Section

Oil and Gas

896 posts

Running a Fossil Fuel Business Isn't What It Used to Be

by Frank Holmes, CEO, CIO, U.S. Global Investors September 20, 2021 It’s becoming more and more difficult to…

September 22, 2021

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

Quail Pricing in Oil Assets

by Cole Smead, Smead Capital Management On the insistence from a friend and a colleague, I watched the…

August 17, 2021

BofA: Oil's All About The Benjamin

by Francisco Blanch, Warren Russell, et al, Bank of America Securities Brent prices should average $68/bbl in 2021…

June 22, 2021

Will the Energy Sector Evolve or Devolve?

by Susan Hutman, Director, Investment Grade Corporate Credit Research, Fixed Income Responsible Investing, AllianceBernstein Change in the White…

February 22, 2021

Why the Future Still Means Fossil Fuels, for Now

by Fred Fromm and Matthew Adams, Franklin Equity Group, Franklin Templeton Despite some news reports that suggest the…

February 2, 2021

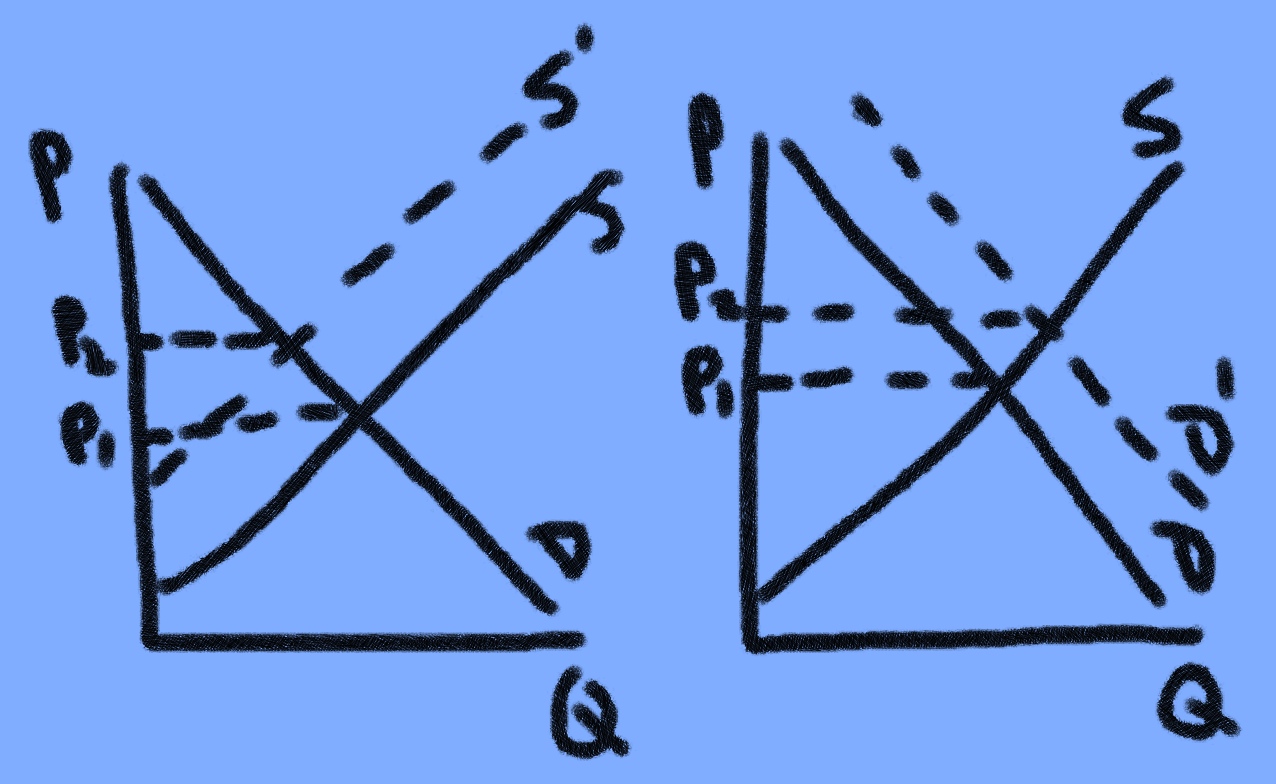

MacroView – The Energy Rally Is Likely Premature

by Lance Roberts, RIA The rally in energy companies is likely premature. To understand why such may be…

December 13, 2020

Extraordinary Opportunity: Investing in the Great Energy Transition

While the environmental and economic threats posed by climate change are immense, the investment opportunities being created in the search for renewable power are equally unprecedented. It’s become evident that the great transition from fossil fuels to renewable energy stands to be one of the most important developments of the new millennium – for both investors and the planet.

October 30, 2020

Canada’s changing energy sector

by Craig Basinger, Derek Benedet, Chris Kerlow, Alexander Tjiang, Brett Gustafson, Richardson GMP Canada’s energy sector has gone…

September 28, 2020

Precious Commodities: Assessing Gold and Oil in the Pandemic Age

Dynamic Funds' Portfolio Managers, Robert Cohen and Jennifer Stevenson views on gold and oil, and positioning in the current economic climate.

June 24, 2020

Opus Virus: Destruction-to-Restoration-to-Reformation.

by Hubert Marleau, Market Economist, Palos Management What Happened In the Market Last Week: Everybody should know by…

April 26, 2020

Here’s Why 2/3rds of US Oil & Gas Companies May not Exist a Year from Now

by Bryce Coward, CFA, Knowledge Leaders Capital Energy companies are facing a life or death moment in 2020…

April 22, 2020

Oil Prices Fall Below Zero

by David Kastner, CFA, Managing Director, Senior Investment Strategist, Charles Schwab & Company Oil prices fell below zero…

April 22, 2020

U.S.-Iran Conflict: What It Means for Oil

by Dillon Culhane, AGF Management Ltd. Dillon Culhane discusses the impact on oil of the escalating conflict between…

January 7, 2020

Roil over oil? How rising Iran-U.S. tensions could impact markets

by Paul Eitelman, Russell Investments On the latest edition of Market Week in Review, Senior Investment Strategist Paul…

June 17, 2019

Niels Jensen: Addicted to Oil?

by Niels Jensen, Absolute Return Partners LLP We aren't addicted to oil, but our cars are. R. James…

May 5, 2019