by Lance Roberts, Clarity Financial

In Tuesday’s post, “A Shot Across The Bow,” I discussed the recent “Tech Wreck” and the warning sign that was delivered when trading algorithms begin to run in the same direction. To wit:

“The plunge was extremely sharp but fortunately regained composure and shares rebounded. A ‘flash crash.’

One day, we will not be so lucky. But the point I want to highlight here is this is an example of the ‘price vacuum’ that can occur when computers lose control. I can not stress this enough.

This is THE REASON why the next major crash will be worse than the last.”

Of course, it generally isn’t long after publishing commentary about the dangers of the current crowding into ETF’s, that I receive some push back.

Shocker: For fee broker advises against indexing https://t.co/VfCIYBEMnp

— JiveJoseph_Duarte (@JiveJoey_D) June 13, 2017

First, I am not a “broker.” I am a “fee-only” investment advisor which operates under the “fiduciary standard.”

While we do charge a below average fee for our services, our focus is on capital preservation and total portfolio returns to achieve our client’s long-term financial planning goals. Our client, and most importantly their hard earned savings, are our priority. (Read more in “The Financial Manifesto.”)

Secondly, I find a consistent uniformity of those who have fallen victim to the “buy and hold” and “passive indexing” mantra such as:

- They have never been through a major bear market.

- Have done little, if any, historical analysis with respect to market dynamics.

- Are generally very aggressively exposed to the markets leading to a need for “confirmation bias.”

- Have little or no understanding of the impact of loss with respect to long-term outcomes.

- Are generally investing with very small sums of money in the hopes of building exponential wealth.

- Believe in the long debunked theory of “compounded returns” in the markets.

Lastly, these individuals are NOT “passive” investors. They are simply “passive holders” while markets are rising and will become “active sellers” during the next significant decline.

However, let me clear, I am certainly NOT against using “indexed based” ETF’s for managing exposure to the markets for individuals who wish to have:

- Lower trading costs

- Higher tax efficiencies

- Less turnover

- Lower volatility

- Access to asset classes not covered in a traditional equity portfolio

But gaining access to those benefits does NOT mean being oblivious to the underlying risk of ownership. The firm I manage money for runs both an all-ETF strategy, as well as a blended ETF/Equity portfolio, we also apply a very strict set investment rules toward the management of “risk” in the portfolio. In other words, the entire practice adheres to Warren Buffet’s primary rules on investing:

- Don’t Lose Money

- Refer To Rule No. 1.

As is always the case, the time spent making up lost capital is far more detrimental to the long-term investment outcome than simply recouping a missed opportunity for gains.

Which is the point of today’s post.

Rise Of The Machines

While I have written often on the dangers of both ETF’s and “Passive Investing” (See here and here), my friend Evelyn Cheng highlighted confirmed the same yesterday.

“Quantitative investing based on computer formulas and trading by machines directly are leaving the traditional stock picker in the dust and now dominating the equity markets, according to a new report from JPMorgan.

‘While fundamental narratives explaining the price action abound, the majority of equity investors today don’t buy or sell stocks based on stock specific fundamentals,‘ Marko Kolanovic, global head of quantitative and derivatives research at JPMorgan, said in a Tuesday note to clients.

Kolanovic estimates ‘fundamental discretionary traders’ account for only about 10 percent of trading volume in stocks. Passive and quantitative investing accounts for about 60 percent, more than double the share a decade ago, he said.”

As discussed on previously, as long as the algorithms are all trading in a positive direction, there is little to worry about. As Evelyn noted there is a LOT of money piling into these trades globally.

“‘Derivatives, quant fund flows, central bank policy and political developments have contributed to low market volatility’, Kolanovic said. Moreover, he said, ‘big data strategies are increasingly challenging traditional fundamental investing and will be a catalyst for changes in the years to come.'”

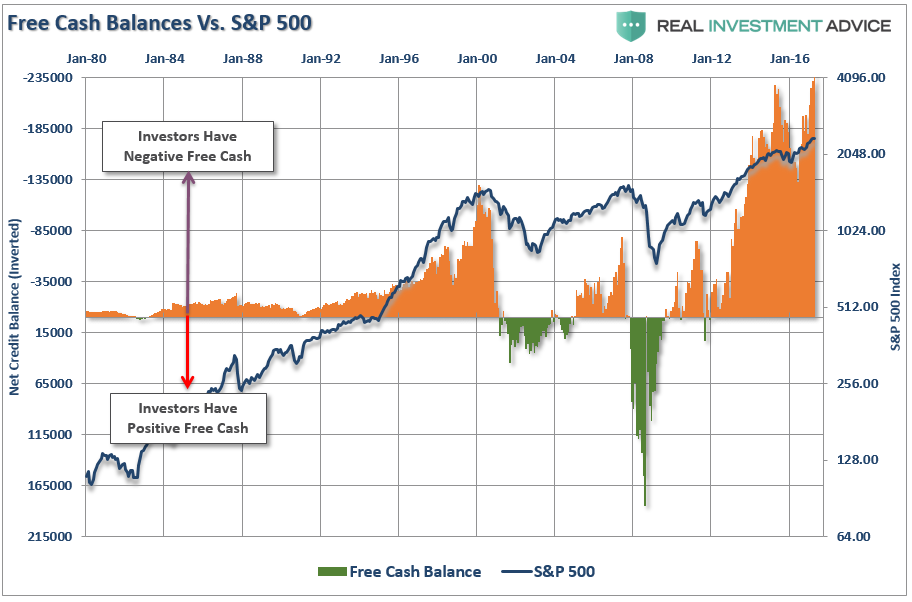

There are two other problems underlying the chase for ETF’s. While investors have been chasing returns in the “can’t lose” market, they have also been piling on leverage in order to increase their return. Negative free cash balances are now at their highest levels in market history.

The second problem, which will be greatly impacted by the leverage issue, is liquidity of ETF’s themselves. As I noted previously:

“The head of the BOE Mark Carney himself has warned about the risk of ‘disorderly unwinding of portfolios’ due to the lack of market liquidity.

‘Market adjustments to date have occurred without significant stress. However, the risk of a sharp and disorderly reversal remains given the compressed credit and liquidity risk premia. As a result, market participants need to be mindful of the risks of diminished market liquidity, asset price discontinuities and contagion across asset markets.’”

And then there was, of course, Howard Marks, who mused in his ‘Liquidity’ note:

‘ETF’s have become popular because they’re generally believed to be ‘better than mutual funds,’ in that they’re traded all day. Thus an ETF investor can get in or out anytime during trading hours. But do the investors in ETFs wonder about the source of their liquidity?’”

What Howard is referring to is the “Greater Fool Theory,” which surmises there is always a “greater fool” than you in the market to sell to. While the answer is “yes,” as there is always a buyer for every seller, the question is always “at what price?”

At some point, that reversion process will take hold. It is then investor “psychology” will collide with “margin debt” and ETF liquidity. As I noted in my podcast with Peak Prosperity:

“It will be the equivalent of striking a match, lighting a stick of dynamite and throwing it into a tanker full of gasoline.”

When the “robot trading algorithms” begin to reverse, it will not be a slow and methodical process but rather a stampede with little regard to price, valuation or fundamental measures as the exit will become very narrow.

Importantly, as prices decline it will trigger margin calls which will induce more indiscriminate selling. The forced redemption cycle will cause catastrophic spreads between the current bid and ask pricing for ETF’s. As investors are forced to dump positions to meet margin calls, the lack of buyers will form a vacuum causing rapid price declines which leave investors helpless on the sidelines watching years of capital appreciation vanish in moments.

If you don’t believe…just go look at what happened on September 15th, 2008.

It happened then.

It will happen again.

But I get it. The markets seem to be in an “unstoppable” bull market. This time certainly “seems different” with ongoing Central Bank interventions. Besides, with interest rates so low, “there is no alternative” for investors to put money.

Therefore, why not fire your advisor, buy a low cost index and just ride the market? Because, things like “Robo-advisors” and “ETF herding” are symptomatic of a lengthy bull market advance where the pain of previous losses has finally been erased.

Client’s don’t pay a fee to chase markets. They pay a fee to employ an investment discipline, trading rules, portfolio hedges and management practices that have been proven to reduce the probability a serious and irreparable impairment to their hard earned savings.

Unfortunately, the rules are REALLY hard to follow. If they were easy, then everyone would be wealthy from investing. They aren’t because investing without a discipline and a strategy tends to have horrid consequences.

What’s your plan for the second-half of the full market cycle.