by Blaine Rollins, CFA, 361 Capital

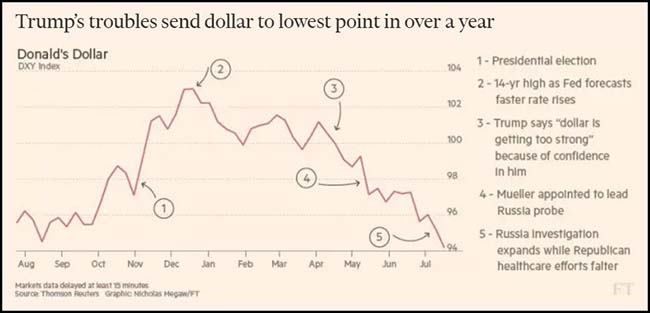

The first week of earnings did little to change the overall market’s trend. In fact, it may have provided reasons to reinforce it. While the week’s reports were mostly beats at the top and bottom lines (just like three months ago), the reception to some of the more cyclical company earnings reports (Banks and Industrials) were very unwelcoming. The large sell-offs in the disappointments last week could give investors one more reason to shift their portfolios away from cyclical exposures and into more growth-oriented companies. Another reinforced trend was the -1% move in the U.S. dollar. This came as a result of the Draghi/ECB comments regarding the Eurozone strength and speculation of a future timetable to start tapering their easing bias. Also hurting the U.S. dollar was the stall of Healthcare legislation in Washington D.C. We will have an even bigger week of company earnings reports this week providing more data points on the outlook for the U.S. economy. Let’s see if we get a better or worse tone to work with in this next round of releases.

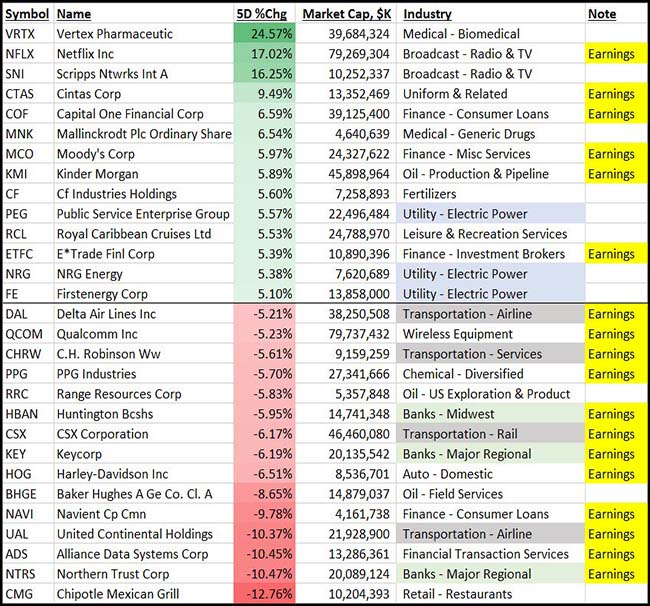

Earnings hit the S&P 500 movers list hard last week…

Unfortunately, most of the moves happened to the downside as Banks and Transportation stocks sent investors jumping for the exit. At least for Financial investors, some of the non-bank financials joined Netflix on the big upside list. But in looking through the first big week of earnings, I have to say that I am not very impressed by the receptions. Especially in a week where the market ended with a gain.

(7/22/17)

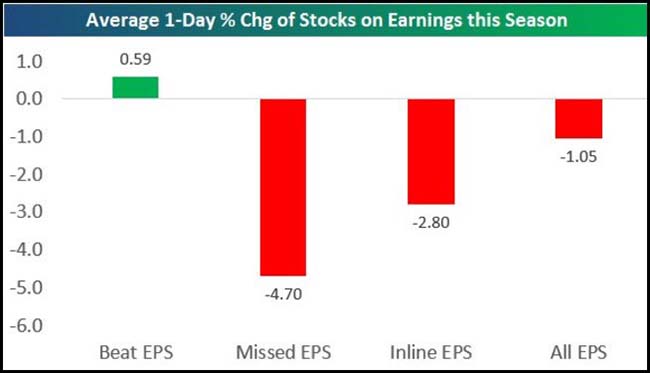

Even Bespoke mentioned that the average action is to the downside for this earnings season…

@bespokeinvest: Stocks that have beaten EPS estimates are only up 0.59% on average, while misses have fallen 4.7% and inlines have fallen 2.8%.

