Why The US Economic Expansion Is Healthy

by Matt Palazzolo, Senior Portfolio Manager, AllianceBernstein

Matt Palazzolo, a Senior Portfolio Manager at Bernstein, recently sat down with AB’s US Senior Economist Eric Winograd to get his latest sense of the state of the US economy. He sees the expansion continuing without interruption, and the Fed remaining on path to raise rates two more times this year. Populism and protectionism are two risks, however, to keep a close eye on.

MATT PALAZZOLO: Eric, what’s your assessment of the current state of the US economy?

ERIC WINOGRAD: Structurally, the US economy is healthy. We’ve seen nearly seven years of solid, if unspectacular, growth. It’s appropriate now to think of this as an expansion rather than a recovery—and a rather long expansion at that. In their last meeting, the Fed recognized the transition by saying that they’re now trying to sustain an expansion, rather than cause an acceleration in the rate of growth.

Around that trend, there will still be fluctuations—periods when the economy grows a little bit faster, and periods when it grows a little bit slower. But overall, the US economy should continue to grow at a measured pace.

MP: Much has been made in the press in recent weeks about the difference between “hard” and “soft” data. Can you explain the difference and share your views on which one is more, or less, useful?

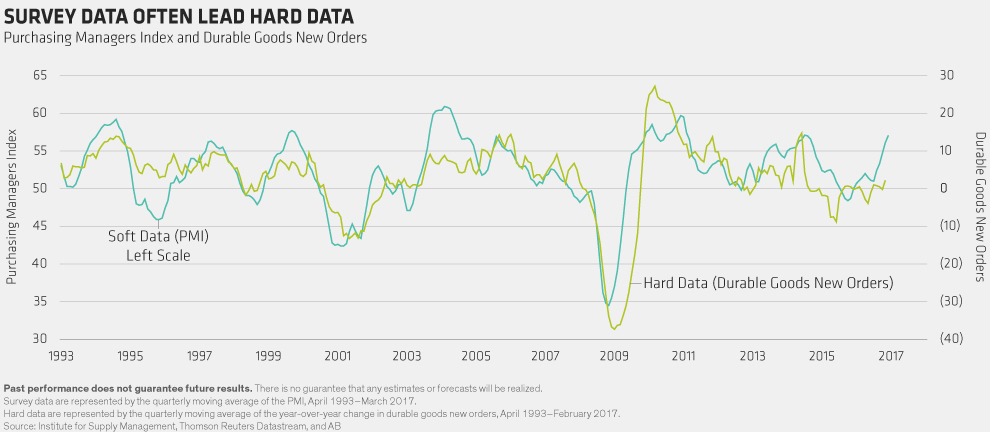

EW: This has been a topic of discussion among economists and financial-markets professionals over the last few months. “Soft data” usually involves surveys of consumers and businesses, which is an attempt to determine sentiment about the economy. “Hard data” is an attempt to quantify economic activity—how much of a given commodity has been sold, or how much industrial activity increased or decreased, for example.

Perhaps surprisingly, the soft data tend to be more reliable predictors of future economic activity than the hard data, because quantifying activity across the US economy is a challenge due to the size of the US and its varied industries.

As a result, hard data are revised repeatedly in the weeks and months subsequent to their release. Over time, the revisions usually move the hard data to what the soft data were indicating at the beginning.

Currently, strong survey data show a more positive read on the US economy. That gives us confidence that the economy as a whole is doing well. We expect the hard data to reflect that eventually (Display 1).

MP: President Trump has been talking a lot about the potential for fiscal policy changes, tax reform, and infrastructure spending. What’s your gauge on the likelihood of such policies getting pushed through Congress? And what would the potential impact be on the economy?

EW: My general sense is that a significant fiscal policy change this year is unlikely. The new administration hasn’t made much progress on its legislative agenda to date, other than high-level announcements. And even if we do see a tangible fiscal proposal at some point, it’s unlikely to have an economic impact this year, due to the length of time it would take to be adopted and implemented.

That said, new fiscal policy could change the economic picture quite significantly. Fiscal expansion at this point in the cycle could be inflationary, which could offset the boost to growth it could provide.

MP: The Fed has been targeting 2% inflation over the last couple of years. In your opinion, what’s the likelihood that it gets there? And what is your base case for interest-rate increases in 2017?

EW: We think that the Fed, with help from the strong economy, has largely succeeded in its goal of increasing inflation toward its 2% target. The Fed isn’t quite there yet, but the odds are in favor of getting there by early next year.

If the economy grows in line with our forecast of 2.3% GDP growth in 2017, we think the Fed would likely raise rates twice more this year and begin to reduce its balance sheet around year-end.

MP: What are the key concerns that might disrupt your base-case scenario and cause the economy to slow down meaningfully?

EW: Two risks concern us. The first is the rise of populism as a global political phenomenon. If manifested in certain sorts of fiscal policies, populism could lead to higher near-term growth but also to higher inflation—something we are keeping a close eye on.

Protectionism is the other—and a more tangible risk. Given the Trump administration’s frustrations in advancing its legislative agenda to date, it may use trade policy, where the executive branch can act more independently, to fulfill promises made to the electorate.

It’s uncertain what shape these trade policies will take. It could be a series of ad hoc tariffs. It could be demands to renegotiate free trade agreements. There are a whole host of possibilities. We think that each of them, if adopted, would likely have a negative impact on near-term economic growth. If these risks aren’t realized, however, we expect the US economy to continue its already long-lived expansion.

MP: Eric, thanks for your insights.

The views expressed herein do not constitute research, investment advice or trade recommendations,and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein