Section

Corporate Debt

139 posts

2020 Mid-Year Outlook: Corporate Bonds

by Collin Martin, CFA, Fixed Income Strategist, Schwab Center for Financial Research Key Points Investment-grade corporate bonds: Consider…

June 28, 2020

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Michael Greenberg: Rebalance? Yes, but where?

Michael Greenberg, Vice-President and Portfolio Manager, Franklin Templeton Multi-Asset Solutions joins us to talk about his perspective…

May 7, 2020

Canary in the Coal Mine

by Brad Tank, Chief Investment Officer—Fixed Income, Neuberger Berman The credit market has lagged while equities have rallied—is…

May 6, 2020

Fixed-Income 2020: The Year of the Sequoia (Call Notes and Replay, April 30, 2020)

by Bill Housey, Senior Portfolio Manager, First Trust Portfolios Summary notes and conference call replay for “Fixed-Income 2020:…

May 4, 2020

What Happens When a Corporate Bond Issuer Defaults?

by Collin Martin, CFA, Fixed Income Strategist, Schwab Center for Financial Research Key Points Corporate defaults are likely…

April 23, 2020

What Plunging Oil Prices Mean for Energy Bonds

by Gershon Distenfeld, Co-Head, Fixed Income, AllianceBernstein On April 20, the price of oil skidded into negative territory…

April 23, 2020

Guy Haselmann: A Thoughtful Look at World Order After COVID-19

Our conversation with Capital Markets Strategist, Guy Haselmann, on COVID-19's market, economic and social shock, and contemplating…

April 15, 2020

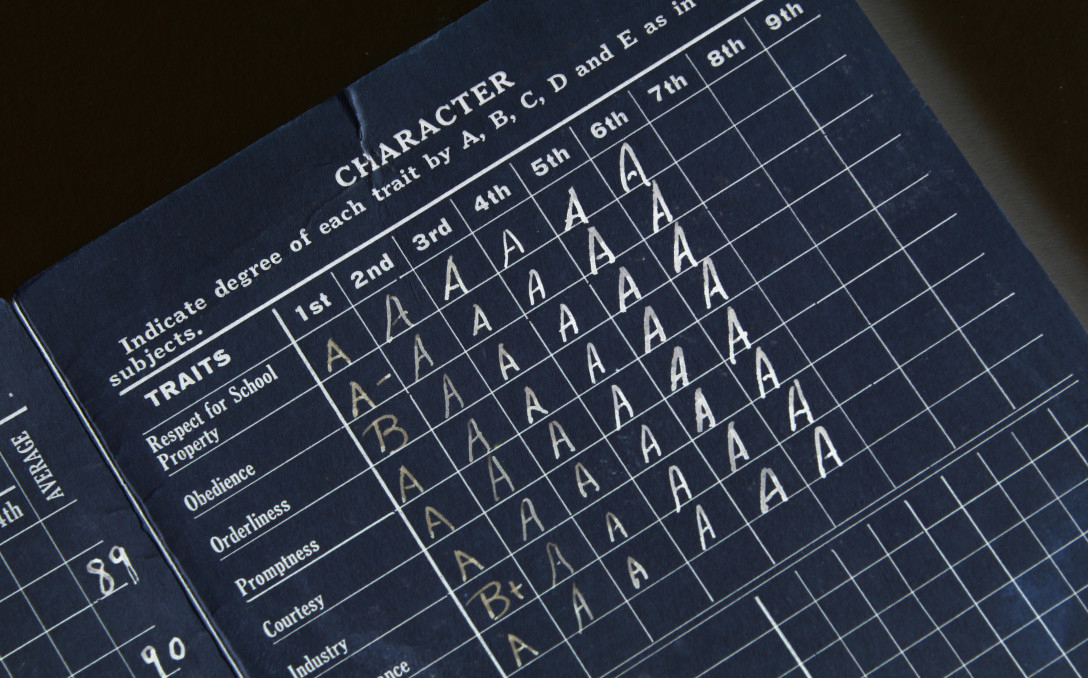

What Happens When a Corporate Bond is Downgraded?

by Collin Martin, CFA, Fixed Income Strategist, Schwab Center for Financial Research What should you do when your…

April 14, 2020

Sandy Liang: The Correction/Opportunity Set of 2020's Bond and Credit Market Crisis

Sandy Liang, Portfolio Manager of the Purpose Credit Opportunities Fund, Purpose Investments shares his expert critique on…

April 14, 2020

Mark Noble: Did ETFs Pass the Pandemic Sell-Off Test?

Mark Noble, EVP, Horizons ETFs, and Head of ETF Strategy joins us for an in-depth…

April 13, 2020

GMO: Shelter in Credit

by Jon Roiter, Co-head of Credit Opportunities, GMO LLC Jon Roiter is co-Portfolio Manager of GMO’s Credit Opportunities…

March 29, 2020

Coronavirus: Riskier Fixed Income Prices Swoon

by Collin Martin, CFA, Fixed Income Strategist, Schwab Center for Financial Research Key Points Concerns that the spread…

March 6, 2020

Corporate Debt Is At Risk Of A Flash Crash

by John Mauldin, Mauldin Economics The world is awash in debt. While some countries are more indebted than others,…

August 26, 2019

Negative is the New Subprime

by Michael Lebowitz, CFA, and Jack Scott, CFA, 720 Global Research What is nothing? What comes to mind…

August 15, 2019

US Corporate Cash Is Down: Should Investors Worry?

by Sharat Kotikalpudi Director, Quantitative Research, Multi-Asset, and Caglasu Altunkopru, Head, Macro-strategy, Multi-Asset, Alliance Bernstein The recent decline…

July 25, 2019