Section

Interest Rates

1030 posts

Expect Higher Treasury Yields in Second Half

by Sober Look While many investors refuse to accept this fact, we are clearly marching toward higher treasury…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Rising Rates: The Good, the Bad…No Ugly

by Douglas J. Peebles, AllianceBernstein The US Fed has said it will almost certainly boost short-term interest…

Getting Closer: Fed Continues its Tapering & Moving Toward Rate Hikes

Getting Closer: Fed Continues its Tapering & Moving Toward Rate Hikes by Liz Ann Sonders July 30, 2014…

Why Treasury Yields Can't Catch a Bid

by James Picerno, Capital Spectator Some analysts are again projecting that the age of higher interest rates has…

Who's Afraid of Low, Low Rates?

by James T. Tierney, Jr., AllianceBernstein Falling yields on Treasuries are often seen as a signal of a…

The Chase for Yield

by Ben Carlson, A Wealth of Common Sense “People become risk-seeking when all their options are bad.” –…

We Shouldn't Be Shocked By This New Proposal... But We Are

by Simon Black of Sovereign Man blog, Prof. Ken Rogoff’s book ‘This Time is Different: Eight Centuries of…

Interest Rate Scenarios and Stock Market Performance

by Ben Carlson, A Wealth of Common Sense “In the case of equities or real estate or farms…

Behold the Bounce Back in Risk Parity Returns

by Macro Man Although tomorrow's Fed minutes will likely attempt to elucidate some semblance of a revamped exit…

Putting the Plunge in Eurozone Yields into Perspective

by Dr. Ed Yardeni More surprising than the rally in US Treasury bonds is the plunge in Eurozone…

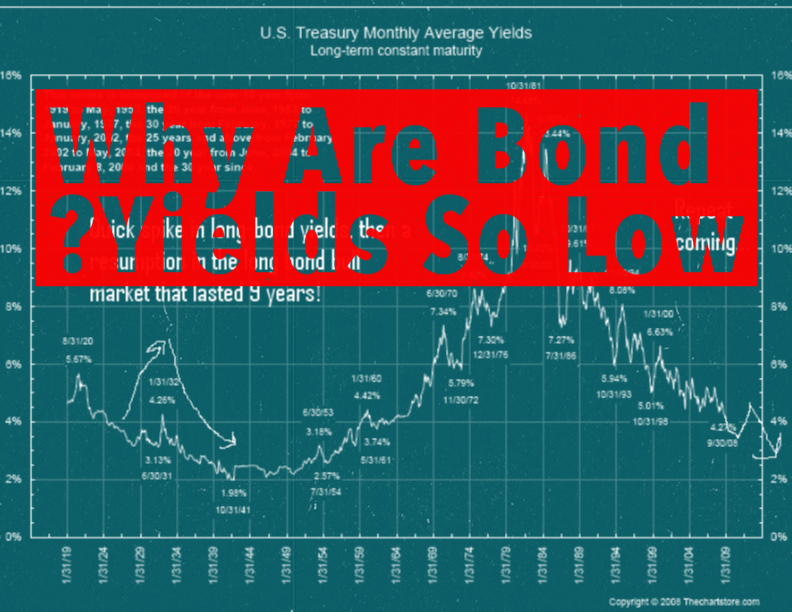

Louis Vincent Gave: Why Are Bonds Yields So Low?

by Louis Vincent Gave, Gavekal Research Why Are Bond Yields So Low? As long as men continue to…

An Improving Economy, But Lower Rates. Why the Disconnect?

Despite economic data showing an improving economy, interest rates remain stuck in a low and narrow range. Russ…

Economic Policy Uncertainty Doesn’t Tell us Much About Stock Returns

by Rick Ferri What happens in Washington has broad-reaching effects on the economy and our personal wealth. Uncertainty…

Want to See The Markets Get Confused? Even Lower Interest Rates

by Market Anthropology The most fatal illusion is the settled point of view. Since life is growth and…

Why the Bull Market (and Economy) Still Have a Couple of Years to Run

The Transition From a Risk Premium Reduction Market to a Growth Market by Conor Sen Matt Busigin (@mbusigin)…