Section

Insight

19835 posts

Do Mom and Pop Even Care Anymore?

by Ben Carlson, A Wealth of Common Sense “Successful investing is anticipating the anticipation of others.” – John…

August 18, 2014

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Vialoux's Technical Talk - August 18, 2014

by Don Vialoux, Timing the Market Economic News This Week July Consumer Prices to be released at 8:30…

August 18, 2014

Value Stocks In Market Corrections

by The Brooklyn Investor So with all of this talk of a market correction coming and people wondering…

August 15, 2014

Gold Miners Are Holding Their Own

by The Short Side of Long Chart 1: Gold Miners have performed quite well since late May bottom Source:…

August 15, 2014

Avoid Buying Individual Stocks in Distress

by David Merkel, Aleph Blog There is a temptation, particularly among novice value investors, to throw money at…

August 15, 2014

Vialoux's Technical Talk - August 15, 2014

by Don Vialoux, Timing the Market Pre-opening Comments for Friday August 15th U.S. equity index futures were…

August 15, 2014

Why Active Managers Underperform

by Cam Hui, Humble Students of the Markets It is a tru-ism these days that active managers tend…

August 15, 2014

Seven Things to Consider About Emerging Markets Now

by Morgan Harting, AllianceBernstein After several years of disappointing returns, emerging-market (EM) equities are regaining interest, attracting flows and…

August 15, 2014

Past Performance Doe Not Guarantee Future Results

by Erik Swarts, Market Anthropology We've all read the distilled disclaimer above a thousand times before. And yet,…

August 15, 2014

Vialoux's Technical Talk - August 14, 2014

by Don Vialoux, Timing the Market StockTwits released yesterday Quiet technical action by S&P stocks this morning. $WYN,…

August 14, 2014

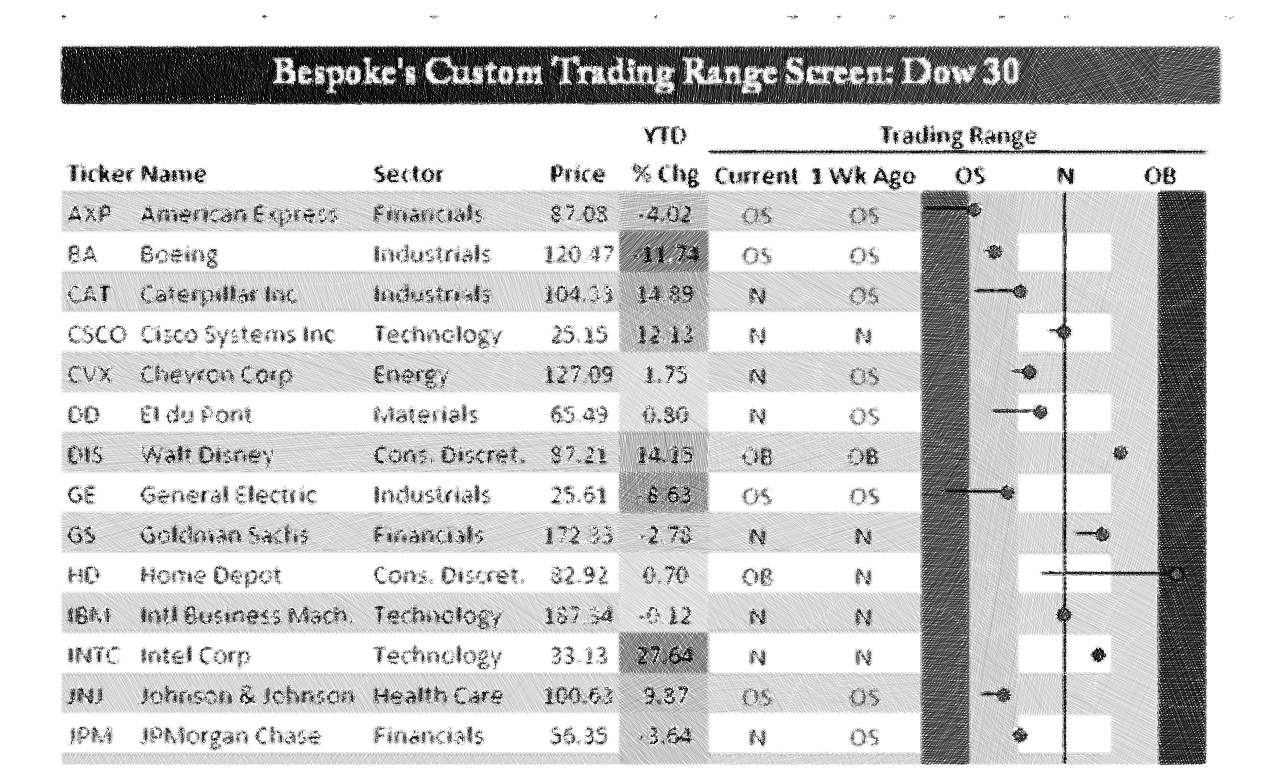

Dow Trading Range Screen (August 13, 2014)

by Bespoke Investment Group Last Thursday we noted that the market was oversold everywhere, and historically when those…

August 13, 2014

High-Yield Bonds: Call Waiting

by Ivan Rudolph-Shabinsky, AllianceBernstein High-yield bonds’ attractive income has made them popular in today’s low-rate environment. But market complacency…

August 13, 2014