Japanese Linkers: Opportunity Rising for Global Bond Investors - Context

by Fixed Income AllianceBernstein

March 13, 2017

An opportunity may be arising in one of the forgotten corners of the global fixed-income market—Japanese inflation-linked bonds (JGBi), or “linkers.” Active global bond investors can take advantage.

For many years, Japanese government bonds (JGBs) have been a barren field for global investors, as yields have wallowed at rock-bottom levels, even in negative territory. It’s been even harder to make a case for Japanese “linkers,” whose principal value is linked to the inflation rate, as stubborn deflationary pressure has persisted—until now.

The investment landscape is changing as global economic growth and inflationary pressure have been gathering pace since late 2016 on the back of improved business confidence and higher commodity prices. US policies to spur reflation and a push for more fiscal stimulus in Japan and other major economies are adding fuel to this trend.

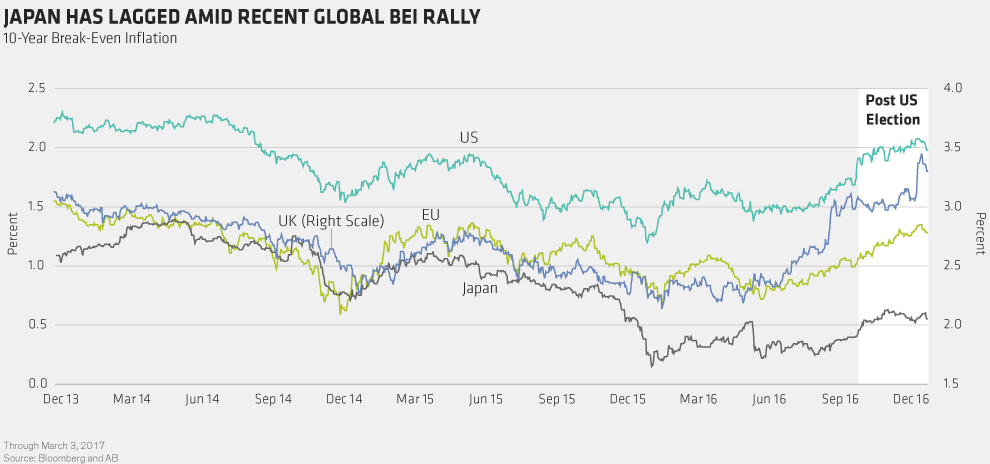

As a result, global break-even inflation (BEI)—the difference between the yield of a conventional government bond and an inflation-linked bond of the same maturity—has been on an uptrend. We believe that Japan’s BEI, which so far has lagged its global counterparts, has some more room to catch up, and investors can take advantage of this uptrend by buying JGBis. There are three major factors behind our positive view: favorable economic fundamentals, valuations and supply/demand.

Fundamentals: Growth and Inflation Outlook Improving

Consensus forecasts for both growth and inflation in Japan have risen in recent months due to an expansionary fiscal policy at home and improving external demand. The Bank of Japan’s (BOJ) monetary policy also remains very accommodative.

In addition to these policy steps, the labor market remains extremely tight, and the outlook for wages has continued to improve. We expect the core consumer price index, which dipped 0.3% year over year in December 2016, to rise 0.7% in fiscal year 2017.

Valuations: Japan Has Lagged in Recent Global BEI Rally

While BEI has been on an uptrend globally, our positive view on Japanese BEI stems from a conspicuous divergence between Japanese and global BEI since the second half of 2016. After the US election in November, BEI in the US, Germany and the UK spiked by 30–40 b.p., while the expansion in Japan has been only half that size (Display). This makes Japanese BEI cheap relative to its global peers, particularly as core inflation in Japan should pick up further in the second half of the year.

Assuming that oil prices and the yen’s exchange rate stay at their current levels, a rise in electricity tariffs—which typically lag oil prices by several months—and higher prices for imported goods due to the yen’s weakness are likely to filter through to consumer price inflation, which in turn would lift Japanese BEI.

Furthermore, the chances of linkers outperforming nominal bonds are increased by the prospect that the BOJ will begin tapering its asset purchases, perhaps in 2018, as its 2% inflation target comes within reach.

Even if all these upbeat forecasts fail to materialize, Japanese linkers offer an attractive feature that acts as a protection against a relapse into deflation. The Japanese government guarantees that the capital repayment at maturity will always amount to at least the par value, effectively providing a “floor” against deflation.

Supply/Demand: Large, Regular Buyers Keep Market Tight

Supply has been perennially tight, as steady purchases by the BOJ and public pension funds, on top of buybacks by the Ministry of Finance, have taken up a large part of new JGBi issues. And the appetite for JGBi among foreign investors has been on the rise since BEI bottomed last summer. With the reflation theme dominating the outlook, we would expect more global linker funds to increase their asset allocation to the Japanese market, given its attractive valuations relative to its global peers.

So, if Japanese linkers are so attractive, why aren’t mainstream global investors snapping them up? One big reason is because these securities aren’t included in major global government bond indices, and many investors put their money in passive funds that are benchmarked to those indices.

Actively managed portfolios that have the flexibility to invest outside the benchmark can enhance their potential return and achieve better diversification. With the risk in many global markets tilting toward higher interest rates, Japanese linkers make going off the beaten track worthwhile.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein