Section

Economy

4498 posts

Faber’s Ivy Portfolio: As Simple as Possible, But No Simpler (GestaltU)

by Adam Butler, GestaltU We’ve been discussing sources of performance decay, degrees of freedom, and the implied statistical…

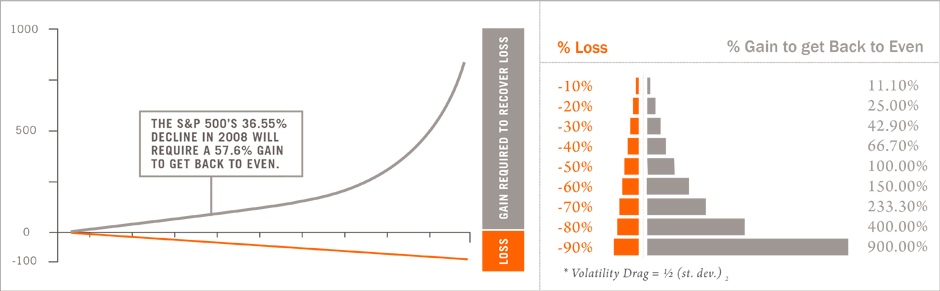

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

The Market's January Heart Attack

by Craig McFadzean and Christopher Crowe, Turn8 Partners After a solid start to 2014 the markets seemed to…

Jeffrey Saut: "Dear Mr. Smith ..."

“Dear Mr. Smith ...” by Jeffrey Saut, Chief Investment Strategist, Raymond James February 18, 2014 Dear Mr. Smith:…

The Economy and Bond Market Radar (February 18, 2014)

The Economy and Bond Market Radar (February 18, 2014) Treasury bond yields were higher this week with the…

Where to Go if Commodity Prices Continue to Push Higher

Still Waters Run Deep by Market Anthropology Back in October and November of last year, we speculated that…

Peter Tenebrarum: The Cash On The Sidelines Myth Lives On

by Pater Tenebrarum of Acting Man blog, It's Not a Bullish Argument – It Isn't an Argument at…

James Paulsen: Investment Outlook (February 12, 2014)

Is monetary policy still supportive for the stock market? by James Paulsen, Chief Investment Strategist, Wells Capital Management…

Thrasher: Technical Weekly – Signs of a Commodities Breakout

by Andrew Thrasher This most recent correction, dip or whatever you want to call it fit the pattern…

Are Commodities Breaking Out?

by The Short Side of Long Chart 1: Important news this week is the commodity index break out!…

Market Update: Will EM Derail the Global Recovery?

by Ryan Lewenza, North American Equity Strategy, TD Wealth With the global equity markets under pressure, and concerns…

The Economy and Bond Market Radar (February 10, 2014)

The Economy and Bond Market Radar (February 10, 2014) Treasury bond yields were mixed this week. We saw…

Stocks and Inflation Expectations are Once Again Synching Up

by Capital Spectator The tumble in stock prices lately has been accompanied by a so-far mild retreat in…

James Paulsen: Investment Outlook (February 2014)

Recovery gaps still suggest considerable potential for stocks by James Paulsen, Chief Investment Strategist, Wells Capital Management Although…

William Smead: EM Misery and US Large-Cap Euphoria

by William Smead, Smead Capital Management Many investors are wondering why emerging stock market misery currently equates to…