by Adam Butler, CEO Resolve Asset Management

This is the second of a three-part series we’re affectionately calling “How to Get Comfortable with Being Uncomfortable.” The series covers the tremendous headwinds investors in traditional portfolios are likely to over the next decade or more, and the steps required to turn a bad situation into a great opportunity. These steps – set realistic expectations, diversify as much as you can handle, and take advantage of others’ mistakes with factor investing – are designed to help investors through whatever the future holds.

Reminder: Valuations are a Problem

In Part 1 of this series, we addressed how valuations on stocks and bonds remain extremely lofty. As a result, it is unrealistic to expect the portfolios that investors have grown comfortable with over the past few decades to produce the returns investors need to achieve financial independence. In fact, after adjusting for inflation and fees, we estimate that investors will be hard-pressed to earn more than 2% per year on traditional portfolios of domestically focused stocks and bonds over the next decade.

Investors who are entrenched in the current investment model face the uncomfortable choice of working longer, saving more, or lowering expectations about their retirement lifestyle.

But investors have other choices if they are willing to think more broadly about their investment options. These choices are no panacea. While they may substantially reduce investors’ savings burden, and provide long-term returns that will support a more substantial retirement lifestyle, they inflict a different type of discomfort.

Global Risk Party and Maximum Diversification

One way investors can make their portfolio more resilient to an uncertain future is to consider more comprehensive diversification strategies. Many investors would be surprised to learn that typical “balanced” portfolios composed of 60% stocks and 40% bonds actually derive over 90% of their risk from equities. This is because equities are so much more volatile than stocks. Even worse, equities only produce positive returns during periods of persistent positive growth shocks, benign inflation and abundant liquidity. While these conditions have prevailed in most years over the past few decades, there have been notable exceptions. In addition to the acute crisis periods like 2000-2002 and 2008, which many investors lived through personally, both equity and bond markets suffered through a 16-year period of low growth and high inflation from 1966 through 1982.

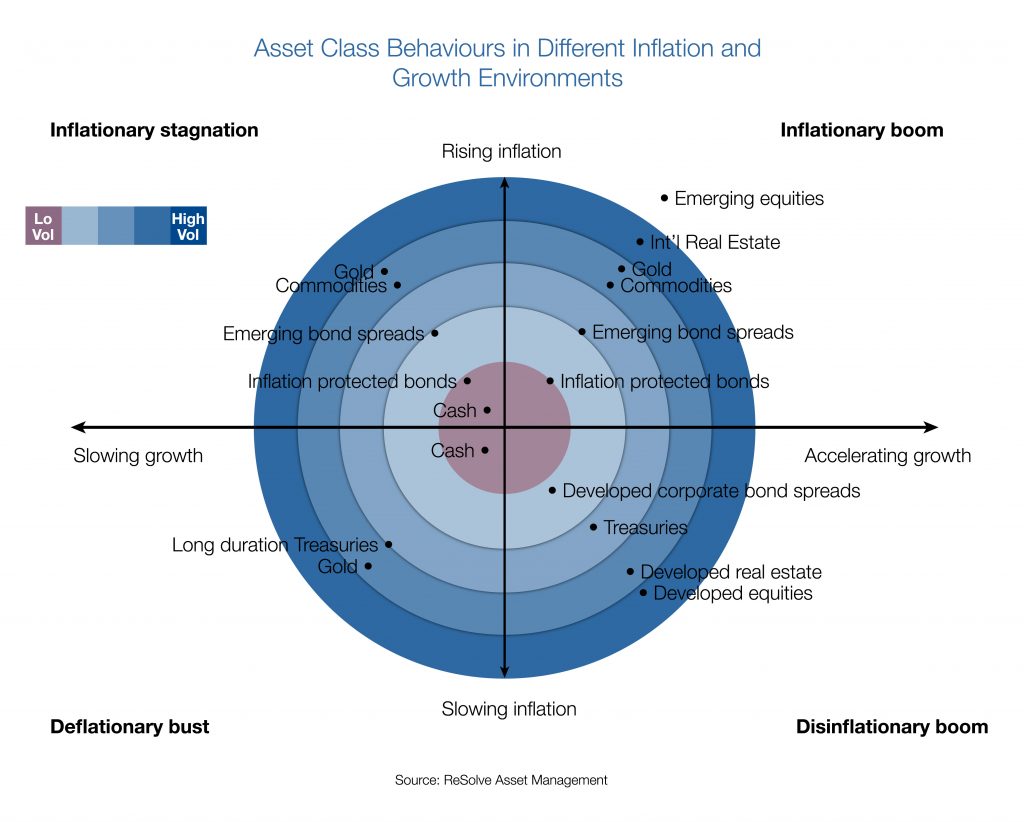

Figure 1 puts the idea of extreme diversification in context, by illustrating how various global asset classes would be expected to react to the economic effects of growth and inflation. Investors who do not feel qualified to forecast future economic environments might be well served by allocating to all of these asset classes so that they have the opportunity to profit however the future evolves. Of course, the asset classes in Figure 1 have very different risks, and complex relationships with one another.

The portfolio that maximizes the opportunity for diversification across these diverse assets is called the Global Risk Parity portfolio.

Figure 1. Asset class responses to the four major economic environments.

Source: ReSolve Asset Management

Source: ReSolve Asset Management

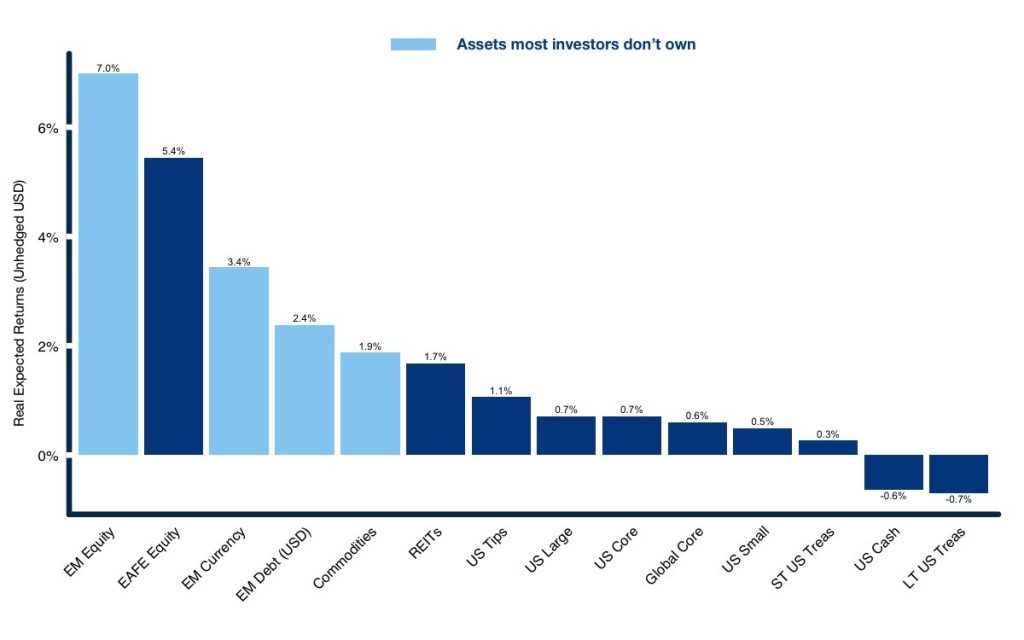

One way to introduce the prospect of higher future returns is to introduce frontier asset classes, such as emerging-market stocks and bonds. By many measures, emerging-market stocks, currencies and bond markets represent substantially better value – and commensurately higher prospective returns – than the developed markets with which investors are typically comfortable. For example, global firm Research Affiliates expects emerging market stock and bond markets, and commodities, to produce 7%, 3.4% and 1.9% real annualized returns over the next decade (See Figure 2). While these returns may appear unexciting, they compare quite favorably to expectations for US stocks and bonds, which range from 0.7% to -0.7%. By construction, global risk parity strategies allocate a significantly larger portion of capital away from U.S. equities, and provide greater allocation to markets that may offer higher expected returns.

Figure 2. Global Asset Classes: 10-Year Expected Real Returns

Source: Research Affiliates

If your Emotions Can’t Handle Extreme Diversification, Here is a Solution

When investors become acquainted with the arguments in favor of extreme diversification, they are often convinced that global risk-parity should form a meaningful portion of their portfolio. While I wouldn’t argue with this sentiment, diversification is not always an easy path to follow. Concentrated equity portfolios typically deliver very exciting returns during periods of strong growth and low inflation. Diversified investors will experience this excitement, but to a lesser extent. This breeds feelings of regret, especially when investors’ domestic equity market is leading the charge.

In practice, we advise clients to hold a portion of portfolios in their home equity market, and in other markets that they watch. This will attenuate feelings of regret, which often cause investors to make unwise choices under extreme emotion.

Capitalize on the Market’s “Willing Losers”

While a certain core of financial academics continues to cling to an outdated model of efficient markets, open-minded academics, and most experienced market practitioners, now acknowledge that investors make errors. Some of these errors are truly random and are offset by equally random errors in the opposite direction. But there are some types of errors that investors make over and over again in the same way. Some of these errors are actually not errors at all. Rather, they reflect the fact that investors have a variety of preferences in markets other than a pure focus on wealth maximization. I call these investors “willing losers” because they have decided to forego wealth maximization to pursue alternative objectives.

Minimizing the mistakes in your own portfolio while capitalizing on the mistakes of others are two sides of the same coin. Both require identifying errors – both irrational and rational – and systematically implementing methods to address them. In part 3, we will explore these promising methods, known collectively as “factor investing.”

Click here to learn more about Global Risk Parity.