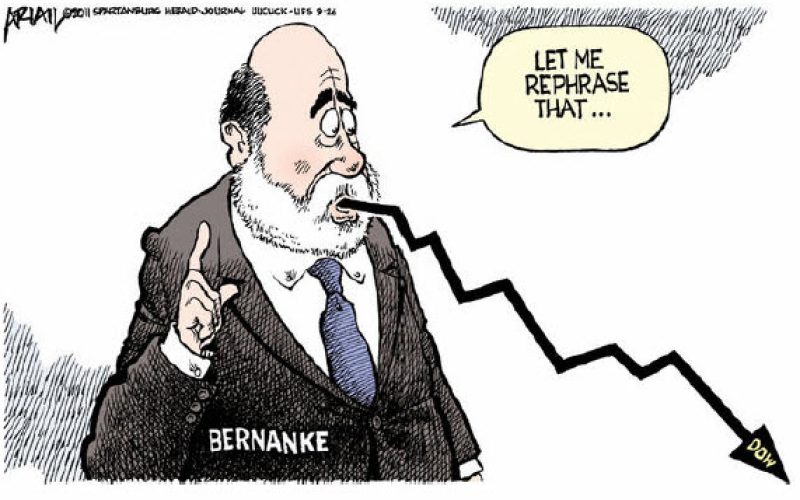

Lately, Fedspeak has plummeted to new depths of indecipherability as frantic Fed governors, terrified by the extent of the reaction to the slightest hint that the Free Money Express is pulling into the station, have scrambled to fine-tune the effects their hieroglyphics have had on markets. Dovish! No, hawkish! No, Dovish! Wait... what was the question again?

In talking about a "tanking" economy, Bernanke was referring to ZIRP - not QE - and was at great pains to reinforce the idea that rates will be held essentially at zero for some considerable time to come; but the crucial point is his statement that "the Fed [can't] get interest rates up very much, because the economy is weak...."

In a nutshell, that is the problem.

The US economy — and by extension the US government — simply cannot afford to let interest rates rise, because the economy is too weak to support higher rates, and the government can't afford to pay higher interest rates on its massively increased debt load.

The important point is that, ultimately, it won't be the Fed that decides where interest rates are, but rather the market; and should the Fed follow through on its trial balloon and begin to wind back bond purchases, the market has demonstrated that it will send rates higher very quickly indeed — a completely unaffordable outcome.

As always, Bill Fleckenstein put things into calm perspective this week, and his comments on the situation the Fed finds itself in bear repeating to a wider audience:

Thus, when I contemplate the amount of damage that will be done by four years (and counting) of QE, I really just shudder in wonder at how big the disaster might be, though there is no doubt it will be a disaster. The Fed has expanded its balance sheet to $3.5 trillion and now owns over 20% of outstanding U.S. debt.

Either it is going to continue to buy bonds forever, which is impossible, or there is going to be a massive dislocation at some moment in time because someone else is going to have to buy that debt when the Fed ultimately stops, even if it doesn't choose to sell anything (and just lets the debt run off). There will be no painless extrication from QE, and as I have said, I don't believe the Fed will be able to leave ZIRP willingly.

Precisely.

But it's not only Bernanke and his cronies who talk in mysterious dialects. Everywhere we look over the past few years, strange communications have been popping up...

Grant Williams' Full TTMYGH Letter below: