by Lance Roberts, Clarity Financial

I have written over the last couple of months the market was likely to rally into the end of the year as portfolio managers, hedge, and pension funds chased performance and “window dressed” portfolios for year-end reporting purposes. As I noted in this past weekend’s missive:

“I still suspect there is enough bullish exuberance currently to push the Dow to 20,000 and the S&P to 2,300 by the end of the year. However, I am more concerned about what I believe may occur after the inauguration in January.

I have discussed previously the importance of ‘price’ as an indicator of the market ‘herd’ mentality. One of the major problems with the fundamental and macro-economic analysis is the psychology of the ‘herd’ can defy logical analysis for quite some time. As Keynes once stated:

‘The markets can remain irrational longer than you can remain solvent.’

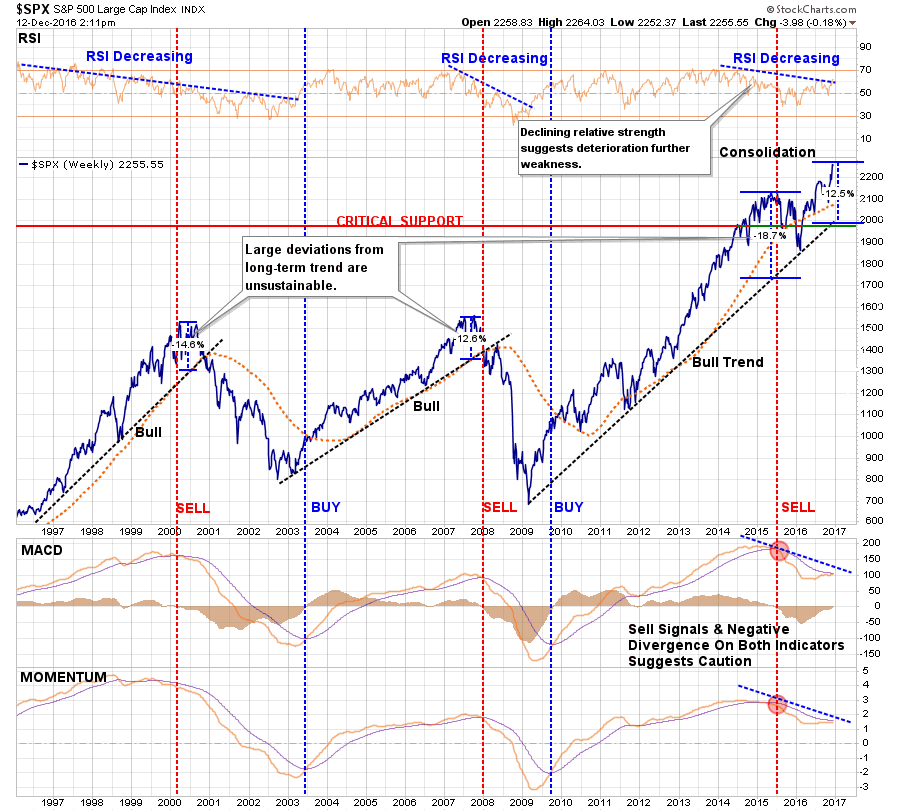

Many an investor have learned that lesson the hard way over time and may be taught again in the not so distant future. As shown in the chart below, the momentum of the market has decidedly changed for the negative. Furthermore, these changes have only occurred near market peaks in the past. Some of these corrections were more minor; some were extremely negative. Given the current negative divergences in the markets from RSI to Momentum, the latter is rising possibility.”

Despite this technical deterioration and excessive price extension, the “bullish vs. bearish” argument continues.

Let’s examine both arguments.

The Bullish Bias

The bulls currently have the “wind at their backs” as the exuberance mounts the new administration will foster in an age of deregulation, infrastructure spending and tax cuts that will be boost corporate earnings in the future. As Jack Bouroudjian via CNBC wrote:

“Let’s be clear, this market run up to the 20K level has a much more solid foundation for valuation. We are not looking at a P/E which has been stretched beyond historic norms as was the case in 1999, nor are we looking at a dot com bubble ready to implode. On the contrary, between digestible valuations and the prospects of real pro-growth policies, we have the foundation for a run up in equities over the course of the next few years which could leave 20K in the dust.