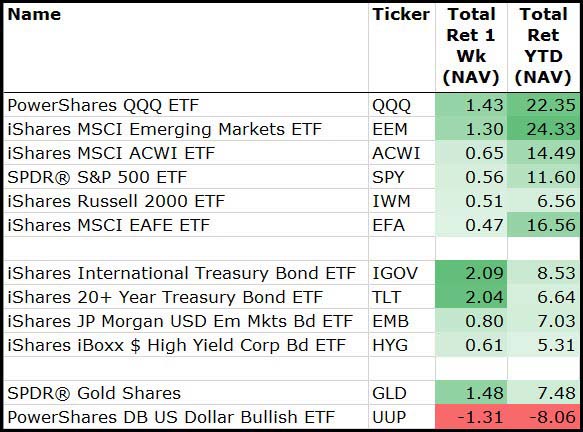

Plenty of green for the week except in the U.S. Dollar (again)…

You have to start wondering if the U.S. Dollar’s rapid decline will begin to start impacting the unit revenue outlooks for foreign companies.

(7/22/17)

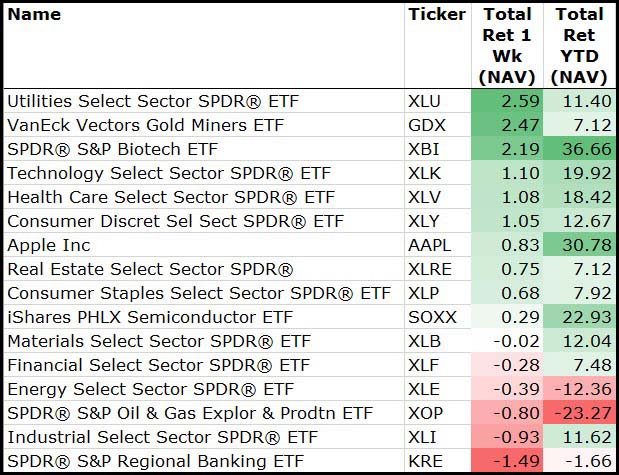

A bit more of a mixed bag when looking at the weekly performance of the U.S. sectors…

Utilities moving in lockstep with interest rates. Biotech, Technology, and Consumer Discretionary are leading as investors want growth companies. Value lags again as cyclical Bank earnings outlooks are a bust this quarter and early Industrial outlooks are also looking questionable. Then there is the value trap that we call the Energy sector.

(7/22/17)

If you stuck with your tech stocks over the last six weeks, congrats…

Your Barron’s subscription just paid for itself in the event that you listened to their June cover story.

(@bespoke)

ING had a good quote regarding the U.S. Dollar…

For the past few weeks, we’ve been working under the assumption that surely it can’t get any worse for the dollar. From an economic standpoint that’s probably a fair statement; negative sentiment over the state over the US economy has been excessive, while question marks over another Fed rate hike later this year also look a bit misplaced. While next week’s FOMC meeting and 2Q US GDP release could see some of this negativity ease up, US political uncertainty is now having an outright dampening effect on investor sentiment. In this environment, it’s hard to see anything but the dollar staying on the back foot, even if further weakness may be economically unjustified.

Further, the U.S. Dollar may not get any help from interest rates in the future if the Citigroup CEO is correct…

Citigroup is only expecting four more rate hikes through 2020

“We’ve got one more rate hike for the US built in and its December of this year. And quite frankly we’re assuming one more rate hike in ’18, one more rate hike in ’19 and one more rate hike in ’20.” —Citigroup CEO Miles Corbat

U.S. Banks could really use higher, longer-term rates to help their net interest margins…

Low long dated rates and rising short rates combined with increasing competition for bank deposits will put the Banks in a tough spot. Maybe they will get regulatory expense help from Washington but they had better not bet the bank on that. They either need a rising NIM or rising loan growth. The lack of one or both is what is troubling investors this month.

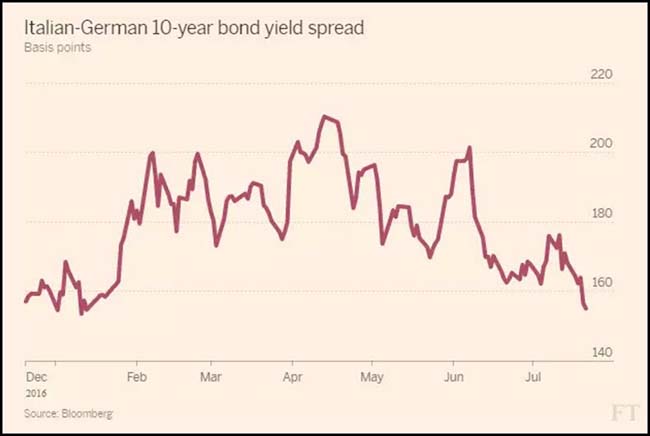

There continues to be an increasing appetite for risk in the Eurozone as evidenced by Italian bond spreads…

Hey man, everything’s fine in the Eurozone – that’s the message the bloc’s bond yields are sending, at least. Spreads between German government debt yields and those of other nations are ending the week around lows last seen months and, in some cases, years ago. The recent upward shift in German debt costs has combined with a downward tick in peripheral yields amid relief at ECB president Mario Draghi’s dovish tone this week, with both effects serving to narrow the gap between ultra-safe Bunds and the debt of periphery countries.

Transportation stocks from rail to truck to plane had a rough week of earnings reports as their outlooks became more uncertain…

“A few of our markets will experience year-over-year volume declines in the third quarter due to market specific headwinds you’re very familiar with. Auto shipments will be impacted by softening production.” —CSX CFO Frank Lonegro (Railroad)

“Truckload volume growth has slowed from the second quarter. The holiday timing makes precise comparisons difficult this early in the month but truckload volume growth has been in the low single digits.” —CH Robinson CEO John P. Wiehoff (Trucking Logistics)

“What is the point of growing faster than GDP, faster than your peers, while your margins are still declining?” Evercore ISI analyst Duane Pfennigwerth asked during an earnings conference call Wednesday.

Chief Executive Officer Oscar Munoz last year pledged to narrow the profit gap with Delta, but the disparity appears likely to expand. Delta Air Lines Inc. last week said its passenger revenue for each seat flown a mile would increase as much 4.5 percent this quarter. United Continental Holdings Inc. forecast no more than a 1 percent gain — and maybe a 1 percent decline.

Munoz is under increasing pressure to show that his aggressive move to increase connecting flights this year at United’s major U.S. hubs and recapture lost market share will pay off in higher earnings. The risk is that the increased capacity instead weakens fares. United executives said their plan is on track will show better results by year’s end.

We mentioned the rapid increase in RV shipments last week. Looks like it might be coming out of the seat of Harley-Davidson…

Harley-Davidson shares were on track for their biggest one-day drop in more than a year after the motorcycle maker issued downbeat outlook and posted disappointing US sales in the second quarter.

Shares in the Milwaukee-based company fell 9.7 per cent to $46.94 after it said it now expects ship 241,000 to 246,000 motorcycles to dealers worldwide this year, down between 6 to 8 per cent from a year ago. That compared to its previous outlook for shipments to be flat to “down modestly”.

Moreover, in the current quarter it expects shipments to be down between 10 to 20 per cent from a year ago.

That accompanied a 5.6 per cent drop in second quarter revenue to $1.58bn, compared with Wall Street estimates of $1.6bn. Investors were also disappointed after Harley said retail motorcycle sales in the US were down 9.3 per cent from a year ago. That followed a 5.7 per cent decline in the previous quarter and came despite a much easier comparison in the second quarter of 2016, analysts noted.

One of the larger comments on fossil fuels from last week’s calls…

CSX, a freight railroad company with origins in the bituminous coal seams of Appalachia, will not buy a single new locomotive to pull coal trains, chief executive Hunter Harrison told analysts on Wednesday. “Fossil fuels are dead,” Mr Harrison said. “That’s a long-term view. It’s not going to happen overnight. It’s not going to be in two or three years. But it’s going away, in my view.”

