Section

Insight

19483 posts

James Paulsen: Some Guesses for 2014?

James Paulsen's Outlook for 2014, without further comment: We are pleased to bring you the latest edition of…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

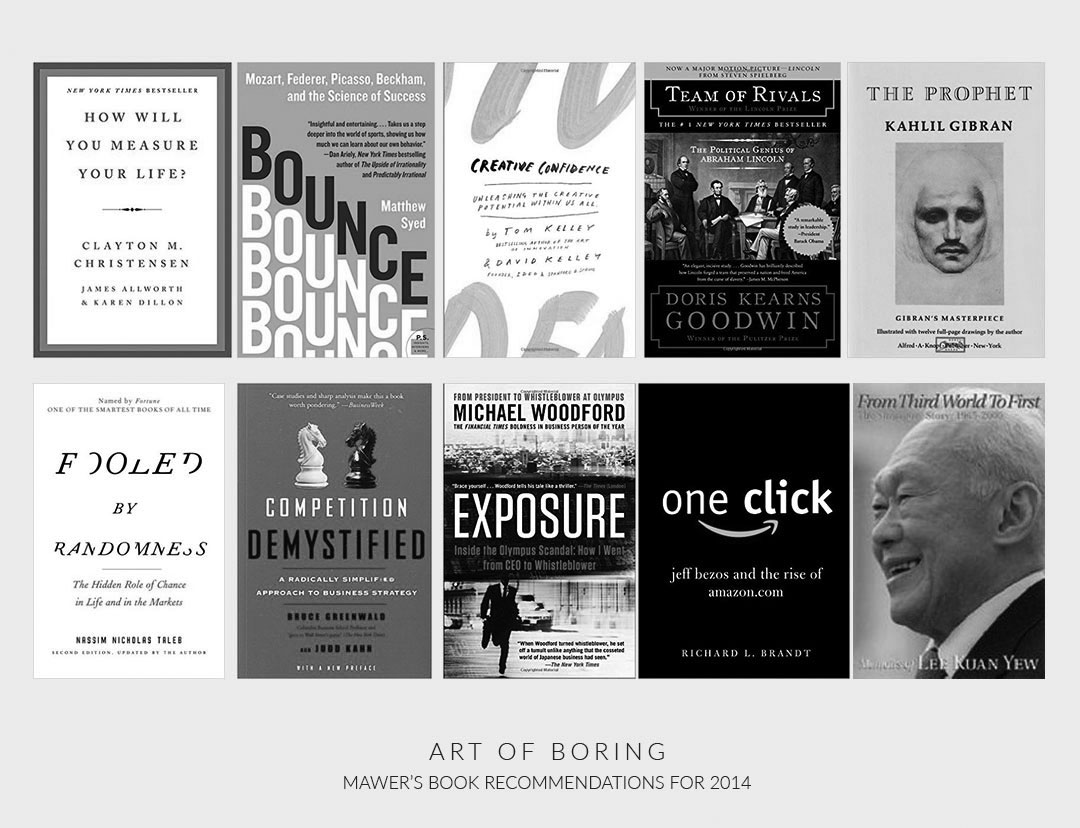

Mawer’s top 10 book recommendations for 2014

by Mawer Investment Management, via The Art of Boring Blog The beginning of each year is often a…

Mawer’s top 10 book recommendations for 2014

by Mawer Investment Management, via The Art of Boring Blog The beginning of each year is often a…

Mawer’s top 10 book recommendations for 2014

by Mawer Investment Management, via The Art of Boring Blog The beginning of each year is often a…

Andrew Thrasher: Is the Consumer Staples Sector Getting Ready to Outperform?

by Andrew Thrasher The chart I want to look at today is an interesting one because what we…

David Merkel: How Often Should CEOs Check Their Stock Prices?

by David Merkel, Aleph Blog I was doing my daily reading, when I bumped across the article, Why…

Cullen Roche: The Ten Biggest Myths in Economics

by Cullen Roche, Pragmatic Capitalism Heidi Moore asked a good question on Twitter yesterday about the most prominent…

Stock Sector Performance Since Taper Announcement

by Bespoke Investment Group With the Minutes from December's FOMC meeting due out today, traders will be looking…

Hedgers are Getting Long 10-year U.S. Treasury Futures

by Charts, Etc. Blog A few months ago, I discussed the relationship between the 10-year UST yield and…

Liz Ann Sonders: Outlook for Economy/Stocks in 2014

January 6, 2014 by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.…

Russ Koesterich: A Better Economy May Not Necessarily Be Better For Stocks

Russ K explains why an improving economy doesn’t necessarily mean another stellar year for U.S. equities. by Russ…

Bill Smead: David (Active Management) vs. Goliath (Passive Indexes)

by William Smead, Smead Capital Management Malcolm Gladwell is a fantastic writer and his new book, David and…

Jeffrey Saut: "I'm Back"

"I'm Back" by Jeffrey Saut, Chief Investment Strategist, Raymond James January 6, 2014 Well, I'm back after roughly…

Dr. Ed Yardeni: Buybacks, Great Rotation, and Melt-Up

Buybacks, Great Rotation, and Melt-Up (excerpt) by Dr. Ed Yardeni Until last year, retail investors didn’t believe that…