Section

Economy

4451 posts

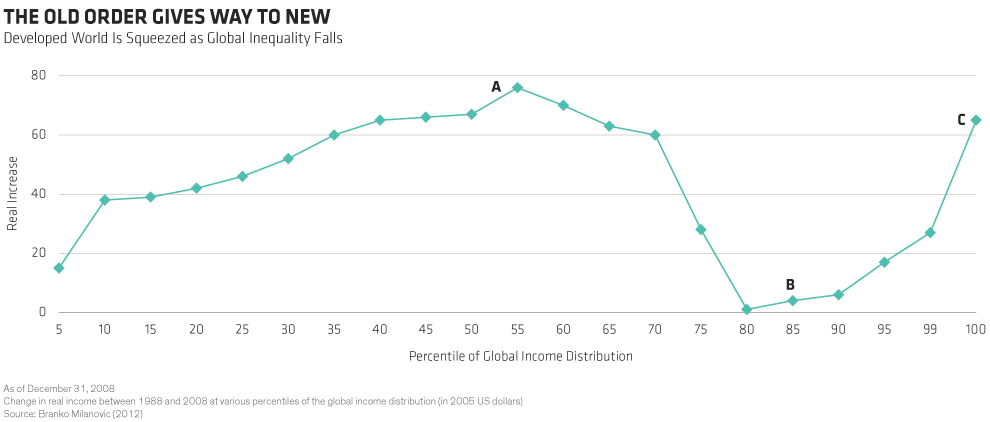

Populism: Here Today, Still Here Tomorrow

Populism: Here Today, Still Here Tomorrow by Darren Williams, Guy Bruten, Fernando J. Losada, Fixed Income, AllianceBernstein Today’s populism…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

The QE Tapering Checklist - Context

The QE Tapering Checklist - Context by Fixed Income AllianceBernstein Europe’s bond markets are preparing for the European…

Populism: Here Today, Still Here Tomorrow - Context

Populism: Here Today, Still Here Tomorrow - Context by Fixed Income AllianceBernstein Today’s populism has grown rapidly, but…

Turn Down For What: Why is Job Growth Slowing?

by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab and Company, Inc. Weaker job growth…

Will Downbeat Labor Report Give the Fed Pause?

Will Downbeat Labor Report Give the Fed Pause? by Eric Winograd, Senior Economist – United States, AllianceBernstein May’s labor-market…

June Events Have Potential To Be Market Movers

by Matthew Peterson, and Ryan Detrick, LPL Research PDF Version KEY TAKEAWAYS • June brings several significant events…

Who's Right? : Stocks vs. Bonds and the Economic Outlook

by Michael Lebowitz, 720 Global Research There is a healthy debate between those who work in fixed-income markets…

Interesting Times in Asia

by Carl Tannenbaum, Asha Bangalore, Ankit Mital, Northern Trust SUMMARY Interesting Times In Asia Looking at Productivity Though…

Reflation (as we define it) has room to run

by Jean Boivin, PhD, Head of Economic and Markets Research at the BlackRock Investment Institute Reflation means different…

Populism Peters Out

by Carl Tannenbaum, Northern Trust Carl R. Tannenbaum, Chief Economist, Northern Trust, discusses economic concerns stemming from European…

Eight and half years later ... are you still waiting?

by Douglas Drabik, Fixed Income, Raymond James Quantitative easing (QE1) was first announced at the end of 2008.…

How Innovation Creates Opportunities Late in the Cycle

by Karen Hiatt, Allianz Global Investors In high-priced markets, there are good reasons to look for innovative companies…

Do Low Rates Justify Higher Valuations?

Do Low Rates Justify Higher Valuations? by Lance Roberts, Clarity Financial Just recently my colleague Jesse Felder penned…

Is the Bond Market Signaling a Change in Course for the Federal Reserve?

Is the Bond Market Signaling a Change in Course for the Federal Reserve? by Steven Vanelli, CFA, Knowledge…