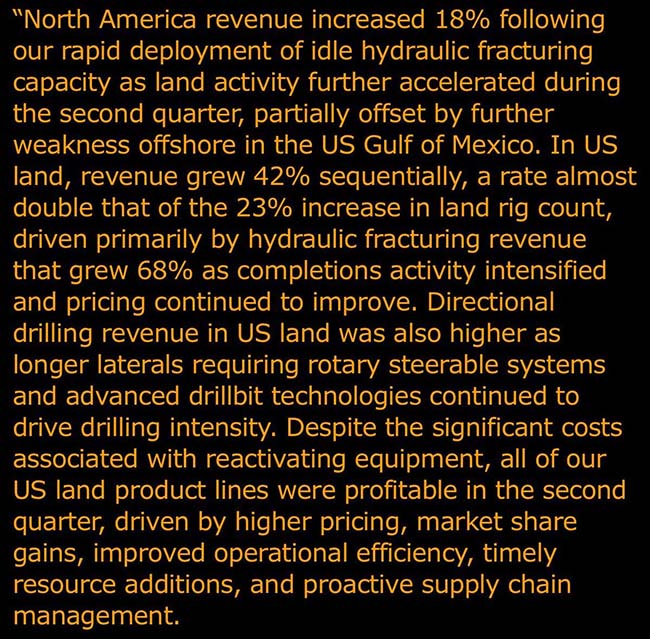

Comments from Schlumberger makes it sound like North America is fracking itself at a record pace…

Maybe OPEC had better hope that the U.S. and Canada gets every last carbon atom out of the ground sooner rather than later so that they no longer have to compete with our fracking anymore.

(@EventDriveMgr)

Here is just a small sample of all of the earnings that will hit this week…

(@eWhispers)

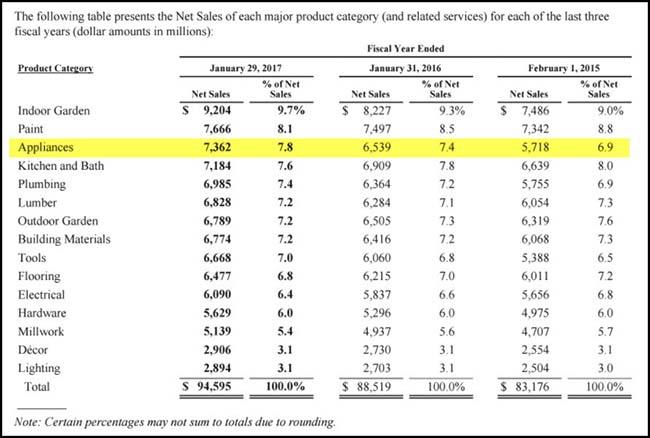

Home Depot, Lowes and Best Buy took 4-5% diggers last week on news that Kenmore appliances will be offered through Amazon…

Looking more closely shows that appliances are almost 8% of Home Depot’s sales…

Important to note that it has been a fast growing part of the store. And likely that the financing or warranty sales associated could make appliances a larger part of the bottom line. Pretty sure that Home Depot and Lowes are safe for now versus Amazon on the Indoor Garden category though.

(@MarioGabelli)

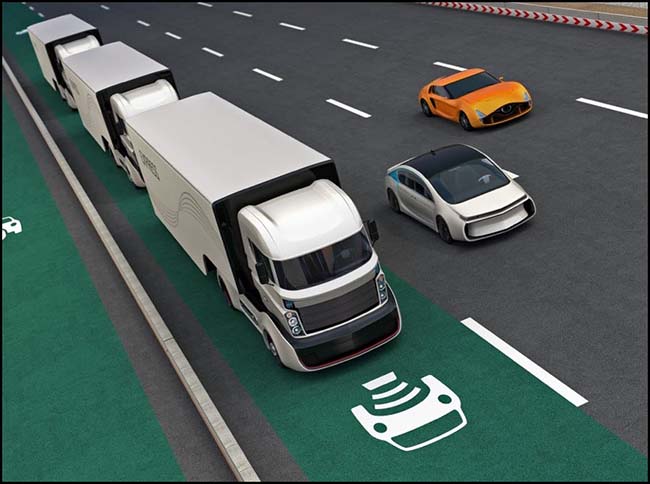

Finally, SHORT Botts’ Dots. And get LONG lane line stickers…

Finally, SHORT Botts’ Dots. And get LONG lane line stickers…One area this comes into with California is we’ve been using those Botts’ Dots. The automated vehicles [AVs] can follow lane lines. They can’t follow the Botts’ Dots, so we’re actually changing our delineation standards to go away from the Botts’ Dots which we’ve been using for decades because AVs have a difficult time following those.

All of our lane lines are going to get thicker. Today our lane lines are only four inches thick. Now every lane line we lie down going forward is going to be six inches thick. I’ve already started to see some of this transition. That’s good for the AVs, but it’s also good because it will be much more clear delineation for the human driver as well.

(SCPR)