Guy Haselmann, FETI Group

96 posts

Mr. Haselmann has 30 years of diverse capital markets experience, including 14 years building and managing assets at 2 well-known macro hedge funds. During his career, Mr. Haselmann traded numerous capital market securities. He has developed risk management strategies and trading procedure guidelines.

Previously, Mr Haselmann was Director of Capital Markets strategy, at Scotiabank GBM, where he incorporated a global macro approach. Mr. Haselmann has been published in academic journals, newspapers, and has written countless strategy pieces. He has appeared on various TV and Radio programs, such as BNN Bloomberg and Bloomberg. Mr. Haselmann is a guest lecturer at several universities, including his alma mater the University of Delaware Lerner College of Business and Economics. He is a frequent panelist at industry conferences.

In addition, Mr. Haselmann was a gubernatorial appointee to the NJ State Investment Council and was appointed by the chair to the Investment Policy, Executive, and Nomination subcommittees. Mr. Haselmann is President, and a member of the Board of Governors, of the NY Money Marketeers.

Specialties: Analyzing global macroeconomic policies and capital market interconnections to strengthen investment and strategic decision-making in financial markets. Providing portfolio construction solutions to enhance risk-adjusted returns. Macro trading and strategy. Risk management. Alternatives advisory services. Hedge funds and other alternative investments. Funds of Hedge Funds. Analysis for optimizing position sizes. Capital market products. Options.

Previously, Mr Haselmann was Director of Capital Markets strategy, at Scotiabank GBM, where he incorporated a global macro approach. Mr. Haselmann has been published in academic journals, newspapers, and has written countless strategy pieces. He has appeared on various TV and Radio programs, such as BNN Bloomberg and Bloomberg. Mr. Haselmann is a guest lecturer at several universities, including his alma mater the University of Delaware Lerner College of Business and Economics. He is a frequent panelist at industry conferences.

In addition, Mr. Haselmann was a gubernatorial appointee to the NJ State Investment Council and was appointed by the chair to the Investment Policy, Executive, and Nomination subcommittees. Mr. Haselmann is President, and a member of the Board of Governors, of the NY Money Marketeers.

Specialties: Analyzing global macroeconomic policies and capital market interconnections to strengthen investment and strategic decision-making in financial markets. Providing portfolio construction solutions to enhance risk-adjusted returns. Macro trading and strategy. Risk management. Alternatives advisory services. Hedge funds and other alternative investments. Funds of Hedge Funds. Analysis for optimizing position sizes. Capital market products. Options.

FOMC Races to Catch-up

by Guy Haselmann, FETI Group (The views expressed herein are solely those of the author) Executive Summary Given…

January 11, 2022

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

Guy Haselman: Controlled Chaos

by Guy Haselmann, Capital Markets Strategist, FETI Group The intention of the monetary and fiscal bailout plans was…

April 27, 2020

Guy Haselmann: Coronavirus – The Catalyst for System Failure?

by Guy Haselmann, Capital Markets Strategist Today’s global economic system is more intertwined than at any point in…

March 9, 2020

The Death of the 60/40 Portfolio

Listen to this article: Your browser does not support the audio element. The death of the 60/40 portfolio…

August 19, 2019

Guy Haselmann: The Current Monstrous Attack on World Order is a Creation of the Fed's Own Making

by Guy Haselmann, Macro Strategist Three decades of benefits from globalization and free trade have come to end.…

August 9, 2019

Guy Haselmann: The Fed's Dangerous Inflation Obsession

by Guy Haselmann, Macro Strategist We accept too much of what Fed officials say at face value. Given…

July 31, 2019

Guy Haselmann: The Fed's H- Curve

by Guy Haselmann, Macro Strategist Is it possible that there exists a specific threshold that when exceeded central…

March 20, 2019

Guy Haselmann: "An old failed theory has reared its ugly head again"

by Guy Haselmann, Macro Strategist For decades, the Federal Reserve claimed that monetary policy worked on an 18-to-24-month…

March 14, 2019

Guy Haselmann: Humble Opinion and Observations

One “Guy’s” humble opinion and observations (1/17/19) by Guy Haselmann The S&P is up 6.5% this year. It…

January 21, 2019

Guy Haselmann: Unloved Treasuries

Unloved Treasuries by Guy Haselmann, Managing Director, Product Solutions, OpenDoor Trading LLC As I resume my market commentary,…

