by Lance Roberts of Street Talk Live blog,

Douglas McIntyre, of 24/7 Wall Street, recently wrote an article discussing the 10 reasons why the market will, or won't, crash. The problem is that the view presented is terribly myopic which creates a misleading discussion of the current market environment. My notations are in order to balance the discussion accordingly:

Like clockwork, every time the American stock market makes new highs, some people insist it cannot go higher. A subset of those believe the market will crash. Others even believe it will reset like it did when the S&P 500 dropped from more than 1,500 in October 2007 to just above 600 in March 2009. A review of the most widely held beliefs about why a new crash is coming shows that some are bogus, while others almost certainly are likely to be right.

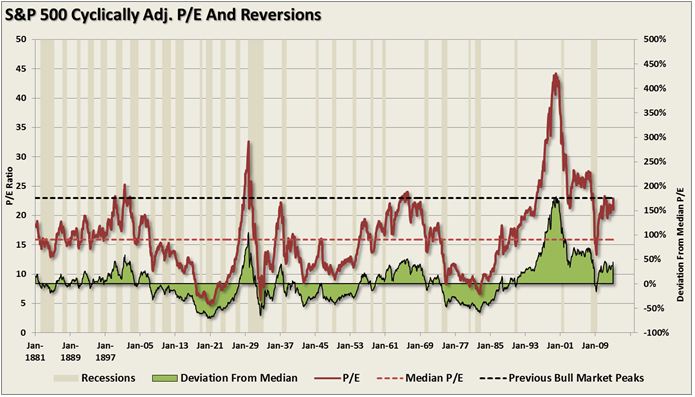

The reason that when markets push to new highs that analysts begin to discuss the potential for the next crash is simply because every crash in history has occurred from market highs. The chart below shows the history of the S&P 500 going back to 1871. Each major "crash" has occurred from market peaks when valuations, based on trailing 12 months reported earnings, exceeded 20x earnings.

Here are the top ten:

1. The S&P 500 price-to-earnings (PE) ratio is too high. Right now, it stands at almost 20. Market expert Mark Hulbert recently made the point that:

... according to data compiled by Yale University finance professor Robert Shiller. The average P/E for the S&P 500 since 1871 is 15.5 and the median P/E is 14.5.

Much analysis based on ancient history has the disadvantage of being old. Earnings have been measured differently over time, and accounting for earnings has evolved. The "S&P is too high" argument can be thrown out. Earnings definitions change too rapidly, as do the ways that public companies report them.

Once again a quick study of history will show that when valuations exceed 20x earnings that forward returns from investments begin to fall. Furthermore, every major reversion has come from levels of excess valuation. The problem with the statement above is that "earnings definitions" have not changed in regards to the only measure that truly matters which is trailing reported earnings. All other measures, such as forward operating and pro-forma earnings, are extremely faulty measures used to justify owning overvalued assets by Wall Street looking to create fees and revenues and offload those same assets to the retail market.

2. The economic recovery has slowed. Well, the recovery has been slow since the recession. If a weak gross domestic product (GDP), a poor housing market and historically high unemployment undermine the market, the S&P should not have moved from its recent low of just over 600 to its current level just shy of 1,700. This is another poorly reasoned argument, if only based on a short period of activity.

The reason that the market has risen well in excess of the underlying economic activity is summed up with just two words: Quantitative Easing.

Without the interventions by the Federal Reserve it is not only very likely that the current market would be much lower in price but it is extremely likely that the U.S. would have already experienced a secondary recession.

3. Forward earnings forecasts are weak. This is a strong argument. Many of America's biggest companies anticipate poor fourth-quarter numbers, which could extend into 2014. Among the causes are a recession-plagued European economy, which is essential to the revenue of many multinationals. American consumers may have lost the bit of optimism they have had as the recovery barely bounces along the floor without a powerful recovery. Corporations dependent on consumer sales may have trouble posting improved numbers.

Forward earnings, as stated above, is an extremely poor indicator of future performance. However, the fact the forward earnings forecasts have continued to fall, so that companies can "beat" their respective earnings estimates, shows the fault in using "guesses" about future profitability in trying to justify owning overvalued assets in the first place.

4. The federal government could be shut down for weeks or even months. This is another powerful position. Federal spending is a significant part of GDP. The United States employs too many people for a drop in their purchasing power to be shrugged off. If Washington is shuttered, many federal workers will drop off the payroll. So, the average citizen has reason to be anxious. If America cannot keep its own government operating, well, America cannot keep its own government operating.

First of all a government "shut down" is unlikely as the Republican Party has little "stomach" for the fallout from such an event. However, even if a "shut down" occurs it will only be temporary and will not result in a "default" of payment. It could certainly roil the overvalued and extended markets but since the Fed is maintaining its bond purchases to offset just such a risk, as I recently discussed, a crash from this scenario is unlikely.