One of the great lessons in the market is that when ‘Animal Spirits’ take control, one must simply go with it. It’s not easy to recognize a paradigm shift, in fact many can only realize the phenomenon after the fact. The Trump victory coupled with the sweep in congress makes this a classic paradigm shift and the financial world needs to embrace it.

The dark days of wasted revenue and liberal tax and spend policies is giving way to an era of fiscal stimulus and pro-growth legislation not seen in 30 years. All this is coming at a time when corporate America, sitting on mountains of cash both domestically and overseas, find itself on the brink of a digital revolution.

Over the course of the next few years, corporations should see top line growth and expanding operating margins. With the understanding that equity prices move on expectations, one must conclude that the rally we have experienced over the last few weeks might be the ‘tip of the iceberg’ when it comes to the move we will see in the coming years.”

This, of course, is just the latest iteration of the “bull argument.” Previously it was Federal Reserve liquidity, low interest rates, and low inflation were good for stocks. Now, it is higher interest rates and inflation is good for stocks. In other words, there is apparently no environment that is bad for stocks. Right?

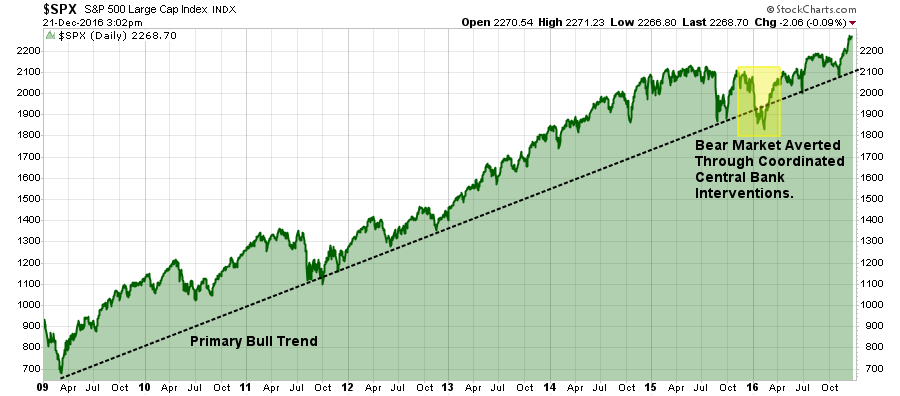

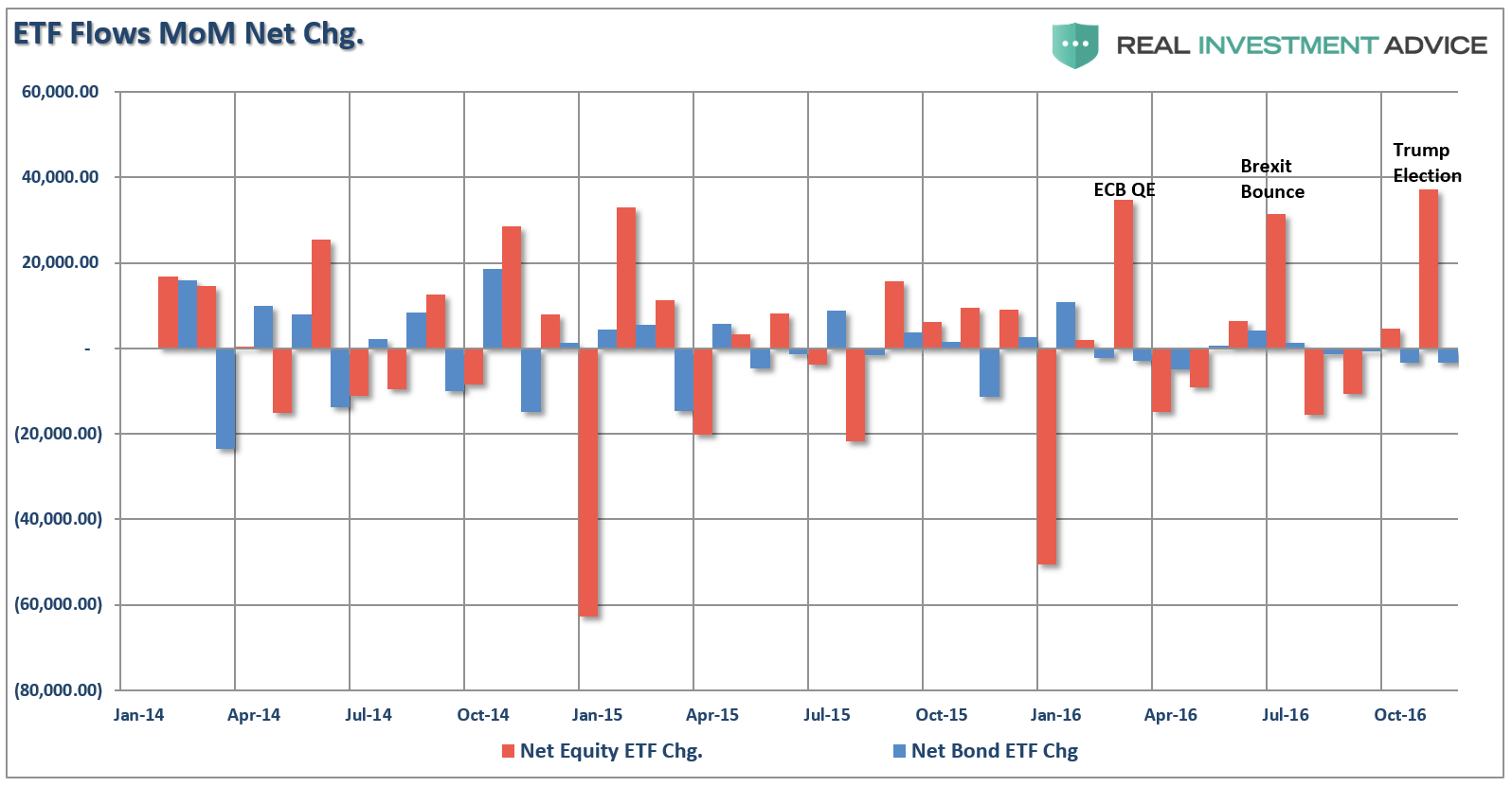

As shown below, the bullish trend has remained firmly intact since the onset of QE1 which brings two Wall Street axioms into play:

Since the primary goal of the Federal Reserve’s monetary interventions was to boost asset prices, in order to stimulate economic growth, employment, inflationary pressures and consumer confidence, there is little argument the Fed achieved its goal of inflating asset prices. The “bulls” drank deeply from the proverbial “punch bowl.”

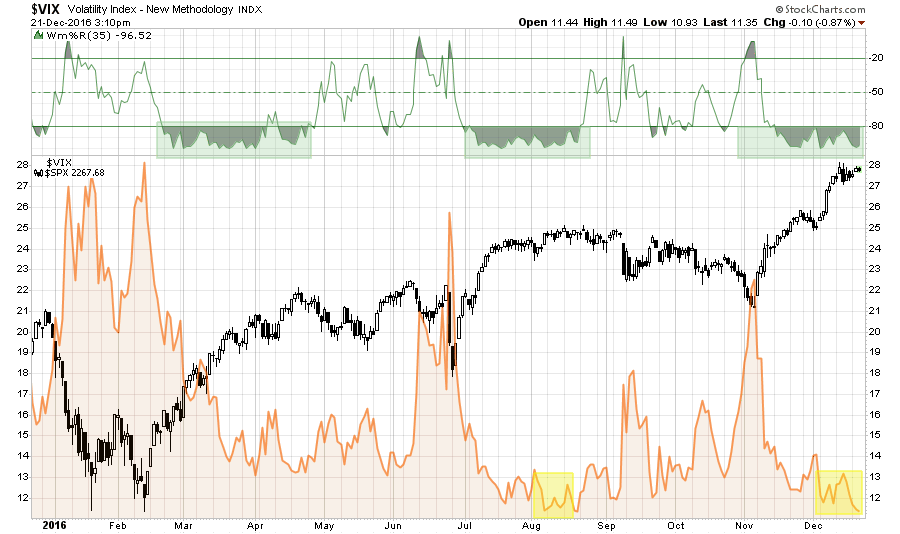

The continuous and uninterrupted surge in asset prices has driven investors into an extreme state of complacency. The common mantra is the “Fed will not let the markets fall” has emboldened investors to take exceptional risks. The chart of volatility shows again that bulls remain clearly in charge of the markets currently with the “fear of a correction” at near historic lows.

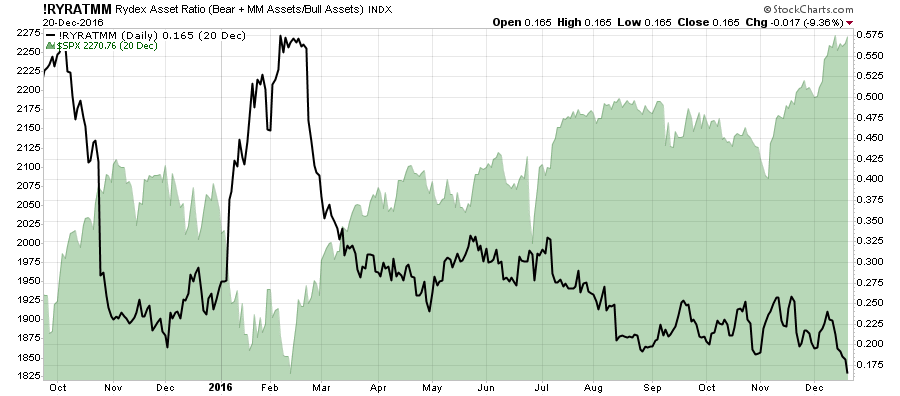

We can see the same level of bullishness when looking at the levels of “bearish” ratio of Rydex funds. (Bear Funds + Cash Funds / Bull Funds)

In other words, since investors have little fear of a correction, they have now gone “all in” following the election.

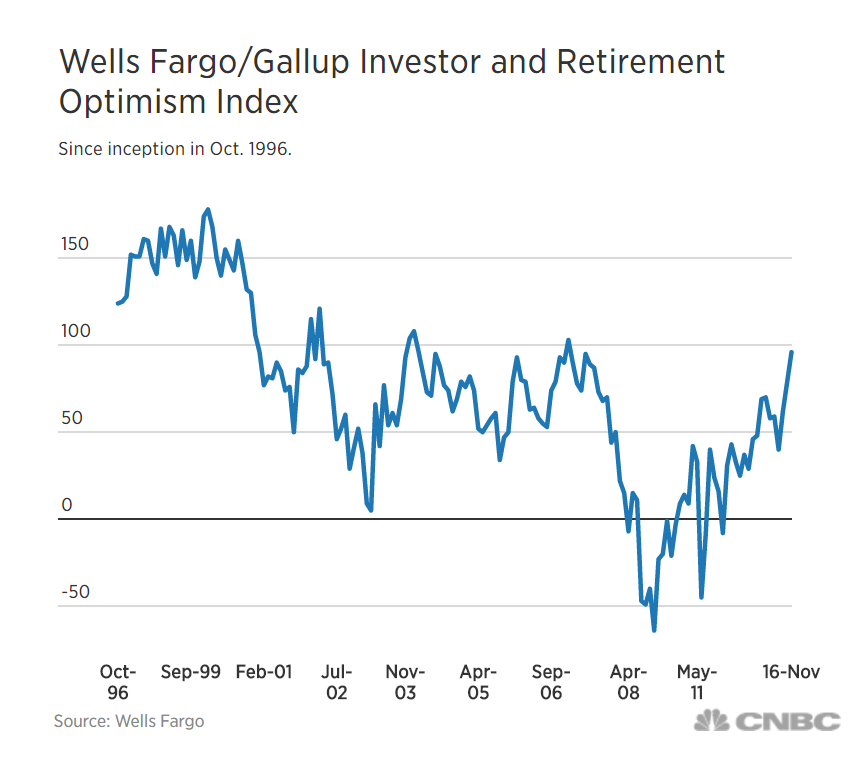

Lastly, since the election, investors confidence has soared as discussed by Evelyn Cheng via CNBC this week:

“Individual investor optimism jumped to a nine-year high in November, according to the Wells Fargo/Gallup Investor and Retirement Optimism Index published Tuesday.

The last time the index approached the November level was before the financial crisis, in May 2007 with a read of 95, the report said. The index was at 103 in January 2007.”

There is little doubt the “Bulls are back.” With the markets pushing all-time highs heading into the 9th year of a bull market, the belief is the momentum is set to continue. In fact, there isn’t a “bear” in sight:

“The unexpected election last month of Donald J. Trump as president has been a game changer for the 10 investment strategists whose market outlook Barron’s solicits twice each year. As stocks took off on Nov. 9 and thereafter, fueled by investors’ enthusiasm for Trump’s expected pro-growth agenda, even our group’s bears turned bullish.“

The Bearish Perspective

While the bulls are pushing a continuation of the market based on “hopes” and “expectations,” the bears are countering with a more rational and pragmatic basis.

