Section

Interest Rates

1069 posts

Quick Thoughts: Risk vs. uncertainty

by Stephen H. Dover, CFA, Chief Market Strategist, Head of Franklin Templeton Institute Weaker US economic data is…

March 12, 2025

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

The Risk Of A Recession Isn’t Zero

by Lance Roberts, RIA The risk of a recession in the U.S. is not zero. This is particularly…

March 9, 2025

Is the US headed for a drop in GDP growth?

by Kristina Hooper, Chief Global Market Strategist, Invesco Key takeaways Gross domestic product (GDP) - A key economic…

March 9, 2025

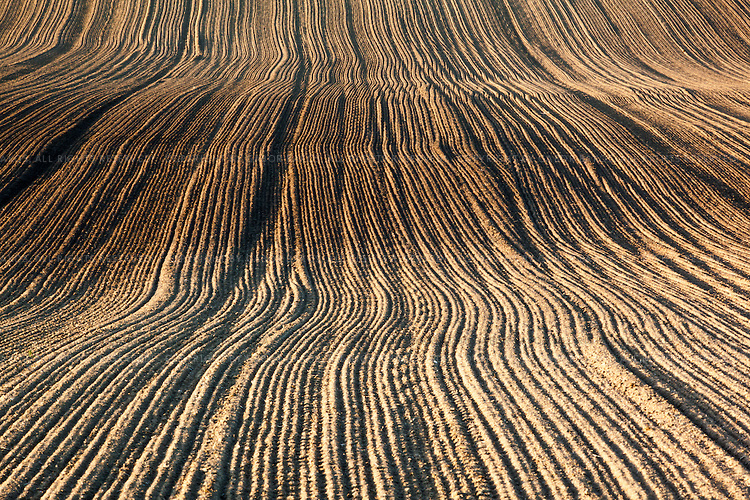

Seasonal Challenges With Economic Data

by Carl R. Tannenbaum, Chief Economist, Northern Trust Seasonal adjustments have limitations. At this time of year, those…

February 26, 2025

What scares the S&P 500?

by Roderick Mackenzie, Tom Becker, BlackRock Quick Read Equity option market pricing offers a unique way to quantify…

February 24, 2025

NBI CIO Martin Lefebvre: Conflicting Forces

The market may look stable on the surface, but beneath it lies a swirling storm of conflicting forces.…

February 19, 2025

2022-lite

by Michael Contopoulos, Director of Fixed Income, Richard Bernstein Advisors As we begin 2025, there are striking similarities…

February 17, 2025

As Always, It's About Inflation

by Hubert Marleau, Market Economist, Palos Management February 14, 2025 The U.S. is not a Democracy: It’s a…

February 17, 2025

Navigating the (new) conundrum

by Jeffrey Rosenberg, Managing Director, Systematic Fixed Income, BlackRock Key points The Fed pause that gives pause: Stronger-than-expected…

February 11, 2025

Safe Haven From the Trade War?

by Jeffrey Kleintop, CFA® Managing Director, Chief Global Investment Strategist, Michelle Gibley, & Heather O'Leary, Charles Schwab &…

February 11, 2025

Forecasting Error Puts Fed On Wrong Side Again

by Lance Roberts, RIA The Federal Reserve’s record of forecasting has frequently led it to respond too late…

February 9, 2025

Navigating Tariffs & Inflation (With Dr. Richard Clarida)

by Liz Ann Sonders, Chief Investment Strategist, Kathy Jones, Head of Fixed Income, Charles Schwab & Company Ltd.…

February 9, 2025

Will History Rhyme? Fixed Income Themes During the First Trump Administration

by Lawrence Gillum, CFA, Chief Fixed Income Strategist, LPL Research Early in the second Trump administration, tariff threats…

February 6, 2025

Trump’s Tariff Shockwave: Derek Holt Breaks Down the Impact

Derek Holt’s Saturday Night Tariff Thrashing delivers a scathing assessment of the Trump administration’s abrupt trade war escalation.…

February 3, 2025

The opportunity right in front of investors

by Doug Drabik, Fixed Income, Raymond James Doug Drabik discusses fixed income market conditions and offers insight for…

January 29, 2025