Section

UK

53 posts

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

Brexit: How Extreme are Market Levels?

by Mike Amey, PIMCO As we start the first full trading week after the UK’s historic vote to…

June 30, 2016

Navigating Brexit

Navigating Brexit by Tim Edwards, Senior Director, Index Strategist, S&P Dow Jones Indices Despite some warnings from volatility…

June 29, 2016

Jeffrey Saut: Take a breath

Take a breath by Jeffrey Saut, Chief Investment Strategist, Raymond James “If you can keep your head when…

June 28, 2016

Janus Capital: Brexit Stage Left

Brexit Stage Left by Janus Capital Group On June 23rd, in a nonbinding referendum, British voters decided to…

June 27, 2016

A Classic Case of Failed Socialism: What’s Next After the Brexit?

A Classic Case of Failed Socialism: What’s Next After the Brexit? By Frank Holmes, CEO and Chief Investment…

June 27, 2016

George Soros: Brexit and the Future of Europe

Brexit and the Future of Europe by George Soros, via Project Syndicate June 25, 2016 NEW YORK –…

June 27, 2016

We have a Brexit Vote. So What Happens Now?

We have a Brexit Vote. So What Happens Now? by David Rae, Russell Investments Earlier today, the results…

June 24, 2016

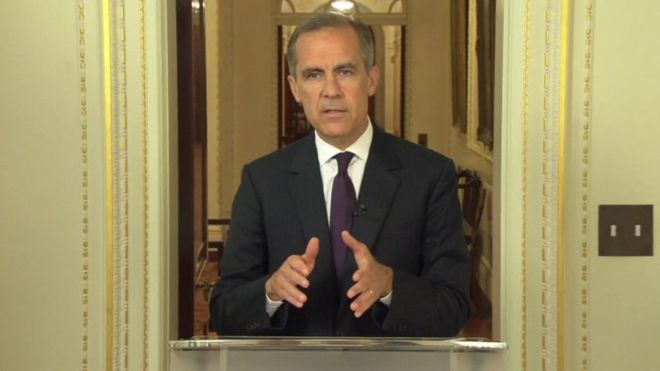

Mark Carney: The BoE is Prepared to Inject US$345bn to Help Markets

Following the 'Brexit' EU referendum result, Mark Carney, Bank of England governor, issued his official statement, below: The…

June 24, 2016

To Brexit or to Bremain? That Is the Question

To Brexit or to Bremain? That Is the Question by Neil Dwane, Allianz Global Investors As 23 June…

June 10, 2016