Section

active investing

334 posts

Cutting through the Noise of Volatile Markets

Cutting through the Noise of Volatile Markets by Colin McLean, FSIP, via CFA Institute Turbulent markets put behavioral…

February 18, 2016

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

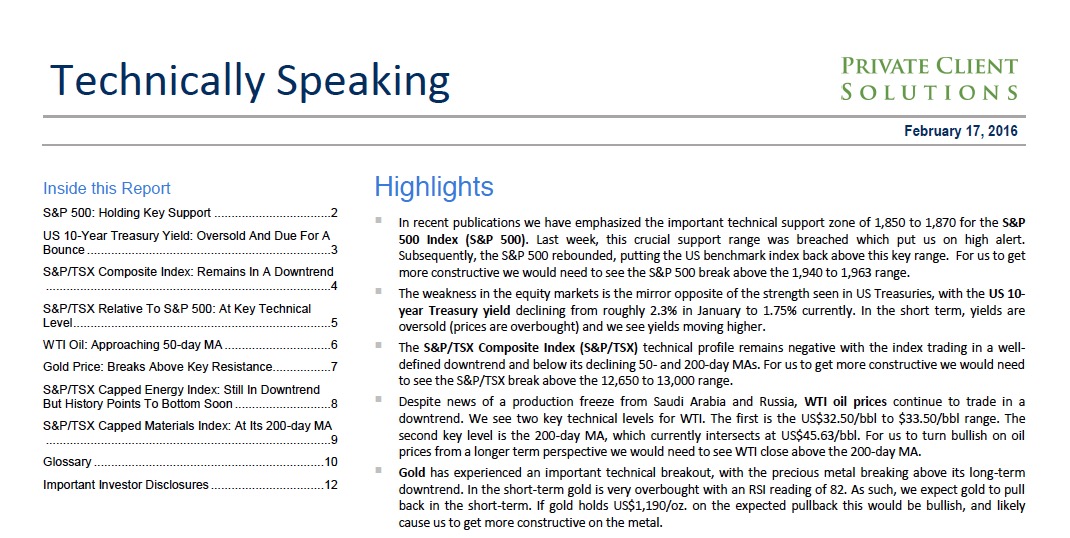

Ryan Lewenza: Technically Speaking (02/17/2016)

Ryan Lewenza: Technically Speaking (02/17/2016) by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James Highlights • In…

February 18, 2016

Why “Best of Breed” Often Fails

Why “Best of Breed” Often Fails by Seth Masters and Joseph Paul, CIO, AllianceBernstein Many investors seek “best…

February 18, 2016

No one said it was going to be easy

No one said it was going to be easy by Robin Powell, The Evidence-Based Investor Ken Fisher doesn’t…

February 17, 2016

Brooke Thackray's Market Letter - February 2016

Brooke Thackray's Market Letter - February 2016 by Brooke Thackray, AlphaMountain Investments February 10, 2015 Let’s not kid…

February 12, 2016

Cliff Asness: Sorting Fact from Fiction

Cliff Asness: Sorting Fact from Fiction Fama on Momentum by Clifford Asness, Ph. D. AQR Capital Management, Inc.…

February 12, 2016

Screening For Investment Ideas In a Bear Market

Screening For Investment Ideas In a Bear Market by Bob Simpson, Synchronicity Performance Consultants February 8, 2016 -…

February 10, 2016

New Paths to More Consistent Equity Alpha

New Paths to More Consistent Equity Alpha by Dianne Lob and Nelson Yu, AllianceBernstein Every investor approaches the…

January 29, 2016

SNAFU: Situation Normal, All-FANGed Up

SNAFU: Situation Normal, All-FANGed Up by Clifford Asness, AQR Capital Management, Inc. One common story making the rounds…

January 19, 2016

Seven Reasons Active Management Underperformed in 2015

Seven Reasons Active Management Underperformed in 2015 by A. Michael Lipper, CFA, via CFA Institute In 2015, most…

