With so much talk about the US Dollar recently, for this weeks edition of the SIA Equity Leaders Weekly, we are going to check back in on the US Dollar Index Continuous Contract and also look in on Silver, as the direction of the US Dollar can really affect what is happening to certain Commodities.

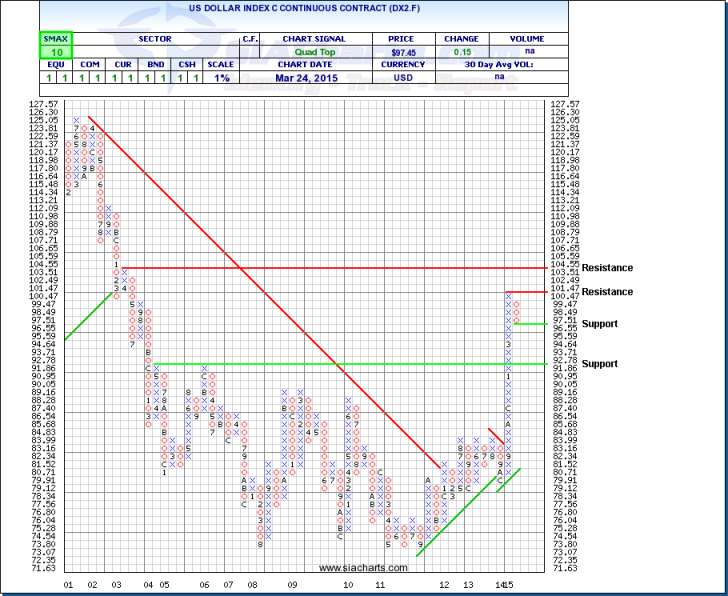

US Dollar Index Continuous Contract (DX2.F)

It has been quite a while since we last looked at the DX2.F (even though we have spoken often about the strength of the US Dollar by looking at the USDCAD), and as you see from the chart, there has been a strong break to the upside over the past 6 months after a 2-year period of consolidation. It has recently pulled back to its first support level after the FOMC opted to leave short-term interest rates alone, so it will be interesting to see if it can rebound from here and challenge its prior high (and possibly beyond) or if the weakness continues. Further weakness could be favorable for Commodities, but renewed strength could put a damper on the short-term upward movement we have recently seen from some Commodities.

Click on Image to Enlarge

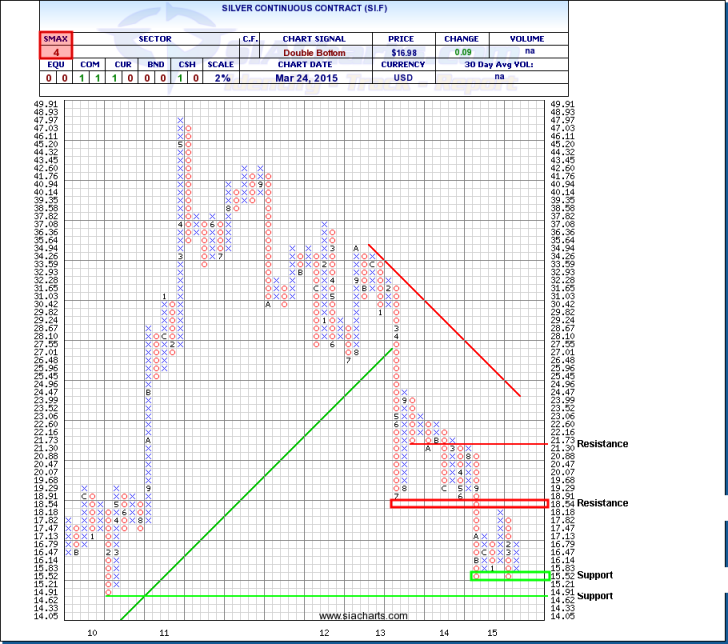

Silver Continuous Contract (SI.F)

Looking at the chart of Silver, we can see that the support level at $15.21 held on the last downward move and that Silver has bounced back off of that level. The next resistance level is up in the $18.50 to $19 range. With the SMAX showing a 4, Silver is still showing short-term weakness against the asset classes.

With Commodities still sitting at the very bottom of the SIA Asset Class rankings, there is still higher levels of risk associated with looking at them for long-term opportunity, with lower risk investments and asset classes being out there instead. But, for those who continue to sit in these, following the US Dollar may help you minimize the risk somewhat as a upward turn around from here could start a new downward move for Commodities.

Click on Image to Enlarge

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

Any questions or to learn more about these relationships, other Commodities, or other information, please call or email us at 1-877-668-1332 or siateam@siacharts.com.

Copyright © SIACharts.com