Section

Insight

19495 posts

It's Different This Time ... But It's Happened Before

It's Different This Time ... But It's Happened Before by Erik Swarts, Market Anthropology For someone carrying a…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Jeffrey Saut: Days of Yesteryear

Days of Yesteryear by Jeffrey Saut, Chief Investment Strategist, Raymond James “Return with us now to those thrilling…

What the ETF Just Happened?

What the ETF Just Happened? by Corey Hoffstein, Newfound Research Yesterday morning's trade prints weren't pretty in ETF…

As Market Fears Grow, Stay Focused on the Long Term

As Market Fears Grow, Stay Focused on the Long Term by Brad McMillan, CIO, Commonwealth Financial Network One…

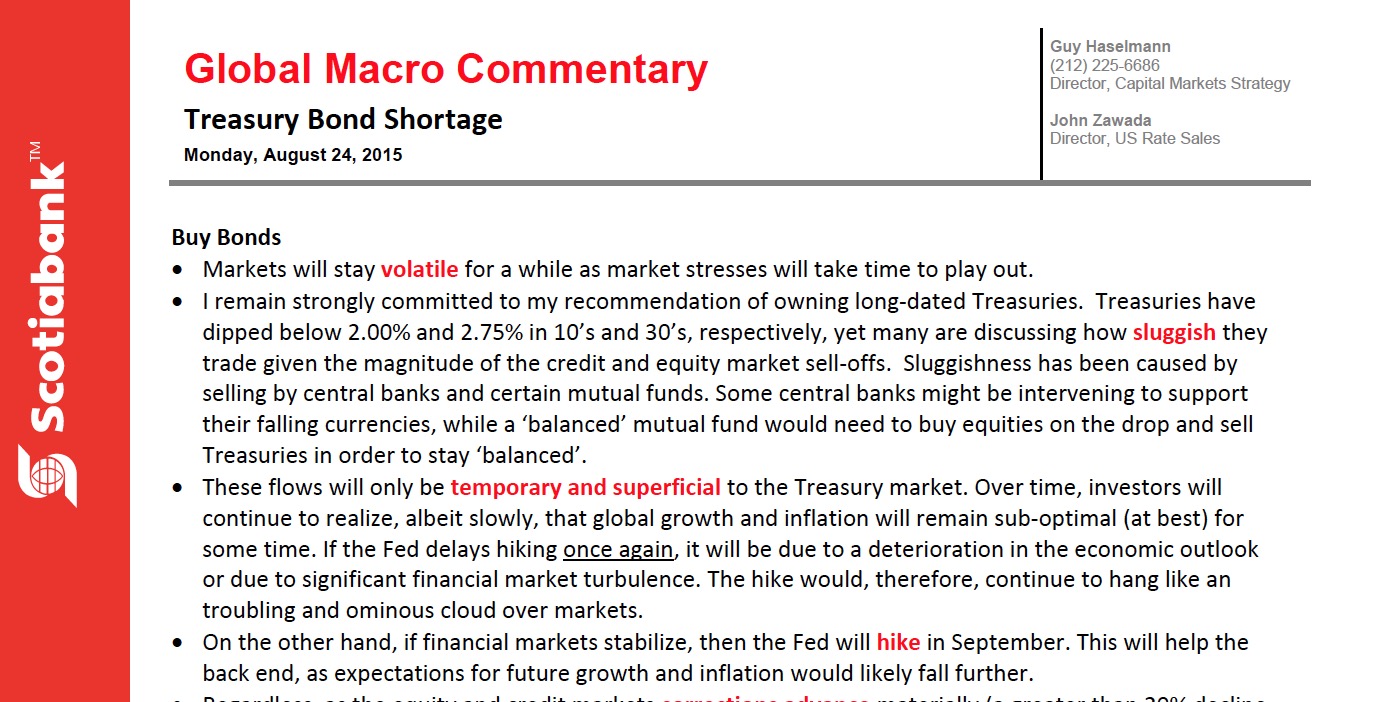

Guy Haselmann: Treasury Bond Shortage

Treasury Bond Shortage by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM Buy Bonds • Markets will stay…

Help Clients Create a Retirement Vision

Help Clients Create a Retirement Vision by Kol Birke, CFP To help clients achieve their ideal retirement, financial…

3 Simple Pieces of Advice I’ve Received About Investing

3 Simple Pieces of Advice I’ve Received About Investing by Ben Carlson, A Wealth of Common Sense This…

Where will the S&P 500 go next? Let the market tell you.

Where will the S&P 500 go next? Let the market tell you. by Adam Grimes Given the action…

Oversold Market Technicals, Market May Be Due for a Bounce

Oversold Market Technicals, Market May Be Due for a Bounce by David Templeton, Horan Capital Advisors The market…

Brooke Thackray: Video Sector Update (August 2015)

Brooke Thackray: Video Sector Update (August 2015) The North American stock markets are starting to roll over, with…

Brooke Thackray: Video Market Update (August 2015)

Brooke Thackray: Video Market Update (August 2015) The North American stock markets are starting to roll over, with…

The Sustainable Active Investing Framework: Simple, But Not Easy

The Sustainable Active Investing Framework: Simple, But Not Easy by Wesley Gray, AlphaArchitect The debate over passive versus active…

I Believe Two Things (And That Might Be Enough)

I Believe Two Things (And That Might Be Enough) by Mark Dow, Behavioral Macro Smart guys are the…

Can Indian Equities Regain Their Mojo?

Can Indian Equities Regain Their Mojo? by Laurent Saultiel, AllianceBernstein Indian equities’ post-election rally last year fizzled out…

The Key to Becoming a Top Advisor: "Focus in Motion"

The Key to Becoming a Top Advisor: "Focus in Motion" by Maria Considine King, Commonwealth Financial Network Advisors…