Section

Deflation

22 posts

Default, Deflation, and Financial Repression

by R. C. Whalen Back in March 2011, author Carmen Reinhart wrote a comment in Bloomberg describing the…

November 29, 2013

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

Paranormal Markets: What’s Bad for the Economy Is Good for Stocks?

Negative economic news has been causing increases in stock prices. Jeff explains how uncertainty over Fed policy is…

November 11, 2013

Jim Grant Defines Deflation

Authored by Jim Grant of Grant's Interest Rate Observer, A derangement of money or credit, a symptom of…

September 18, 2013

Things That Make You Go Hmmm... Like Fedspeak

Lately, Fedspeak has plummeted to new depths of indecipherability as frantic Fed governors, terrified by the extent of…

July 25, 2013

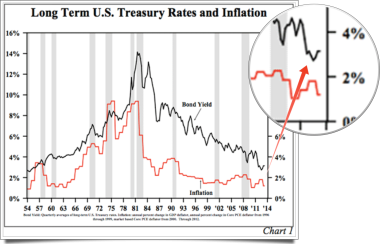

Hoisington: "The Secular Low In Bond Yields Has Yet To Be Recorded"

by Lacy Hunt and Van Hoisington via Hoisington Investment Management, Lower Long Term Rates The secular low in…

July 25, 2013

Jim Rogers: "Beware The Man On The White Horse..."

Submitted by Simon Black via Sovereign Man blog, As far back as ancient times, whenever civilizations fell into…

July 17, 2013

Deflation By Any Other Name Would Smell As Foul

Over the weekend, the BIS came with a curious number on the losses, as quoted by Reuters: The BIS said in its annual report that a rise in bond yields of 3 percentage points across the maturity spectrum would inflict losses on U. S. bond investors – excluding the Federal Reserve – of more than $1 trillion, or 8% of U. S. gross domestic product.

Markets have simply been undead for the past 5 years – or so -, as long as central banks have issued stimulus.

Moreover, in the $82 trillion or so global bond markets, a $1 trillion loss looks very low in comparison, certainly when you see the BIS claim that France, Italy, Japan and Britain can see their bonds lose a third of their value.

Today's stimulus is self-defeating simply because it is unleashed in a toxic financial environment, ridden with hidden debt. [.. ] … it can only function when debts are properly restructured, defaulted upon, their holders bankrupted where applicable.

Signs of concern about high-flying assets like emerging markets can be seen in the options market, where more than 1. 35 million contracts in the iShares MSCI Emerging Markets exchange-traded fund traded on Thursday – 82% of which were put options, generally used to protect against losses.

June 26, 2013