by Ryan Detrick, LPL Research

Ask fixed income investors what keeps them up at night, and they might tell you inflation and Federal Reserve (Fed) interest rate hikes. Many concerns would center on the impact of rising inflation, which would reduce the purchasing power of future cash flows. As such, traders and investors are focusing heavily on inflationary data and paying particular attention to Federal Reserve (Fed) members’ comments on rates. The market’s working theory is that rising inflation would cause the Fed to act more quickly and could potentially lead to three Fed rate hikes for 2017 (in line with the view expressed in our 2017 Outlook of two to three rate hikes). Considering that the bond market is struggling since the last Fed rate hike in December, an overly aggressive Fed is causing considerable angst.

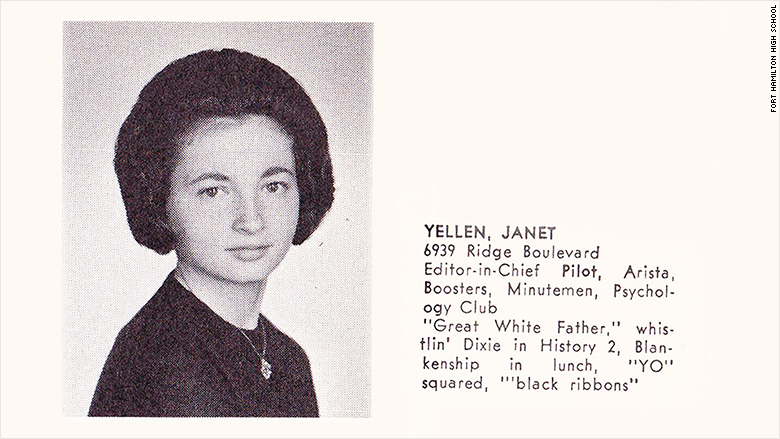

The first in a string of inflationary data points came out of China on Monday, when the Producer Price Index (PPI) data showed price climbed 6.9%, a five-year high. U.S. PPI data also rose in January to 0.6%, above the 0.3% that economists expected. The U.S. Consumer Price Index (CPI) beat expectations on Wednesday as well, with headline CPI jumping 0.6% (versus a consensus estimate of 0.3%), and core CPI, which removes the impact of more volatile food and energy prices, increased by 0.3% (versus the 0.2% consensus). This brings core CPI to a year-over-year rate of 2.3%, above the Fed’s 2% target. The combination of these inflationary figures along with Fed Chair Janet Yellen’s comments on Tuesday have caused a spike in the fed funds futures market.

One week ago the probability of a hike at the Fed’s March meeting (March 15, 2017) was minimal at 26%. Chair Yellen stated in her semi-annual testimony to the U.S. Senate on Tuesday (February 14, 2017) that “waiting too long to remove accommodation would be unwise,” and the probabilities quickly adjusted higher. As of today (February 16, 2017), the probability of a March hike implied by the fed funds futures market stands at 40%.

As we approach March, all eyes will be on inflation data and Fed commentary. A careful review of the Fed probabilities can help investors determine the market sentiment regarding the direction of fed funds rates. Stay tuned to the LPL Research blog for any important updates.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

The Producer Price Index (PPI) of the Bureau of Labor Statistics (BLS) is a series of indexes that measure the average change over time in the prices received by domestic producers of goods and services. PPIs measure price change from the perspective of the seller. The headline PPI (for finished goods) is a measure of the average price level for a fixed basket of capital and consumer goods for prices received by producers.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-582799 (Exp. 02/18)

Copyright © LPL Research