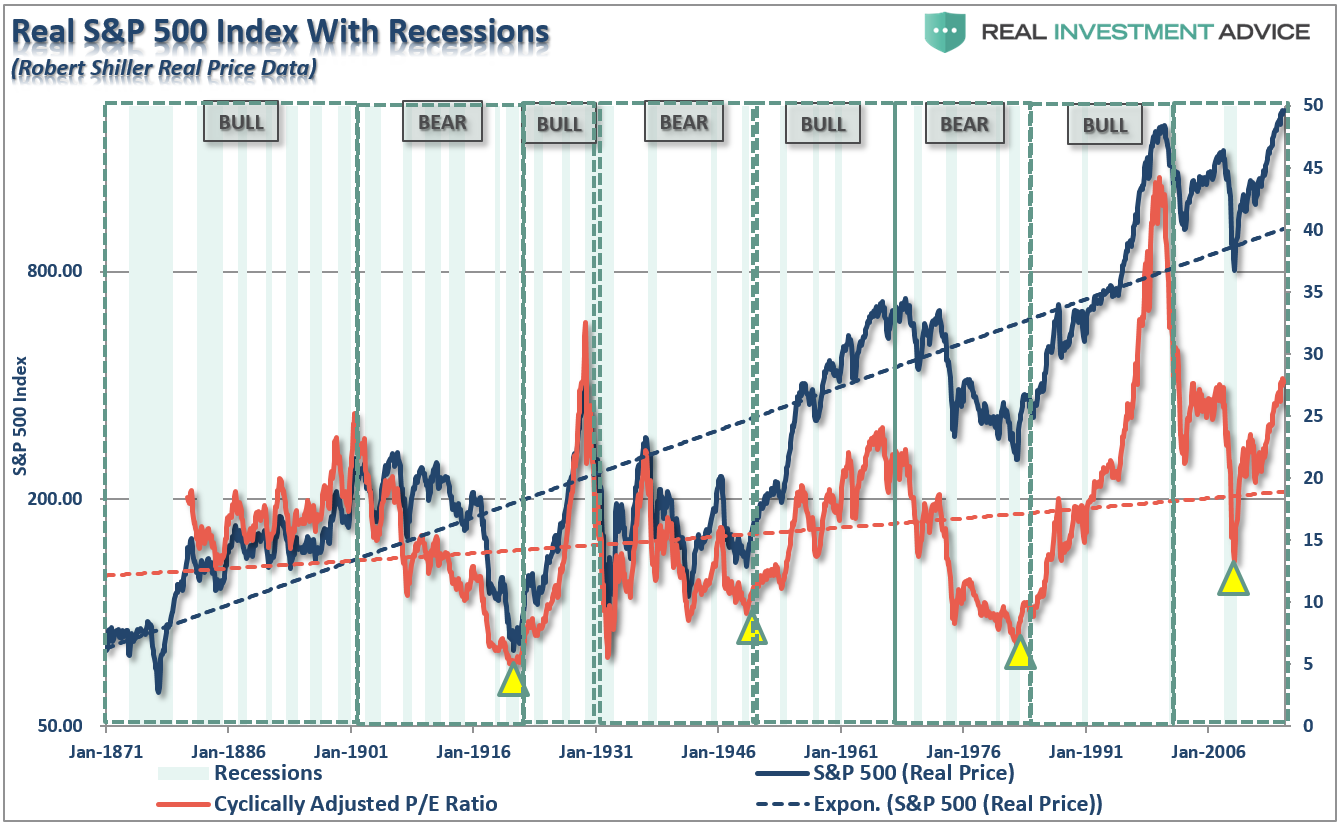

Valuations, by all historical measures, are expensive. While high valuations can certainly get higher, it does suggest that future returns will be lower than in the past.

That statement of “lower future returns” is very misunderstood. Based on current valuations the future return of the market over the next decade will be in the neighborhood of 2%. This DOES NOT mean the average return of the market each year will be 2% but rather a volatile series of returns (such as 5%, 6%, 8%, -20%, 15%, 10%, 8%,6%,-20%) which equate to an average of 2%.

Of course, as discussed previously, investor behavior makes forward long-term returns even worse.

