Divining Brexit

by , Senior Director, Index Investment Strategy, S&P Dow Jones Indices

When macroeconomic risk is dominant, as a select few narratives come to preoccupy investors, correlations increase. For example, in August and September 2015, markets worldwide were roiled in concert: on the changing winds of a collapsing oil price, and a loud “pop” in Chinese equity prices, correlations achieved multi-year highs.

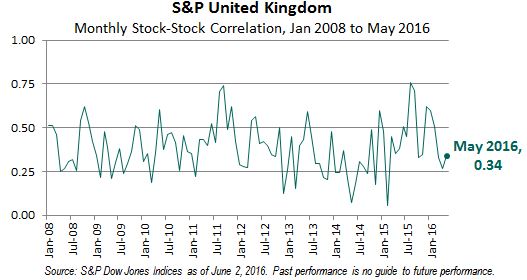

The chart below shows the average monthly correlation among the constituents of the S&P United Kingdom index:

Compared to recent levels, and to longer-term averages, UK equity correlations remain reassuringly low. This tells us that Brexit risk is not currently a major driver of equity pricing.

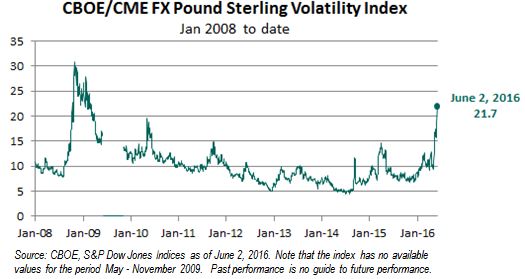

But British equities include a number of global standard-bearers with disperse operations such as BP, Unilever and HSBC. Conversely, the pound sterling has far more direct sensitivity to specifically British trade opportunities, economic growth and sovereign credit. We can also assess Brexit risk with the CBOE/CME FX Pound Sterling Volatility Index, a measure of the expected movement implied by options on the pound / U.S. dollar exchange rate.

The pound’s volatility gauge is warning of considerable trouble ahead. The index currently stands at 21.7, having more than doubled in the last few weeks – to its highest level since February 2009.

Note that the current spike in the chart began just as the June 23rd referendum date moved within the 30-day range measured by the volatility index. Currency volatility shows investors’ Brexit fears.

How can we reconcile these two indicators? Is the market unconcerned with Brexit, as equity correlations indicate? Or should we infer, as currency markets seem to be doing, an impending disruption on a level not experienced since the financial crisis?

Correlations tell us when events have come to dominate, implied volatility indicates the magnitude of misfortunes which may never happen. The key is to appreciate that Brexit is a low probability, high impact event. The low probability means that minor swings in polling have had little impact on the day-to-day fluctuations in the British equity markets. Meanwhile, the high impact is shown by the greatly increased cost of insuring against the possible disruption that a vote for “leave” might entail.

This post was originally published at S&P Dow Jones Indices' Indexology Blog