by Ivan Rudolph-Shabinsky, AllianceBernstein

High-yield bonds’ attractive income has made them popular in today’s low-rate environment. But market complacency has caused callable-bond investors to ignore a lurking risk: duration extension in a rising-rate scenario.

The vast majority of high-yield (also known as noninvestment-grade) bonds are callable. At any point after a predetermined number of years following a bond’s issuance, the issuer can “call” it—meaning take the bond back from the investor before it matures. For example, a bond with a 10-year maturity is typically callable five years after issuance.

The “no call” period before the call date provides investors some protection by preventing an early call. And when issuers do call a bond, they typically pay investors a premium above the face value, which provides further insulation. But investors often overlook an important risk: the chance that a bond won’t be called, especially when interest rates rise.

Issuers Hold the Upper Hand

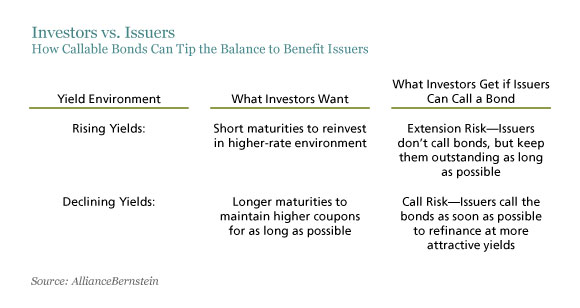

Historically, high-yield callable bonds’ yield advantage over government bonds provided a cushion against rising rates. But with this yield advantage diminished today, that cushion is not as large. At the same time, rising interest rates often dictate the decision an issuer makes with its callable bonds (Display).

If rates and yields rise enough, issuers will likely choose to not call their bonds until a later call date or simply wait until the maturity date to refinance. Investors could be left holding on to bonds they didn’t plan to own so long—bonds now trading at lower prices due to rising yields. And if the bond isn’t called, investors can’t reinvest the proceeds in newer bonds with higher yields. This is known as extension risk.

Of course, if interest rates are lower, issuers have an incentive to call bonds and issue new ones that pay lower coupon income. This cuts issuers’ interest expenses but lowers the returns for investors. There’s a good chance that a bond will be called if it’s trading at a price higher than its call price (for example, a bond callable at $103 but trading at $105).

Sometimes issuers will call a bond even if rates aren’t lower, to maintain financial flexibility. They can refinance when there’s demand from investors, and they don’t have to risk waiting until the maturity date, when market sentiment may be much worse. Issuers will only postpone a call and let the bonds extend if rates rise enough to overcome their need for flexibility in financing.

Unfortunately, it seems the market isn’t properly pricing extension scenarios into callable bonds. Because we’ve seen a long string of interest-rate declines since the high-yield market was developed, we haven’t experienced prolonged rising-rate scenarios. The result is complacency about extension risk.

Managing Extension Risk

We think that investors should focus on high-yield strategies that work to minimize extension risk. This can be accomplished through the use of derivatives such as credit default swaps (which aren’t callable) or by carefully studying bond prices, call features and maturity dates—and knowing when to avoid bonds that don’t provide enough risk compensation.

High yield may still be the best answer to today’s low-yield environment, but fully understanding extension risk and how it factors into callable bonds can reduce the chances of an unpleasant surprise for investors if rates rise.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Ivan Rudolph-Shabinsky is a Portfolio Manager of Credit at AllianceBernstein (NYSE: AB).

Copyright © AllianceBernstein