January 19, 2016

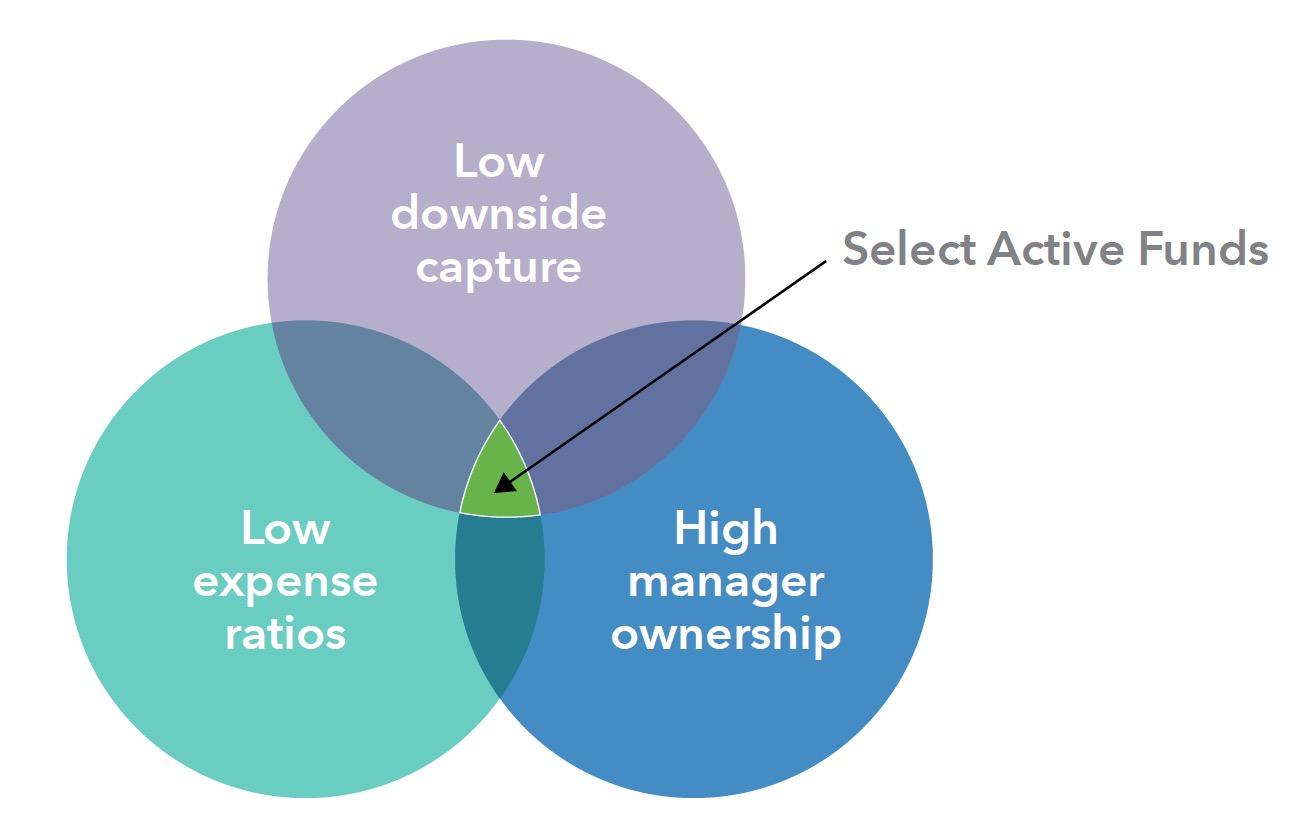

The Active Investing Advantage Depends on Three Fund Manager Traits During Bear Markets – Research

The Active Investing Advantage Depends on Three Fund Manager Traits During Bear Markets – Research Excerpted from Capital…

January 14, 2016

Passive or Active Equities: Why Choose Just One?

Passive or Active Equities: Why Choose Just One? by Dianne F. Lob, Senior Managing Director – Equities, and,…

January 10, 2016

A Stockpicker's Recipe for Success

A Stockpicker's Recipe for Success by David Larrabee, CFA , CFA Institute Fidelity fund manager Chuck Myers, CFA,…

December 29, 2015

Howard Marks: "It's not easy"

Howard Marks: It's not easy here. Oaktree Capital Management Co-Chairman Howard Marks discusses his message to investors. Bloomberg…

October 6, 2015

Forget “Active vs. Passive”: It’s All About Factors

Forget “Active vs. Passive”: It’s All About Factors by Adam Butler, Michael Philbrick, Rodrigo Gordillo, ReSolve Asset Management,…

October 3, 2015