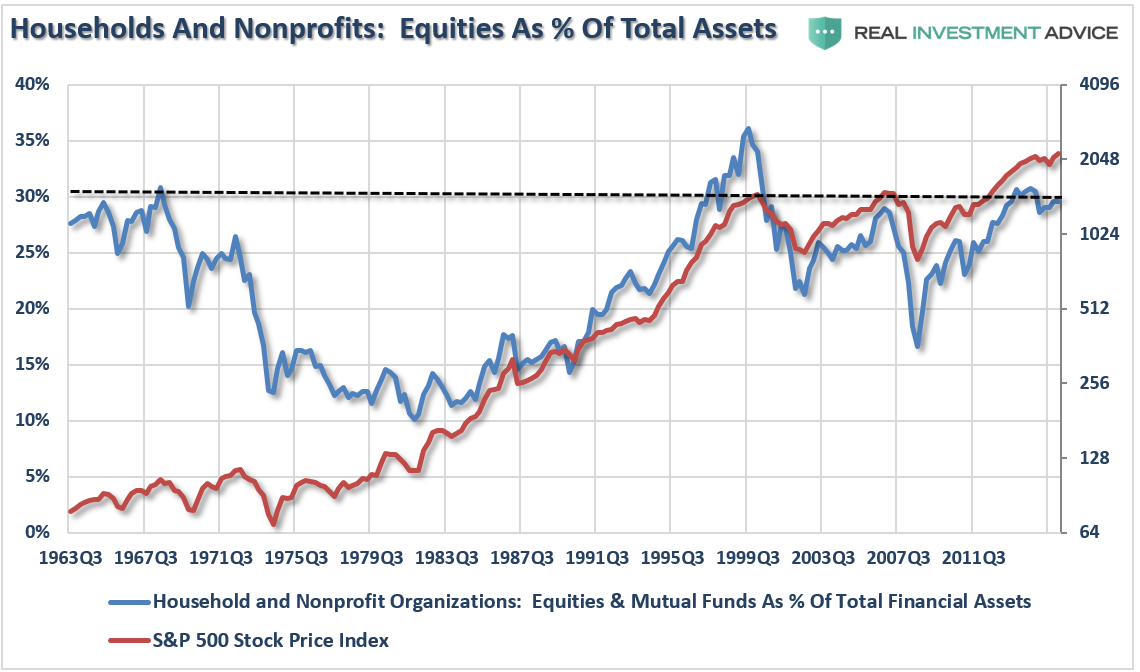

The bulls have continually argued that the “retail” investor is going to jump into the markets which will keep the bull market alive. The chart below supports the bear’s case that they are already in. At 30% of total assets, households are committed to the markets at levels only seen near peaks of markets in 1968, 2000, and 2007. I don’t really need to tell you what happened next.

The dearth of “bears” is a significant problem. With virtually everyone on the “buy” side of the market, there will be few people to eventually “sell to.” The hidden danger is with much of the daily trading volume run by computerized trading, a surge in selling could exacerbate price declines as computers “run wild” looking for vacant buyers.

This thought dovetails into the “hyperextension” of the market currently. Since price is a reflection of investor sentiment, it is not surprising the recent surge in confidence is reflected by a symbiotic surge in asset prices.

The problem, as always, is sharp deviations from the long-term moving average always “reverts to the mean” at some point. The only questions are “when” and “by how much?”

Managing Past The Noise

There are obviously many more arguments for both camps depending on your personal bias. But there is the rub. YOUR personal bias may be leading you astray as “cognitive biases” impair investor returns over time.

“Confirmation bias, also called my side bias, is the tendency to search for, interpret, and remember information in a way that confirms one’s preconceptions or working hypotheses. It is a systematic error of inductive reasoning.”

Therefore, it is important to consider both sides of the current debate in order to make logical, rather than emotional, decisions about current portfolio allocations and risk management.

Currently, the “bulls” are still well in control of the markets which means keeping portfolios tilted towards equity exposure. However, as David Rosenberg recently penned, the markets may be set up for disappointment. To wit:

“In fact, despite base effects taking the year-over-year trends higher near-term, I think we will close 2017 with consumer inflation, headline and core, below 1.5% (though both will peak in the opening months of the year at 2.6% and 2.3% respectively).

The question is what sort of growth we get, and as we saw with all the promises from ‘hope and change’ in 2008, what you see isn’t always what you get.

There are strong grounds to fade this current rally, which has more to do with sentiment, market positioning and technicals than anything that can be construed as real or fundamental. There is perception, and then there is reality.”

Currently, there is much “hope” things will “change” for the better. The problem facing President-elect Trump, is an aging economic cycle, $20 trillion in debt, an almost $700 billion deficit, unemployment at 4.6%, jobless claims at historical lows, and a tightening of monetary policy and 80% of households heavily leveraged with little free cash flow. Combined, these issues will likely offset most of the positive effects of tax cuts and deregulations.

Furthermore, while the “bears” concerns are often dismissed when markets are rising, it does not mean they aren’t valid. Unfortunately, by the time the “herd” is alerted to a shift in overall sentiment, the stampede for the exits will already be well underway.

