Section

Bonds

1706 posts

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

We Are All Active Investors – Part 2

by Cullen Roche, Pragmatic Capitalism Early last year I wrote a post describing the illusion of “passive investing”.…

August 13, 2014

Ignore Yield

by David Merkel, Aleph Blog Yield is not an inherent feature of an asset. Why? Dividends can…

August 8, 2014

Interesting Levels for Silver and Long Duration Bonds Have Further Implications

by SIACharts.com For this week's SIA Equity Leaders Weekly, we are going to look back at both the…

August 8, 2014

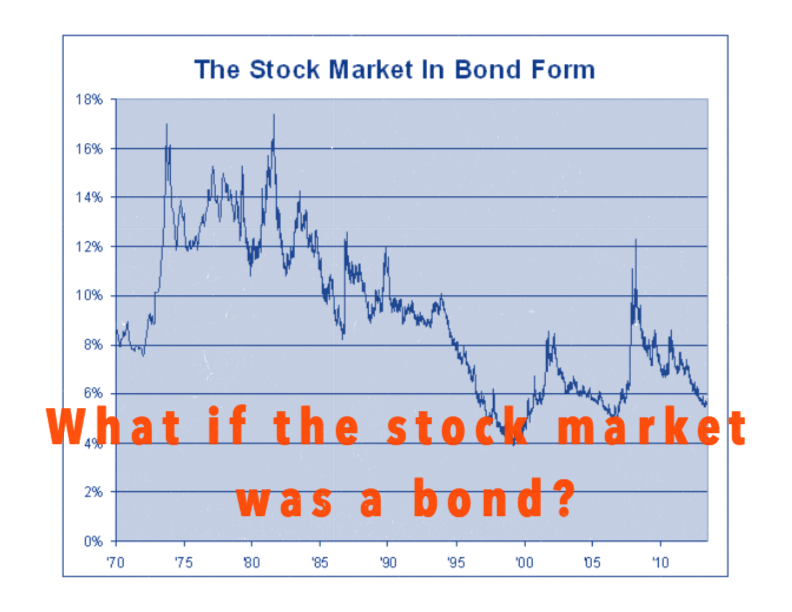

Why To Beware Asset Class "Cross-Dressing"

At a time of ultra-low bond yields and more compressed expected equity returns, investors are using their stock…

July 30, 2014

The Outlook for Yields

July 02 2014 As U.S. economic growth gathers pace, yields on 10-year U.S. Treasuries should shift higher over…

July 4, 2014

Avoid Illiquidity

There are several reasons to avoid illiquidity in investing, and some reasons to embrace it. Let me…

July 3, 2014

When Was the Last Time Treasury Yields Were This Low?

by Sober Look We've had an unprecedented compression in US (and global) government bond yields in a short…

May 16, 2014

Yes, Stocks and Bonds Can Rise Together

by A Wealth of Common Sense “Some men think that rules should be made of cast iron; I…

May 9, 2014

Putting the Plunge in Eurozone Yields into Perspective

by Dr. Ed Yardeni More surprising than the rally in US Treasury bonds is the plunge in Eurozone…

May 9, 2014

The Rebalancing Debate Isn't Much of One

by James Picerno, Capital Spectator Michael Edesess questions the notion of a “rebalancing bonus,” wondering if it’s a…

May 8, 2014

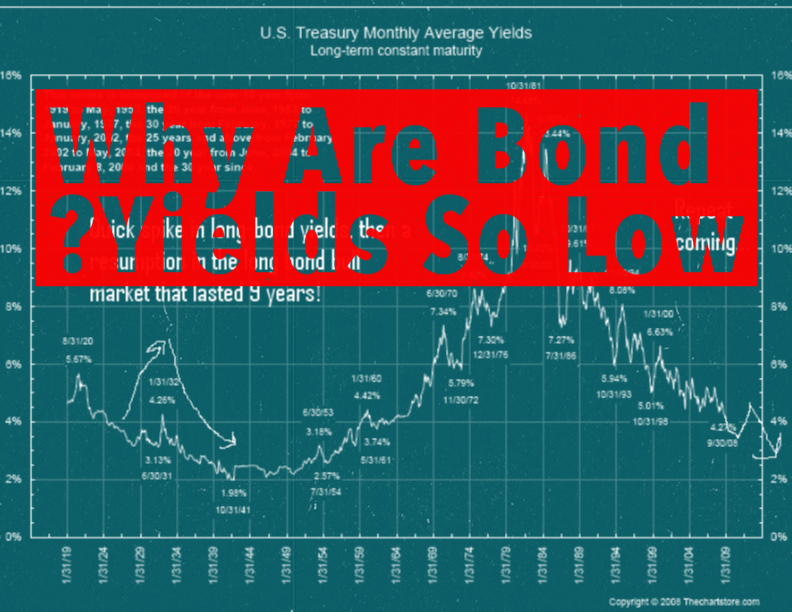

Louis Vincent Gave: Why Are Bonds Yields So Low?

by Louis Vincent Gave, Gavekal Research Why Are Bond Yields So Low? As long as men continue to…

May 7, 2014

Want to See The Markets Get Confused? Even Lower Interest Rates

by Market Anthropology The most fatal illusion is the settled point of view. Since life is growth and…

May 1, 2014

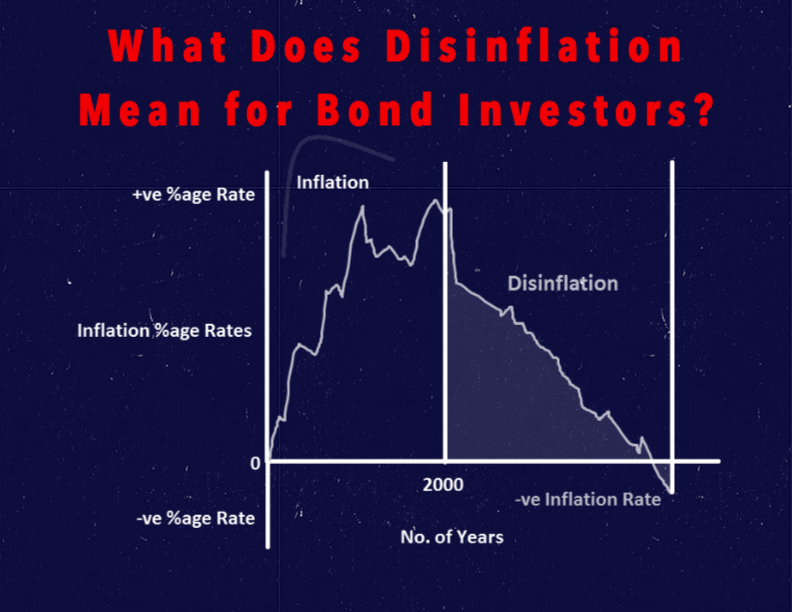

What Does Disinflation Mean for Bond Investors?

by Kathy Jones, Vice President, Fixed Income Strategist, Schwab Center for Financial Research Key Points With slow global…

April 25, 2014