5. There will be a new recession. That is not really likely, even if the government shuts down for a time. Unemployment, even if it is high by historic standards, continues to shrink toward less than 7%. Housing has recovered enough so the market in home sales is brisk. The number of underwater mortgages continues to disappear quickly, which leaves more and more people with positive home equity. That equity, in turn, in the past at least, has helped consumer spending.

Saying that there will not be a new recession is just naive and very short sighted. Recessions are part of the economic cycle and are inevitable. As shown in both charts above recessions occur roughly every 4-5 years on average. Considering that we are already more than 4 years into the current economic recovery we are likely closer to the next recession than not. As far as the stock market goes - the average drawdown during a recession has been in excess of 30%. Ignoring this reality is perilous to your long term returns.

6. Oil prices could spike. Another very unlikely option. Even if the unrest in the Middle East continues, it would take a regionwide catastrophe to stop the flow of crude from Saudi Arabia, Kuwait, Qatar and the United Arab Emirates. Oil production in other countries with large reserves — Canada, Russia, Venezuela, the United States and China — would not be curtailed. Oil prices might rise temporarily, but they are unlikely to stay high for long.

I am not sure what the writer considers to be an oil spike but oil prices have jumped from close to $90 a barrel at the beginning of this year to a high of almost $110 this past summer. That jump has impacted consumer spending which has been in a steady decline on an annualized basis. High oil prices lead to higher costs of living which reduces disposable personal incomes which has already been under pressure from weak economic growth.

7. The Chinese economy will collapse. Another unlikely scenario. Although it slowed briefly this year, Chinese GDP improvement should be well above 7% in 2013. Most expert forecasts call for the number to improve to 8% or better in 2014. The anxiety about high residential property values and regional bank loan levels may be well founded, but it is hard to make a case that the central government of the People's Republic does not have adequate reserves to deal with these problems. China, the world's second largest economy by GDP, will remain open for business, and business will be brisk.

I do agree with this point. The Chinese economy is unlikely to collapse. However, the real growth rate of the economy is far less robust than what the Chinese government reports. The U.S. reports the 1st estimate of GDP 28 days after the end of the quarter. It is subsequently revised two more times and then revised one final time the following year. The Chinese government reports GDP 15 days after the end of the quarter and is never revised. How reliable do you really think the data is? Of course, this is the benefit of a running a centrally controlled economy.

8. Apple's sales will continue to suffer, and along with that its earnings. Apple Inc. is supposed to be a proxy for the consumer's enthusiasm. It is the largest company in the world, based on market cap. However, it is not an overall proxy for the economy or stock market. The "Apple is the economy" argument is all but stupid, and certainly no more than an invention of Apple fanboys.

No argument here.

9. Dark pools will move against the rally. These nearly invisible and massive oceans of unseen traders have watched the market soar and see the only real profit in shorting it. Dark pool trades are made away from the exchanges, which makes their activity hard to track. However, these pools do trade a huge number of the shares in U.S. companies. A conspiracy among them to take the market down has some chance of success, although it would cause mass prosecutions. However, conspiracy theories usually are wrong, and dark pool participants have goals that are different enough that it is improbable they will act in concert.

Setting aside the argument of a "conspiracy" for a moment the reality is that these "dark pools" do pose a serious threat to the overall market. Many of these pools are heavily leveraged and run by algorithmic programs. The problem is that when the market corrects enough to trigger program selling the resultant sell off, combined with margin calls, could lead to a very fast "feeding frenzy" of selling. The volatility of the market since 2009 has risen with the continued rise in program trading and, unfortunately, when the programs begin to "run in reverse" the speed and depth of the correction is likely to take most individuals by surprise.

10. The market will collapse because it always does. This is the most powerful argument for a huge correction. No matter how powerful a rally, the market will not go up forever. That observation is obvious, but that does not prevent it from being true.

The market will eventually correct as it always does - it is part of the market cycle. This is why managing portfolio risk is so critically important - if you don't sell high, you cannot buy low. As I stated in "5 Questions Every Market Bull Must Answer:"

"Being bullish on the market in the short term is fine - you should be. The expansion of the Fed's balance sheet will continue to push stocks higher as long as no other crisis presents itself. However, the problem is that a crisis, which is ALWAYS unexpected, inevitably will trigger a reversion back to the fundamentals.

...with margin debt at historically high levels when the 'herd' begins to turn it will not be a slow and methodical process but rather a stampede with little regard to valuation or fundamental measures. As prices decline it will trigger margin calls which will induce more indiscriminate selling. The vicious cycle will repeat until margin levels are cleared and selling is exhausted.

The reality is that the stock market is extremely vulnerable to a sharp correction. Currently, complacency is near record levels and no one sees a severe market retracement as a possibility. The common belief is that there is 'no bubble' in assets and the Federal Reserve has everything under control.

Take a moment to compare what you have heard, and read, with the questions presented here. Draw your own conclusions and invest appropriately."