by Carl Tannenbaum, Asha Bangalore, Northern Trust

I was recently honored to participate in a China economic forum at the University of Chicago, my alma mater. The event was held in the building where my wife and I had our first date. In my opening comments, I expressed the wish that the location of the event would be a good omen for long, positive relations between the two countries.

That wish certainly seemed to be shared by those in attendance. But relations between the world’s two largest economies have become more complicated recently, and not solely because of regime change in Washington. Ultimately, the fortunes of China and America are closely intertwined. It would be difficult to foresee success for one at the expense of the other.

On the surface, China continues to outperform expectations. It has sustained a high rate of economic growth for longer than most other developing countries. China has come to dominate markets for many commodities, has lifted 500 million people out of poverty in the last 35 years, and its One Belt One Road project aims to spend trillions on infrastructure across 65 countries. With the United States pulling back somewhat from international engagement, China has projected itself as the world’s leading proponent of globalization.

China’s progress has, at least on the surface, been remarkably steady. It isn’t uncommon for emerging economies to have a setback or two on the way to prosperity; development can be haphazard as markets and institutions mature. China, however, learned from the examples of its neighbors, and has managed its growth very carefully.

Among the lessons China took closest to heart was to open up slowly. Nations that release market influences and accept international capital flows too soon can experience volatility that is damaging to nascent economic structures. China has limited the influence of these forces and built substantial reserves as another bulwark against financial instability.

China’s progress has to a large degree been made on the back of manufacturing and exports. But in recent years, this sector has been challenged by sharp competition from other countries (many of them China’s regional neighbors) and slow global demand. The growth of industrial output in China has slowed and the amount of overcapacity has risen.

The Great Transition

To compensate, China has expressed the wish to see its service sector take the lead in the coming years. China has generated a lot of wealth for its citizens, and they are spending more of it. For the past three years, Chinese consumption has grown faster than manufacturing.

But the Chinese service sector represents only about 45% of the country’s gross domestic product (GDP), a level well below that of developed nations in the West. Part of the reason is that consumer credit is not nearly as well developed in China (which may be a good thing for them), but another is a cultural frugality born of hard times and perpetuated by demography.

Because of its one child policy (and because China is not the easiest country to emigrate to), China’s population is collectively aging more rapidly than any other nation’s. The World Bank estimates that the ratio of workers to retirees in China, which currently stands at around 8, will fall to just two by the year 2050. This will place a natural limit on economic growth and could present challenges for the country’s retirement systems. In anticipation, the Organization for Economic Cooperation and Development estimates that Chinese households save over 38% of their incomes (the comparable rate for the United States is just 6%).

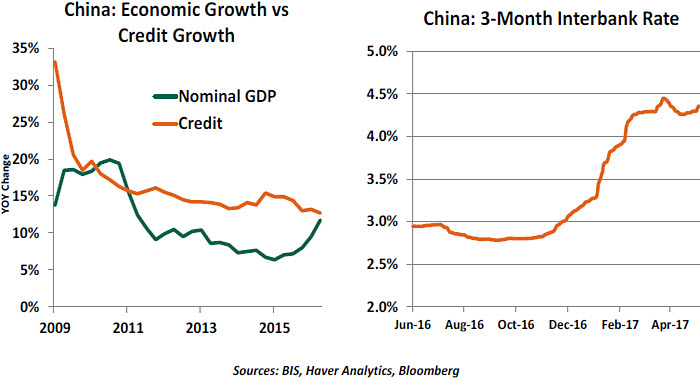

With consumption’s share of GDP rising slowly, Chinese authorities have continued to direct investment to heavier industries in an effort to sustain employment and economic growth. This has contributed to a significant accumulation of debt, which has grown at twice the rate of nominal GDP for a very long time. However, the gap between credit and nominal GDP growth has closed recently.

Loan delinquencies have been rising in China (albeit from low levels) and authorities have been concerned about the leverage behind “wealth management products” (WMPs). WMPs are high-yielding investment vehicles that accumulate equities, real estate and other assets and sell shares to the investing public. They aren’t the most transparent of instruments, though. And while they are offered by China’s banks, they are not guaranteed by China’s banks.

They have nonetheless been very popular because local investors are severely limited in their ability to purchase assets outside of China. But several WMPs have failed over the last few years, illustrating their vulnerability. Chinese authorities have generally made owners of WMPs whole, to avoid financial panic. Retail investors who learn their money isn’t entirely safe can react en masse, an outcome that can shake a financial system to its foundations.

Attempts by the regulators and the People’s Bank to curb WMPs have to be carefully calibrated. Past attempts have provoked untidy market reactions and threatened confidence. A renewed effort in this direction was initiated late last year; borrowing rates have risen significantly since then.

Chinese provinces are also adding to the country’s debt accumulation. Regional governments, seeking to meet growth targets, have been expanding their issuance of bonds to finance local projects. Analysts think this practice has contributed to excesses in real estate and industrial capacity. This may be among the situations Chinese President Xi Jinping may seek to address after consolidating his power at this year’s party congress.

