by LPL Research

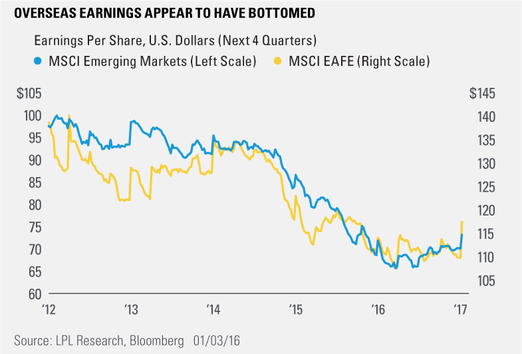

We expect that 2017 will be the year of improving fundamentals, but increasing risk, in many of the international markets. The biggest expected improvement in fundamentals comes from the uptick in corporate earnings. After declining corporate earnings for several years (since 2012 for the MSCI EAFE Index, and since 2011 for the MSCI Emerging Market Index index) earnings have been increasing, and are expected to continue to do so. We also expect that a stronger U.S. economy, boosted in part by tax cuts, infrastructure and defense spending, and deregulation will also boost economies, and therefore companies, across the globe.

The incredible irony is that it is the risks to overseas investing are largely coming from disenchantment over increased globalization. Beginning with the U.K.’s June vote to leave the European Union, many 2016 and scheduled 2017 elections and referendums across Europe are challenging European economic and political integration. Their outcomes have been muted thus far, but could be more extreme and more negative, depending on the results of elections in France and Germany later this year. Of course, U.S. trade policy itself may be a negative for overseas markets, as President-elect Donald Trump has suggested a more protectionist mindset than previous administrations.

Also adding to the risks of overseas investing, for the first time in several years, major global central banks have divergent monetary policies. The U.S. Federal Reserve (Fed) is now clearly tightening monetary policy, the only major central bank likely to do so in 2017, though the Bank of England is under some pressure to raise rates after the pound’s post- Brexit vote decline. A few emerging market central banks, most noticeably Mexico’s, are under the same pressure. Fed tightening is expected to keep upward pressure on the U.S. dollar. Our base case is for this pressure to be contained, with the dollar appreciating modestly over the course of the year. Strength in overseas profit growth should be enough to overcome the expected dollar headwind. However, should there be prospects for more Fed tightening than currently expected, the resulting stronger dollar, which would be negative for overseas investments, might overcome the positive effects of stronger overseas earnings.

*****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Because of their narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

The MSCI EAFE Index is recognized as the pre-eminent benchmark in the United States to measure international equity performance. It comprises the MSCI country indices that represent developed markets outside of North America: Europe, Australasia, and the Far East.

The MSCI Emerging Markets Index captures large and mid cap representation across 23 emerging markets (EM) countries. With 822 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-568295 (Exp. 1/18)

Copyright © LPL Research