Section

Bond Market

1725 posts

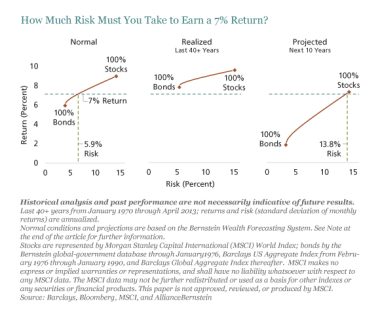

You've Got to Take Risk. So, Manage It

by Seth J. Masters (pictured), Daniel J. Loewy and Martin Atkin, AllianceBernstein Below-average expected returns will make it…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

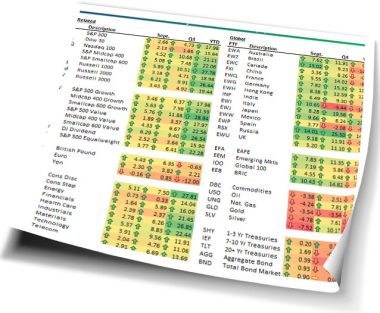

September, Q3 and YTD Asset Class Performance

by Bespoke Investment Group September and the third quarter have now come and gone, and below is our…

The Fed Did Nothing—but Bond Investors Can Act Now

by Douglas J. Peebles, AllianceBernstein The US Federal Reserve surprised the market on September 18 when it announced…

The Bigger Threat Than a U.S. Government Shutdown

by Russ Koesterich, Portfolio Manager, Blackrock Most headlines today are focusing on the looming possibility of a government…

Do We Actually Buy A Piece of A Business When We Buy Stocks?

by Ivan Hoff, Ivanhoff Capital When I try to explain the stock market to people with no experience,…

The Economy and Bond Market Radar (September 30, 2013)

The Economy and Bond Market Treasury yields rallied sharply again this week after last week’s surprise announcement from…

Is The Market Simply Enjoying A Refreshing Pause?

by David Templeton, Horan Capital Advisors Much seems to be made of the S&P 500 Index's five day…

Surprise! (Mawer)

by Mawer Global Investment Research The Fed’s decision to delay tapering its $85 billion (USD) in monthly bond…

Guest Post: 10 Reasons The Market Will (Or Won't) Crash

by Lance Roberts of Street Talk Live blog, Douglas McIntyre, of 24/7 Wall Street, recently wrote an article…

Global Destinations for Yield

September 25 2013 While U.S. stocks are increasingly due for a consolidation, the outlook for global equities is…

Is 60/40 the Right Portfolio Mix for You?

The so-called 60/40 portfolio is widely used as a benchmark for asset allocation when it comes to portfolio…

The Impact of Tapering on Risky Assets

The U.S. Federal Reserve surprised the markets by announcing its decision to postpone reducing the purchase of Treasury…

James Paulsen: Investment Outlook (September 24, 2013)

5 Job Market Myths by James Paulsen, Wells Capital Management Conditions in the job market have always dominated…

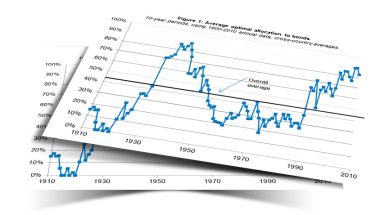

Simon Lack: Bonds Are Not Forever (The Crisis Facing Fixed Income Investors)

by Brenda Jubin, Reading the Markets As you might guess from its title, Bonds Are Not Forever: The…

4 Reasons to Have EM Exposure Now

by Russ Koesterich, Blackrock Blog Since the Fed first signaled its intent to taper last May, emerging market…