June 20, 2016

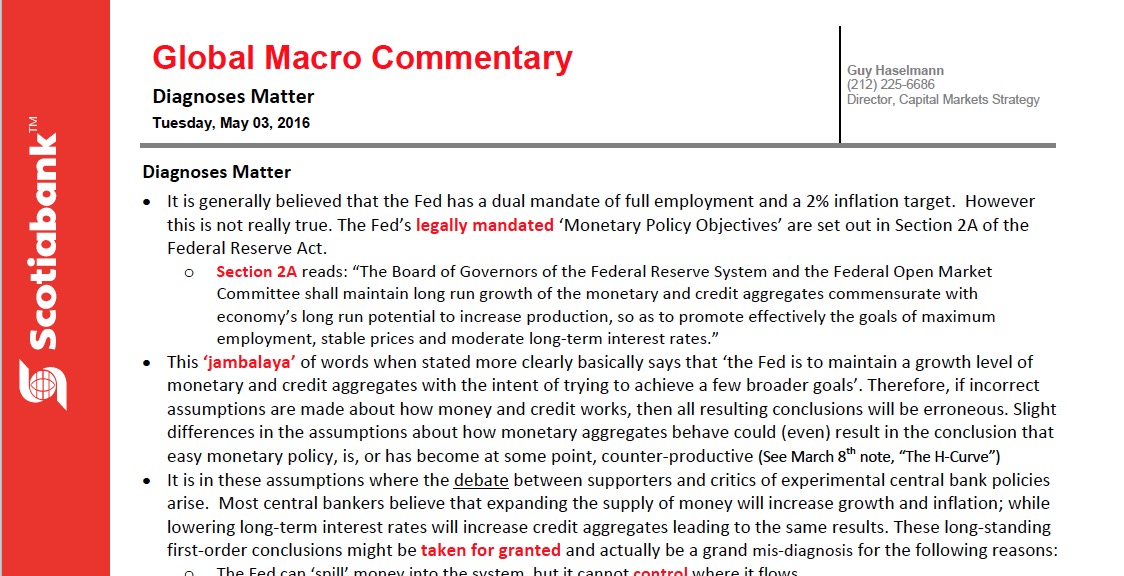

Guy Haselmann: Diagnoses Matter

Diagnoses Matter by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM · It is generally believed that the…

May 4, 2016

Guy Haselmann: Debt, debt, debt

Debt, Debt, Debt · Debt undermines growth and the world has never been more indebted. · Reinhart and…

April 28, 2016

Guy Haselmann: Outlook for Treasuries

Outlook for Treasuries by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM I’ve been getting numerous questions since…

April 8, 2016

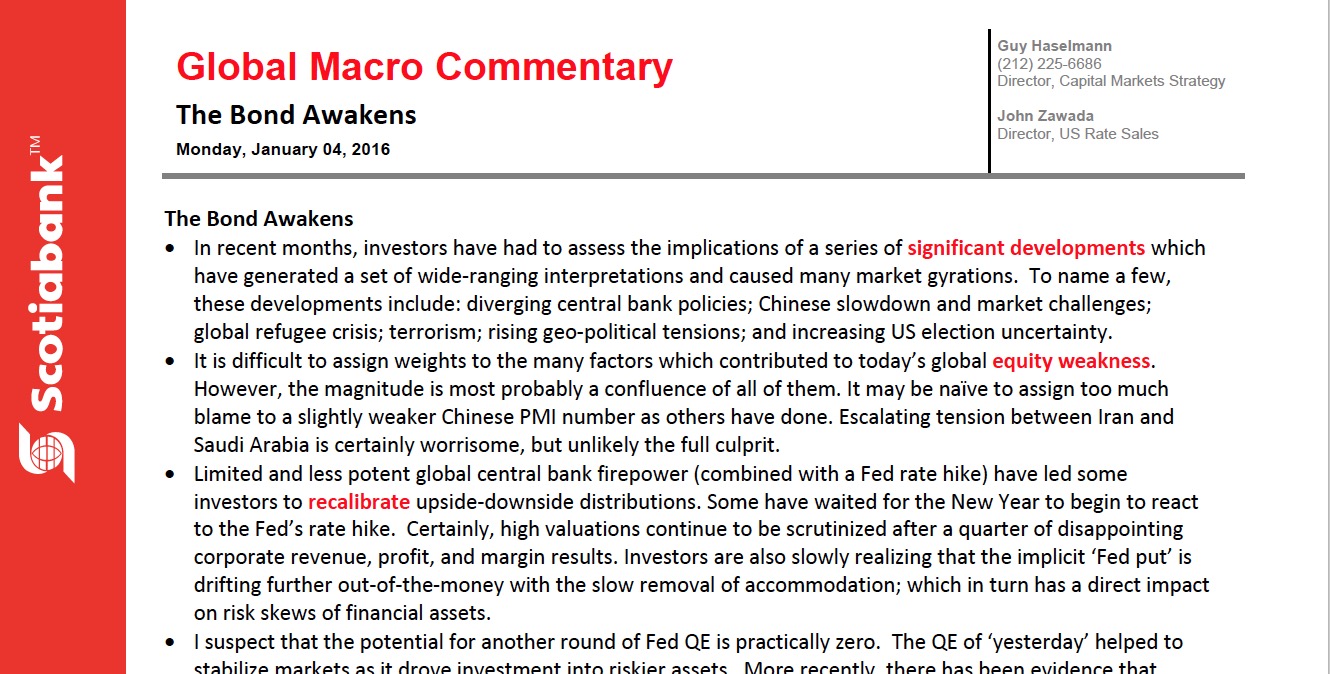

Guy Haselmann: Uncharted

Uncharted by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM • Markets thought the term ‘data’ meant economic…

April 8, 2016