Section

Opportunities

160 posts

TD Wealth: North American Equity Strategy Report (Q2/2014)

by Ryan Lewenza, North American Equity Analyst, TD Wealth Attached is TD Wealth's North American Q2/14 equity market…

April 14, 2014

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

What Happens After The Low-Hanging Fruit Has Been Picked?

by Charles Hugh-Smith of OfTwoMinds blog, Right now China is at the top of the S-Curve, and the…

April 2, 2014

Jeffrey Saut: "Picture This"

“Picture This” by Jeffrey Saut, Chief Investment Strategist, Raymond James March 24, 2014 Picture this: you’re an investor…

March 25, 2014

Buy Dividend Growth, Not Dividend Yield

by Frank Caruso, AllianceBernstein Chasing yield has become a challenging mission for investors in recent years. As yields…

March 13, 2014

Not All Emerging Markets Are Created Equal

by JC Parets, All Star Charts As bad as the Emerging Market space has been, not all of…

March 6, 2014

You Raised All This Money, Now What Do You Do?

You Raised All This Money, Now What Do You Do? By Brian Livingston, General Manager of SIACharts If…

March 4, 2014

Counting to a Trillion: How Sensors Are Changing the Face of Investment Opportunity

by Benjamin Ruegsegger, AllianceBernstein How well did you sleep last night? Well, for about $130, you can buy…

February 27, 2014

Agricultural Commodities (Including Coffee) Are on the Run in 2014

Agricultural ETF Rises Sharply by Hale Stewart, The Bonddad Blog Above is a chart of the DBA --…

February 25, 2014

Robert Shiller: What's The Market Telling Him Now?

Robert Shiller, recent winner of the Nobel Prize in Economic Sciences, a Yale professor and the co-creator of…

February 25, 2014

How “Emergent Phenomena” Instigate Turns in the Market

How do you deal with a risk that has never been seen before? I’m going to focus on…

February 21, 2014

An "Escape" from Bangkok: Part 2

by Paul Moroz, Mawer Investment Management Today’s post is the conclusion to last week’s An Escape from Bangkok:…

February 21, 2014

Inflation Is A Contrarian Bet

Inflation Is A Contrarian Bet by The Short Side of Long Chart 1: Inflation surprise index could actually…

February 20, 2014

Costs Matter, But Behavior Matters More

by A Wealth of Common Sense “Scale coupled with automation can basically bring costs down to zero.” –…

February 18, 2014

Where to Go if Commodity Prices Continue to Push Higher

Still Waters Run Deep by Market Anthropology Back in October and November of last year, we speculated that…

February 14, 2014

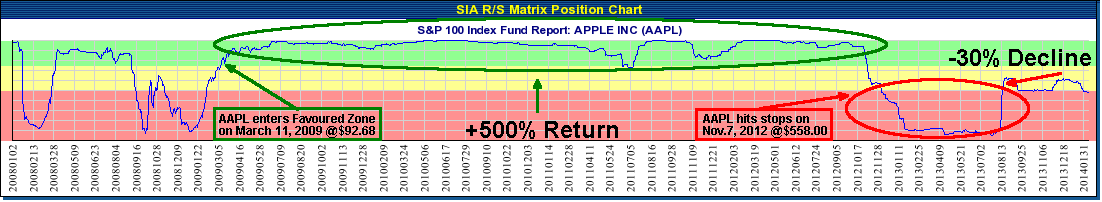

Equity Strategy: How and Why the Relative Strength Mindset Works

For this week's SIA Equity Leaders Weekly, we are going to discuss the importance of "Developing a Relative…

February 13, 2014