Section

Fixed Income

3288 posts

In a Little While: Market's Not Out of the Woods Yet

September 3, 2013 by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

David Merkel: Most of the Time, Rules Work ... What About When They Don't?

65% of the time, the rules work. 30% of the time, the rules don’t work. 5% of the time, the opposite of the rules works.

The Economy and Bond Market Radar (September 2, 2013)

The Economy and Bond Market Radar (September 2, 2013) Treasury yields moved lower this week. This was particularly…

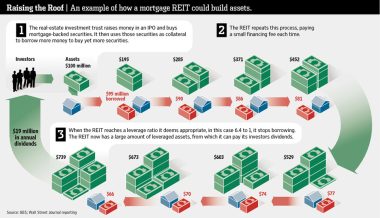

Jeff Gundlach Likes Mortgage REITs Now

By Michael Aneiro, Barrons Speaking on CNBC just now, onetime mortgage REIT hater Jeff Gundlach of DoubleLine Capital was…

William Smead: Forrest Gump Stock Market

by William Smead, Smead Capital After watching “Forrest Gump” for about the thirtieth time recently, I realized that…

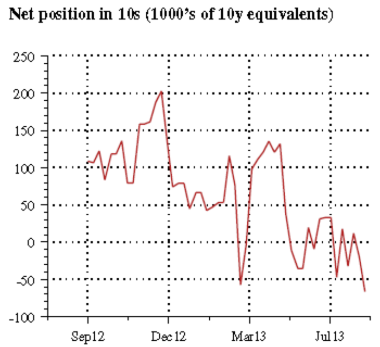

Speculative Positions in Treasuries Are Now Net Short and Growing

by Sober Look Speculative money has become visibly short rate products. As discussed this weekend (see post) there…

Are Stocks Too Expensive?

In response to recent questions about whether the stock market is overvalued, Russ gives two reasons why equity…

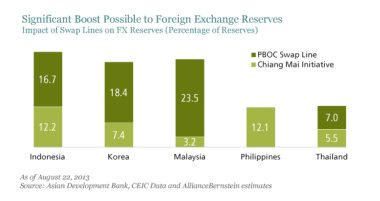

Is Asian Turbulence a Win for China?

by Anthony Chan, AllianceBernstein While this week’s sell-off in Asian currency and bond markets does not, as yet,…

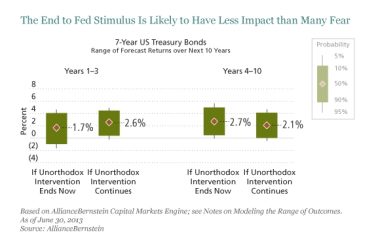

How Much Will Fed Tightening Hurt?

by Seth J. Masters, AllianceBernstein Seth J. Masters (pictured) and Ding Liu A lot of people worry about what…

Jeffrey Saut: Random Thoughts in the Summer Doldrums

Random Thoughts in the Summer Doldrums by Jeffrey Saut, Chief Investment Strategist, Raymond James August 26, 2013 On…

Is the Treasury Sell-Off Overdone?

by Sober Look ETF Trends recently published an article called "Treasury ETFs: The Ultimate Contrarian Trade" (here). It…

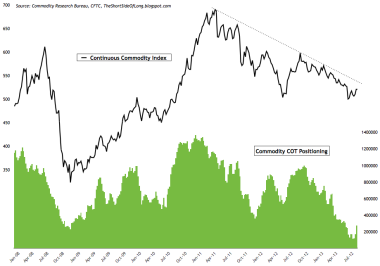

Fund Managers Are Starting to Add to Commodities

by Short Side of Long Weekend Sentiment Summary (August Week 4) Equities Last weeks sentiment update was not…

The Economy and Bond Market Radar (August 26, 2013)

The Economy and Bond Market Radar (August 26, 2013) Treasury yields were mixed this week as the long…

The Two Hardest Things To Do in Institutional Portfolio Management (Merkel)

by David Merkel, Aleph Blog In institutional portfolio management, the two hardest things to do are to buy…

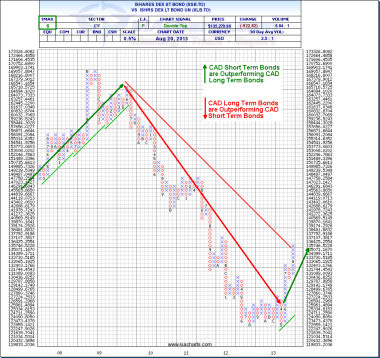

Technical Analysis: Long-Term Interest Rate Direction Has Changed Significantly

by SIACharts.com For this week's SIA Equity Leaders Weekly, we are going to take a look at a…