Is monetary policy still supportive for the stock market?

by James Paulsen, Chief Investment Strategist, Wells Capital Management

February 12, 2014

Since the Fed recently began tapering its quantitative easing (QE) program and since mortgage rates and other long-term yields bounced from last year’s near record-setting lows, many investors believe monetary policy has now turned negative for the stock market. However, monetary policy is a joint effort implemented by both the Federal Reserve and by the laissez-faire marketplace. The Fed primarily controls reserve injections and the level of short-term interest rates while laissez-faire typically establishes the pace of velocity (how fast the money supply turns over creating economic transactions) and the level of long-term yields. Finally, both the Fed and laissez-faire combine to establish the slope of the yield curve.

Some aspects of monetary policy have recently turned restrictive—the pace of reserve injection (QE) has slowed and long-term yields have risen. Other features of monetary policy, however, have not even yet turned positive for the stock market (i.e., money supply velocity is still declining as it has been throughout this recovery), still remain supportive of stocks (i.e., the continuation of an almost zero short-term interest rate), or have just recently turned accommodative (i.e., the slope of the yield curve has steepened significantly in the last year).

Many investors are convinced the stock market is now destined to falter since the Fed has finally started to take away the punch bowl. However, could investors be under-appreciating the many facets of monetary policy and overlooking a couple which are just now starting to boost the prospects for economic growth and the stock market? We explored the possibility the economic recovery was finally being boosted by a rise in monetary velocity in an earlier note (see Economic & Market Perspective from November 11, 2013). This research piece examines another monetary force which has recently turned more supportive for stocks—a steepening in the yield curve.

Are “rising” long-term yields helping boost economic growth?

Higher long-term interest rates are seldom considered a positive for the economy or the stock market. They can be beneficial, however, if they steepen the yield curve.

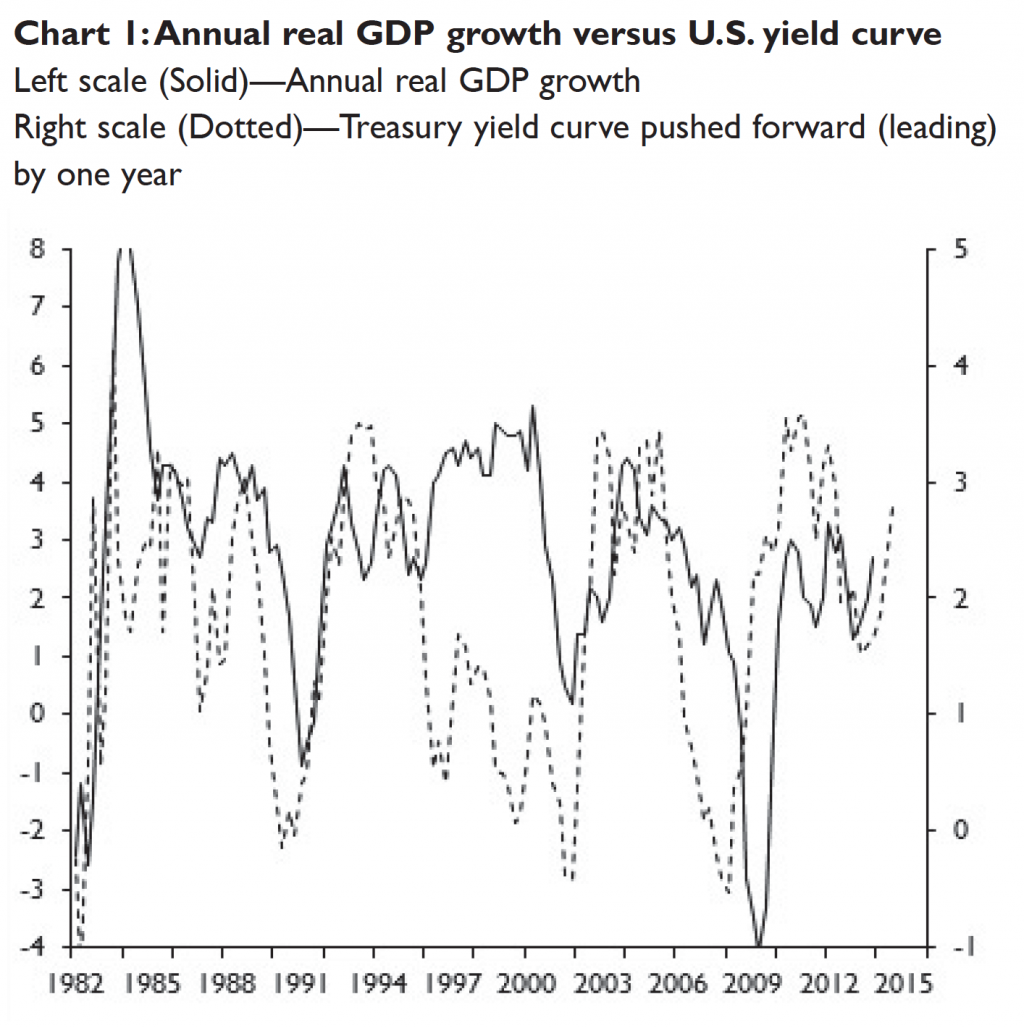

Chart 1 illustrates a long-standing, fairly consistent and leading relationship between the slope of the yield curve and the pace of real economic growth. The dotted line in this chart represents the slope of the Treasury yield curve (i.e., the difference between the 10-year Treasury bond yield and the 3-month Treasury bill yield) and it is pushed forward (or leading the solid line) by one year. As shown, changes in the slope of the yield curve during the previous year have historically given a good indication of the change in the pace of real GDP growth (solid line) in the ensuing year.

In the contemporary period, of the three times the yield curve has steepened (in 2008, in late-2010, and most recently again it bottomed in mid-2012), each subsequently resulted, about a year later, in faster annual real GDP growth. Similarly, the flattening in the curve in both early-2010 and again in 2011 was followed by a significant slowdown in real GDP growth. As shown by the chart, while not a perfect relationship, most major shifts in real economic growth during the last 30 years have been preceded by changes in the slope of the yield curve.

You may read/download the entire report below: