Earnings update: Raising the bar

by Burt White, CIO, LPL Research

KEY TAKEAWAYS

• First quarter earnings season has been excellent by almost any measure.

• The comparison to depressed first quarter 2016 earnings was very easy, so the bar will be raised over the next several quarters.

• Market participants generally expect fiscal policy to begin to provide an earnings boost around New Year’s, an expectation that has become increasingly tenuous.

We continue to expect earnings may provide support for stocks in the months ahead.

Excellent earnings season but bar will soon be raised. First quarter earnings season has been excellent by almost any measure. Results beat expectations by more than usual. The overall growth rate is very strong, even without the big boost from energy. The ratio of companies lowering versus raising second (current) quarter earnings forecasts is well above average and guidance has provided better-than-usual support for analysts’ estimates for the balance of 2017. In total, these are all good things.

While we do not want to rain on the well-deserved earnings parade, two potential headwinds are worth noting. One, the comparison to depressed first quarter 2016 earnings was very easy and the bar will be raised over the next several quarters. Two, market participants generally expect fiscal policy to begin to provide an earnings boost around New Year’s, an expectation that has become increasingly tenuous as healthcare reform, other competing priorities, and various distractions have pushed the timetable back.

[SIDEBAR] Different sources such as FactSet, Bloomberg, Standard & Poor’s and others have different calculations than Thomson Reuters for S&P 500 earnings, based on various methodologies and different interpretations of what constitutes operating earnings. We favor Thomson Reuters and FactSet for their long track records and wide followings.Excellent earnings season by almost any measure

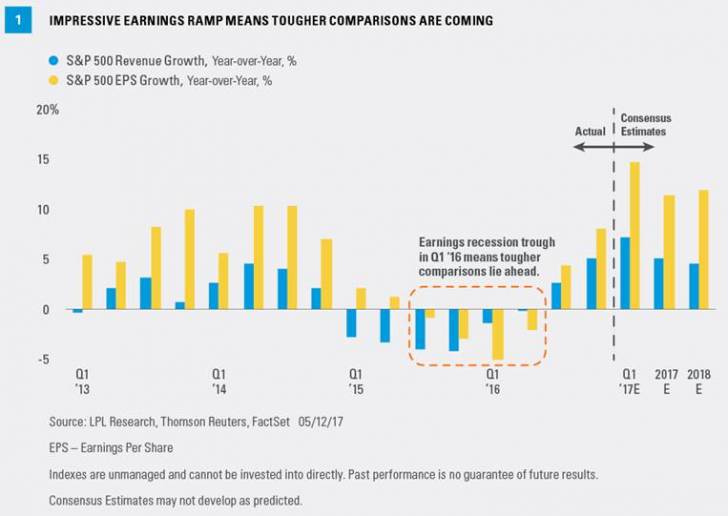

First quarter earnings season has been excellent by many measures. S&P 500 earnings are tracking to a nearly 15% year-over-year increase (Thomson Reuters), the best since the third quarter of 2011[Figure 1]. Despite easy comparisons against the trough of the earnings recession one year ago, we continue to be impressed with corporate America’s ability to maintain high levels of profitability despite pressures of slow economic growth, volatile commodities prices, and rising wages. Earnings have been an underrated driver of the stock market’s recent success—the S&P 500 is up 14% since the earnings recession effectively ended on July 1, 2016, compared with just 4% during the 12-month-long earnings recession from mid-2015 through mid-2016.

Despite the substantial hit to energy sector profits since oil peaked in late 2014, S&P 500 operating margins are just 1% off all-time highs reached in December 2014 (FactSet data). S&P 500 operating margins were two percentage points higher in 2016 than in 2006, and, based on consensus estimates, are expected to add another percentage point in 2017 and possibly another half point in 2018. Those estimates (based on analysts’ consensus) could prove optimistic, but the combination of stellar profitability and strong revenue growth (over 7% year over year in the first quarter), has enabled S&P 500 companies to produce double-digit earnings growth for the first time since the third quarter of 2014.

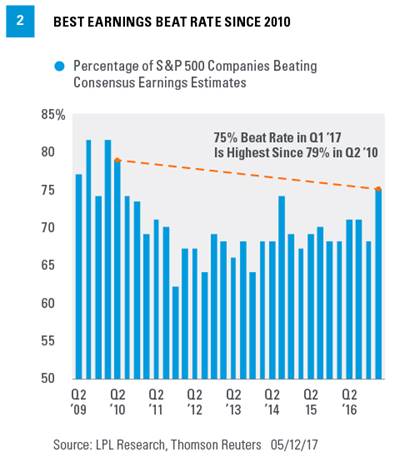

Also worth noting, it is typically more difficult to produce big surprises later in economic cycles. This quarter’s 4.5% upside surprise (14.7% increase compared with 10.2% prior to the start of earnings season) and the beat rate of 75% (best since 2010 [Figure 2]) is about as good as it gets, even including earlier in business cycles when analysts tend to be surprised by the initial upturn subsequent to a prior downturn. Frankly, the breadth of companies surpassing expectations caught us off guard; perhaps more so than the magnitude of the upside surprise (4.5%), which is only about one percentage point above the long-term average.

More good news: Guidance

Upside to the completed first quarter is important and has implications for the current and subsequent quarters. But our focus is always on the future more than the past; as stock prices move more on changes in future expectations than past news. On that score, this earnings season has been equally as impressive.

Since the quarter ended on March 31, 2017, estimates for the forward four quarters (Q2 ’17 through Q1 ’18) have fallen just 0.1%, compared with the typical earnings period decline of 2-3%. The back half of that forward period—Q4 ’17 and Q1 ’18—have actually seen estimates rise over the past six weeks, a rare occurrence.

It is probably not a coincidence that the two “out” quarters saw an increase in earnings given that is the likely time frame for potential policy benefits kicking in. Although potential pro-growth policies have had an impact through rising consumer and business confidence, the most impactful policy—namely tax reform—could easily slip into early 2018.

Another way to assess guidance is the pre-announcement ratio. During earnings season, the ratio of companies providing negative outlooks for the current (second) quarter compared with those that are positive is 2.0, better than the first quarter of 2017 (2.4) and the long-term (post-1995) average of 2.8.

Optimistic outlooks from corporate America, our forecast for better economic growth in the quarters ahead, and the potential for a policy boost, all point to continued solid earnings growth in the coming quarters, potentially in the high-single-digit range.

Sector standout: Industrials

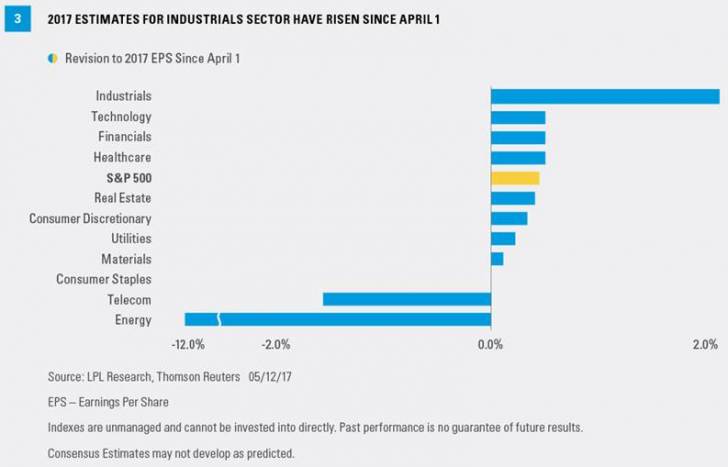

Although energy has made the biggest contribution to S&P 500 earnings growth in the quarter (more than 4% of the 14.7% total earnings growth) and produced the most upside to prior estimates (over 50%, though off a low base), the sector has seen its forward estimates slashed significantly. Industrials has produced the second most upside to first quarter estimates among S&P sectors, while also seeing the biggest positive revision to 2017 estimates [Figure 3]. The 2.9% year-over-year growth rate produced by industrials in the first quarter is nowhere near the top of the sector rankings, but the upside to prior estimates and resilience of future estimates have stood out to us.

We continue to like the industrials sector for improving company fundamentals, the potential for an uptick in capital spending as global growth improves, and the possible policy boost.

The bar has been raised

The strong annual increase in first quarter 2017 earnings largely reflects an easy comparison with the year-ago quarter that was depressed by the energy downturn. First quarter 2016 represented the trough of the earnings recession, seeing a 5% year-over-year decline compared with first quarter 2015. Going forward, the comparisons get tougher. As shown in Figure 1, 2016 quarterly growth rates improved to -2.1% in the second quarter, then rose to +4% and +8% in the third and fourth quarters. Growing earnings off of those stronger quarters last year will be tougher and tougher as 2018 approaches.

Policy risk has risen

With tougher comparisons coming, a policy boost will become increasingly important. With markets generally expecting fiscal policy to begin to provide an earnings boost around New Year’s, the potential for disappointment is high. Republicans are still working on healthcare reform and have given little indication that they will be able to work together effectively on complicated legislation. There is also little indication that Democrats are willing to work with the president on tax reform, while the Russia investigation is clearly a distraction. Bottom line, the timetable for corporate tax reform has been pushed back, increasing the odds that it slips into 2018, and what was previously a negligible chance of complete failure has become material.

[SIDEBAR] Later this month we will update our Corporate Beige Book barometer, an analysis of the topics covered in companies’ earnings conference calls.Conclusion

First quarter earnings season has been excellent by almost any measure, with a strong upside surprise and mostly positive guidance. Although the bar has been raised for subsequent quarters, when tougher comparisons will make double-digit earnings growth more difficult to achieve, we believe more solid earnings gains may lay ahead. The risk of policy disappointment has risen, but the odds still favor a policy boost at some point in the next 12 months, suggesting to us that earnings may provide support for stocks in the coming months and to consider buying any dips that may materialize.

*****