth respects your time and your privacy. If you no longer wish us to retain and use your personal information for the purposes of distributing reports, please let your Dundee Goodman Private Wealth Advisor know. For more information on our Privacy Policy please visit our website at www.dundeegoodman.com

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.