Chinese provinces are also adding to the country’s debt accumulation. Regional governments, seeking to meet growth targets, have been expanding their issuance of bonds to finance local projects. Analysts think this practice has contributed to excesses in real estate and industrial capacity. This may be among the situations Chinese President Xi Jinping may seek to address after consolidating his power at this year’s party congress.

China has not committed what the International Monetary Fund (IMF) calls “original sin,” borrowing internationally in currencies other than their own. In theory, then, the central bank could simply run its printing press to cover losses and preserve the banking system. But such an action could generate inflation, deflate asset prices, diminish real incomes and hinder economic growth.

China has expressed a vision for the next decade that aims to allow markets to operate more freely. But the fragile state of Chinese finance may cause this objective to be deferred.

Irreconcilable Differences?

When the Chinese decide to press ahead with a reform program in earnest, it may run into an economic concept known as the “trilemma.” Simply stated, a country cannot simultaneously be open to capital flows and expect to keep control of its currency and its central bank. During the past generation, China has carefully managed all three of these.

Recently, China has allowed its currency to float a little more freely as a prerequisite for entry into the IMF’s Special Drawing Rights (SDR) facility. (Some would contend that the heavy hand of management reasserted itself after this designation was secured.) China has cautiously opened its capital markets to outside investors and allowed its residents to make limited investments outside the country. But each step will require ceding a little authority and accepting more potential volatility.

It is exceptionally difficult to progress from close control to complete freedom. Given the connection in China between social stability and financial stability, one wonders if it will be able to complete this transition successfully.

China’s ability to work through its economic evolution would be challenging under even the best of circumstances. But last November 8, circumstances changed.

Candidate Donald Trump expressed no great affection for China’s economic practices, criticizing the country for manipulating its currency, stealing intellectual property and costing American jobs. President Trump began to follow through on these views by appointing two China hawks to key positions in the administration.

Peter Navarro, author of the book “Death by China” (a video covering the material can be found here), is serving as Director of the White House National Trade Council. And Robert Lighthizer was recently confirmed as U.S. trade representative. Both men have vowed to address what they see as economic injustice perpetrated by China on the United States.

China has certainly amassed a sizeable trade surplus with the U.S. And while manufacturing employment has been ebbing for decades in the United States (largely the result of technology), the pace of job losses did accelerate when China was granted permanent Most Favored Nation trading status in 2001.

China has certainly amassed a sizeable trade surplus with the U.S. And while manufacturing employment has been ebbing for decades in the United States (largely the result of technology), the pace of job losses did accelerate when China was granted permanent Most Favored Nation trading status in 2001.

China’s defenders point out that U.S. exports to China have grown rapidly and stand to grow even more as consumerism takes deeper root there. Further, American consumers derive important benefits from the inflow of inexpensive goods from China. The balance sheet between the two countries has many entries on both sides of the ledger, and it is nearly impossible to determine who has net equity.

The 2016 U.S. election gave voice to the economically aggrieved. Identifying China as a villain played well to this audience, and the administration vowed to reward its support with action. The tone was set in early December by the president-elect’s call to the president of Taiwan. This enraged Beijing, for whom “one China” is more than a slogan. The U.S. proposals for a border tax, which would have disadvantaged U.S. importers, did not help.

The April summit between Presidents Trump and Xi has seemingly calmed the waters, for now. Rhetoric has cooled, and the two recently announced an agreement that would open Chinese markets to American beef and financial services. (Hailed by U.S. Commerce Secretary Wilbur Ross as a “Herculean” achievement, the terms of the accord had largely been agreed to last year, when Barack Obama was still president. And the accord will barely move the needle on the bilateral trade balance. Nonetheless, it appeared to represent constructive détente.)

The April summit between Presidents Trump and Xi has seemingly calmed the waters, for now. Rhetoric has cooled, and the two recently announced an agreement that would open Chinese markets to American beef and financial services. (Hailed by U.S. Commerce Secretary Wilbur Ross as a “Herculean” achievement, the terms of the accord had largely been agreed to last year, when Barack Obama was still president. And the accord will barely move the needle on the bilateral trade balance. Nonetheless, it appeared to represent constructive détente.)

An outright confrontation is in no one’s best interests. For the United States, getting tougher on trade could result in rising inflation without creating much incremental employment. China (among others) would certainly respond if the administration acted unilaterally; the U.S. sells to China a substantial amount of grain, which could easily be a target of retaliation. A faltering China would certainly challenge Western markets, as it has on several transitory occasions in the recent past.

And then there are the military and strategic issues that surround the relationship, including the management of North Korea.

It may well be that Washington’s harsh initial tone with Beijing was rhetorical, an effort to re-center discussions that will end with moderation. But should tensions escalate once again, the consequences on several levels would be severe.

My wife and I have been together for more than 37 years. Like any long relationship, ours has had its twists and turns; but ultimately, an upward trajectory. I very much hope that China and the United States sustain the kind of long-term partnership that allows each to realize its full potential.

*****

northerntrust.com

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2017 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/disclosures.

Copyright © Northern Trust