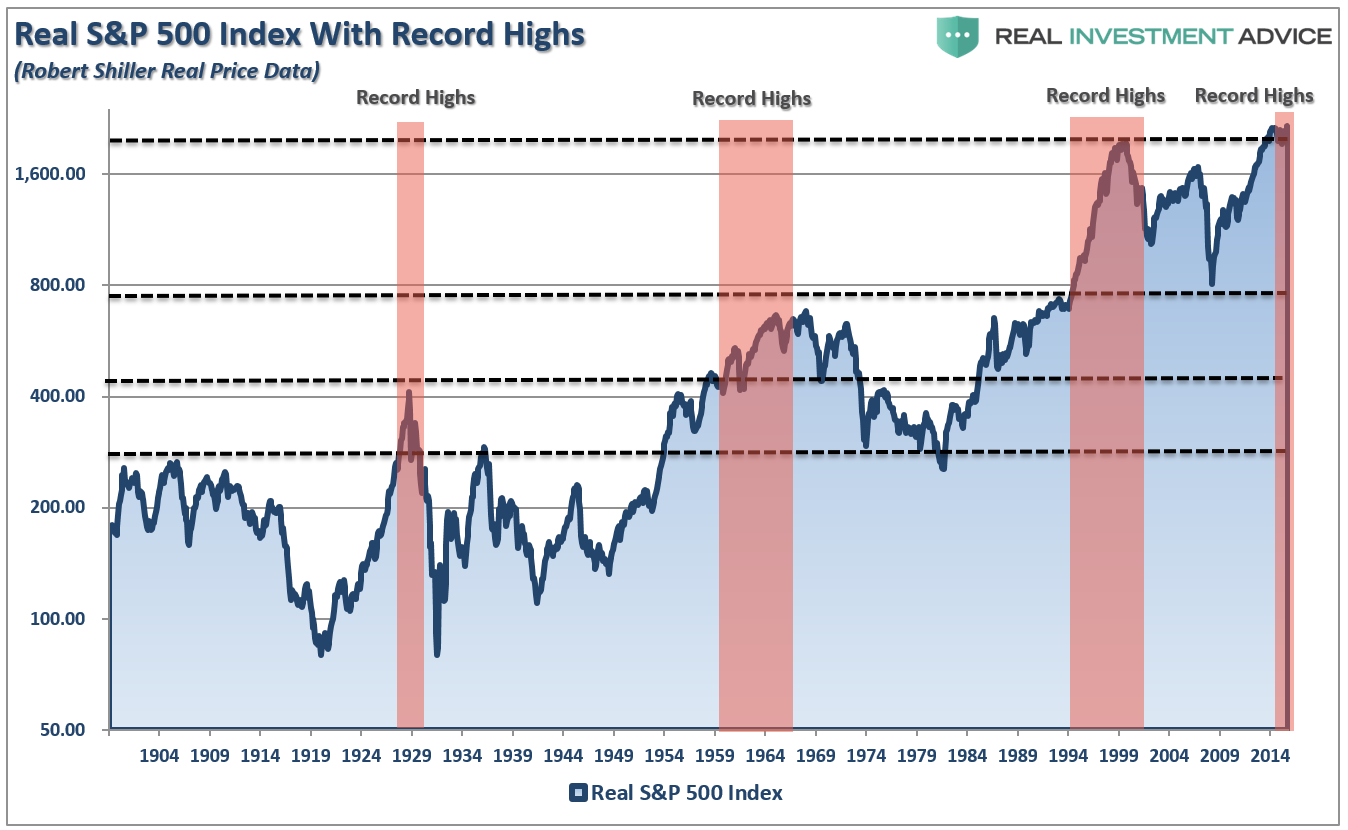

Importantly, when discussing the “bull/bear” case it is worth remembering that the financial markets only make “record new highs” roughly 5% of the time. In other words, most investors spend a bulk of their time making up lost ground.

The process of “getting back to even” is not an investment strategy that will work over the long term. This is why there are basic investment rules all great investors follow:

- Sell positions that simply are not working. If they are not working in a strongly rising market, they will hurt you more when the market falls. Investment Rule: Cut losers short.

- Trim winning positions back to original portfolio weightings. This allows you to harvest profits but remain invested in positions that are working. Investment Rule: Let winners run.

- Retain cash raised from sales for opportunities to purchase investments later at a better price. Investment Rule: Sell High, Buy Low

These rules are hard to follow because:

- The bulk of financial advice only tells you to “buy”

- The vast majority of analysts ratings are “buy”

- And Wall Street needs you to “buy” so they have someone to sell their products to.

With everyone telling you to “buy” it is easy to understand why individuals have a such a difficult and poor track record of managing their money.

As we head into 2017, trying to predict the markets is often quite pointless. The risk for investors is “willful blindness” that builds when complacency reaches extremes. It is worth remembering that the bullish mantra we hear today is much the same as it was in both 1999 and 2007.

I don’t need to remind you what happened next.

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In