Section

Bond Market

1724 posts

The Fed, The Ponies, And Sunk Costs (Colas)

by ConvergEx's Nick Colas, What can the horse track tell us about human nature? A lot, as it…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Where Did All The T-Bills Go?

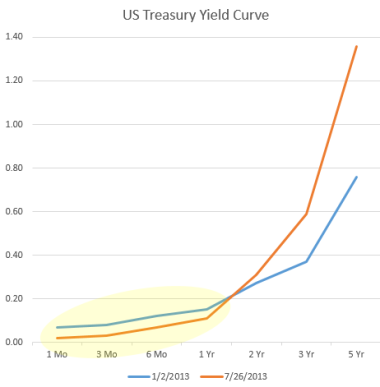

by Sober Look Since the beginning of the year the US treasury curve has steepened substantially, with yields…

Going Negative: Bond Fund Returns CAN Go Negative

by Tom Brakke, Research Puzzle going negative The previous posting showed the rate of change for the S&P…

Liz Ann Sonders: Drifting…but for How Long?

July 26, 2013 by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.…

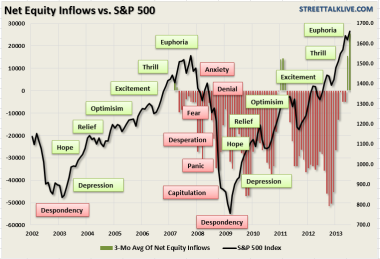

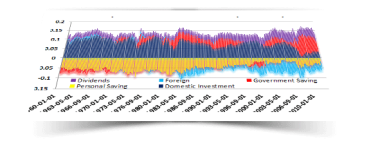

Is It “The Great Rotation” Or “Bad Behavior”

by Lance Roberts, CEO, StreetTalk Advisors There has been a significant number of articles written since the beginning…

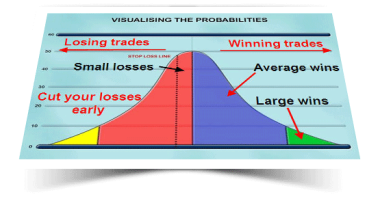

Jeffrey Saut: "Bad Trade?!"

“Bad Trade?!” by Jeffrey Saut, Chief Investment Strategist, Raymond James July 29, 2013 “I asked the obligatory question:…

Technical Take: "We anticipate that the S&P/TSX Composite will peak soon"

prepared by Ryan Lewenza, U.S. Equity Strategist, TD Wealth Attached is TD Waterhouse's Technical Take, prepared by U.S. Equity…

Howard Marks Takes The Market's Temperature

Full transcript here Source: Marks Takes the Market’s Temperature By Jason Stipp Morningstar, 07-18-2013 http://www.morningstar.com/cover/videocenter.aspx?id=603377

The Economy and Bond Market Radar (July 29, 2013)

The Economy and Bond Market (July 29, 2013) The treasury market sold off modestly this week as yields…

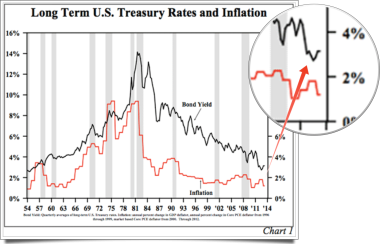

Hoisington: "The Secular Low In Bond Yields Has Yet To Be Recorded"

by Lacy Hunt and Van Hoisington via Hoisington Investment Management, Lower Long Term Rates The secular low in…

Is Inflation Really Gone Forever?

by Jon Ruff, AllianceBernstein Recent movements in asset prices suggest that markets have forsaken any possibility of an…

The Economy and Bond Market Radar (July 22, 2013)

The Economy and Bond Market Radar (July 22, 2013) The treasury market rallied again this week after Fed…

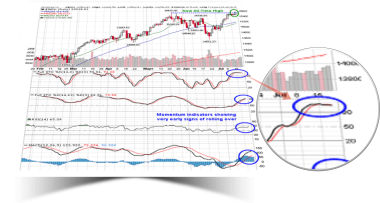

Technical Talk: New All-Time Highs Reached, Momentum Indicators Rolling Over

by Don Vialoux, Tech Talk Upcoming US Events for Today: No Significant Events Scheduled Upcoming International Events for…

Is Gundlach Right, Have Bonds Bottomed?

by Mebane Faber A few weeks ago bond king and fellow Angeleno Jeff Gundlach mentioned that he thought…

Three Things I Think I Think

by Cullen Roche, Pragmatic Capitalism Some random thoughts here on a slow news day: The Merrill Lynch…