Section

Commodities

623 posts

Technical Outlook for N.A. Equities, Bonds, Commodities (June 2015)

Technically Speaking (June 18, 2015) The S&P/TSX Composite Index (S&P/TSX) broke down through its short-term upward channel. With…

June 19, 2015

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

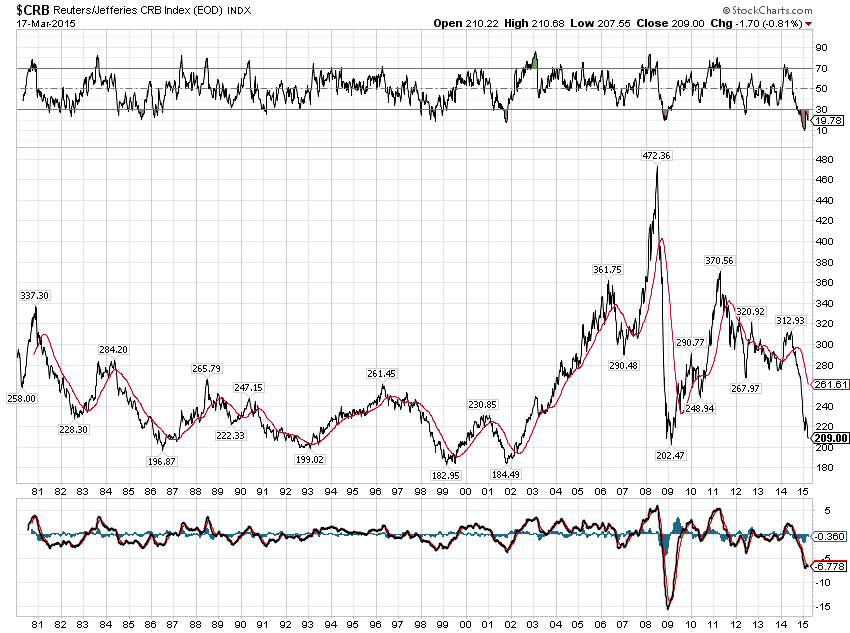

Commodities Still in a Bear Market

by Tiho Brkan, The Short Side of Long Second chart of the day focuses on commodity prices. Those that…

June 1, 2015

What's Up With the USD and Rising Long-term Yields?

by SIACharts.com It has only been a month and a half since we last looked at both the…

May 21, 2015

Is the Agribusiness Sector Set To Explode Higher?

Agribusiness is My Favorite Base in the World by J.C. Parets, AllStarCharts.com The bigger the base, the higher…

May 12, 2015

The Commodity Crash is The 2nd Worst in Almost 4 Decades

by The Short Side of Long Today's chart of the day focuses is on long term prices of commodities.…

April 15, 2015

SIA Weekly: The Rising Dollar's Effect on Certain Commodities

by SIACharts.com With so much talk about the US Dollar recently, for this weeks edition of the SIA…

March 26, 2015

Commodity Crash Points to a Bottom

by The Short Side of Long Chart 1: Commodities have crashed back to levels seen in 2001 & 2009 We…

March 19, 2015

What About the 1970s?

by Ben Carlson, A Wealth of Common Sense Every time I write about commodities being a poor investment…

February 11, 2015

Gold and Gold Stocks: Structural Turnaround, or Head Fake?

by SIACharts.com With Kinross Gold, Agnico Eagle Mines, Silver Wheaton, and Goldcorp all currently sitting within the Favoured…

February 5, 2015

SIA Weekly: Downward Trend in Copper and Natural Gas Continues

by SIACharts.com Commodities overall have continued to show weakness versus other asset classes. Everyone knows about the dramatic…

January 30, 2015

Good News, Bad News on the Commodities Downturn

by Cam Hui, Humble Student of the Markets I've been thinking a lot about the latest oil has…

January 30, 2015

Free Fallin'

Crude prices are falling, but whether WTI and Brent hit $40 or $60 doesn’t matter. What people should…

December 30, 2014

Dr. Copper Has Been Replaced

by Andrew Thrasher There used to be a belief on Wall Street that copper had a Ph.D. in economics…

December 5, 2014

What Caused the Great Depression?

by Ben Carlson, A Wealth of Common Sense The price of oil is down nearly 40% in…

December 3, 2014

The Commodity Supercycle Ain't Over - Yet

by Erik Swarts, Market Anthropology As surprising as it might sound today, we believe the secular trend for…

November 18, 2014