Section

Monetary Policy

1116 posts

Are the Bond Vigilantes Ready to Ride Again?

by Chris Fasciano, Chief Market Strategist, Commonwealth Financial Network "I used to think that if there was reincarnation,…

May 29, 2025

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Above the Noise: Making sense of markets, Treasuries, and tariffs

by Brian Levitt, Global Market Strategist, Invesco Key takeaways Markets and tariffs - Markets may only need incremental progress,…

May 22, 2025

Recalibrating Risk: Why Markets Are Rethinking the Recession Narrative

by Hubert Marleau, Market Economist, Palos Management Last week, I wrote: “Contrary to Goldman Sachs, which gave a…

May 19, 2025

Investing alongside change

by Rick Rieder, Global CIO of Fixed Income, BlackRock April's Incredible and Historic Moves: Risk-assets struggled amidst extremely…

May 15, 2025

Central banks are treading carefully

by Invesco Global Market Strategy Office Key takeaways US-China tariffs - Markets are taking a significant de-escalation of…

May 15, 2025

4 scenarios for uncertain markets

by Tom Cooney, Jared Franz, Jayme Colosimo, & Jody Jonnson, Capital Group There are no facts about the future…

May 14, 2025

Market chaos is harvesting income opportunities

by Doug Drabik, Fixed Income, Raymond James Doug Drabik discusses fixed income market conditions and offers insight for…

May 14, 2025

Fed Holds Rates Steady but Warns of Rising Risks

by Kathy Jones, Head of Fixed Income, Charles Schwab & Company Ltd. The Fed held the federal funds…

May 8, 2025

Criticism Of The Fed: Rule, Not Exception

by Carl Tannenbaum, Chief Economist, Northern Trust Central banks work best when left independent. As we’ve gone increasingly…

May 6, 2025

No Recession Yet, But Risks Remain

by Brian Wesbury, Chief Economist, & Robert Stein, Deputy Chief Economist, First Trust Portfolios Noise about tariffs, business…

May 5, 2025

Tariffs: Q1 Impacts and Q2 Negotiations

by Jeffrey Kleintop, CFA® Managing Director, Chief Global Investment Strategist, Michelle Gibley, & Heather O'Leary, Charles Schwab &…

May 5, 2025

Dominoes: Recessions' History Guide

by Liz Ann Sonders, Chief Investment Strategist, & Kevin Gordon, Charles Schwab & Company Ltd. Recession risk remains…

May 1, 2025

Caution Over Exuberance: Navigating Q2 with BMO’s Guided Portfolio Strategy

“Hope for the best, but prepare for the worst.” That’s the mantra underpinning BMO Global Asset Management’s Q2…

May 1, 2025

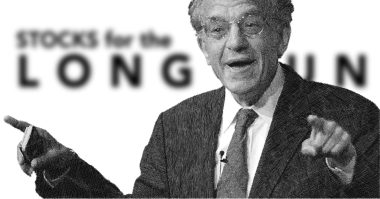

Powell Downplays Progress, Risks Becoming Trump’s Scapegoat

by Professor Jeremy J. Siegel, Senior Economist to WisdomTree and Emeritus Professor of Finance at The Wharton School…

April 24, 2025