by Jeffrey Saut, Chief Investment Strategist, Raymond James

“Miracle on 34th Street” is a 1947 movie whose plot takes place between Thanksgiving Day and Christmas in New York City. It focuses on a department store Santa Claus who claims to be the real Santa. I have watched the movie ever since I was a pup and always look forward to seeing it over the holidays. This year I got to watch it from my room at the Grand Central Hyatt in New York City. Cheryl and I always stay at the Hyatt because we learned to use the subway system while living there in the early 1970s, and the convenience of getting to the “tubes” from the Hyatt is seamless. Given the recent “polar vortex” (Vortex) the ability to go from Grand Central Station to Wall Street without going outside was spiffy, but I digress.

Most readers of these missives know for the past three weeks I have resided at the Hyatt in NYC seeing portfolio managers (PMs), doing various media “hits,” and marinating olives with the group “Friends of Fermentation.” Indeed, we had our own miracle on 34th street over the past few weeks. Last week began with the Friends of Fermentation (FOF) Christmas party where such notables as Arthur Cashin, Bob Pisani, David Kotok, John Mauldin, Charlie Plosser (former president of the Philly Fed: Plosser) were in attendance. Serendipitously, a number of us walked from the party over to Delmonico’s (Delmonicos) to have dinner and pick Charlie’s “Federal Reserve” mind. The joint was full and the maître ‘d was surprised that eight of us showed up without a reservation, telling us to wait a few minutes to see what he could do. Again, serendipitously, we were ushered into the private dining room in the back of the restaurant.

Tuesday I met with accounts during the day and at 4:30 p.m. rode the number 4 express down to Bobby Van’s for the nightly gathering of FOF. Hereto in attendance were many notables including the uber-smart Danielle DiMartino Booth (Dimartinobooth), who invited us to dinner along with about 20 of her closest friends. She held “court” there leading a spirted discussion about the state of the state. Wednesday it was more of the same except when we showed up for FOF our reserved corner of the bar was packed with cameras to video Arthur Cashin’s annual prediction for the new year. CNBC’s Bob Pisani was the moderator and the guy sitting behind him in the video is me (video). When the taping was over Bob and a few of us took the number 4 express back to midtown to “crash” Wall Street icon Buzzy Geduld’s (Buzzy) Christmas party, once again serendipitous. Thursday was more of the same.

So what did I learn over the past few weeks? Well, at the Blackrock CIO Roundtable Larry Fink told us that this is the biggest “honeymoon” he has ever seen, but that it feels like you should stay long stocks into the January 20th inauguration where reality just might show up. My dinner with Mary Lisanti (PM of the Lebenthal Lisanti Small Cap Growth Fund) was enlightening combined with a bunch of investment ideas. I have known Mary for years and have stayed long her fund (ASCGX/$18.82) because over the longer term I believe Mary will make me money.

I met with Hamilton Reiner, the PM for the JP Morgan Hedged Equity Fund (JHQAX/$17.28), whose objective is to provide participation in rising equity markets and a hedge in declining markets using a disciplined options strategy. I also met with Yaz Romahi, the CIO for JP Morgan’s Quantitative Beta Business. JP Morgan has seven principles for long-term investing: 1) plan on living a long time; 2) cash isn’t always king; 3) harness the power of dividends and compounding; 4) avoid emotional bias by sticking to a plan; 5) volatility is normal, don’t let it derail you; 6) staying invested matters; 7) diversification works.

Next I met with Advent Capital’s Mark Piazza and Paul Latronica. They were brought to my attention by the folks at Alex Brown, who use Advent’s Separately Managed Accounts (SMA) to invest in convertible securities. They pointed out that there is not a lot of “fast money” in the convert complex and that’s a good thing. As you know we are very fond of converts. Andrew Duffy is the PM of the James Alpha Global Real Estate Fund (JARIX/$18.46). The fund invests in specialty REITs with the objective to outperform the benchmark index over the long term by managing concentrated portfolios of high quality global real estate securities that generate consistent alpha with below average volatility. Andy used to work at Raymond James and has close ties to our REIT team if you want to check out his expertise. Marc Halle is yet another REIT-centric PM; he manages the Prudential Global Real Estate Fund (PURAX/$22.25). REIT (Real Estate Investment Trust) portfolio benefits include: 1) Income; 2) lower volatility; 3) diversification; 4) represent real assets; and 5) total return.

It’s always great to meet with my friends at Goldman Sachs. I met with Gary Chropuvka and Monali Vora, two of the PMs of the Goldman Sachs U.S. Equity Dividend and Premium Fund (GSPKX/$12.19). The fund has no sector “bets” and has interesting tax advantages. In attendance was also Kyri Loupis, the PM for the Goldman Sachs MLP Energy Infrastructure Fund (GMLPX/$8.12). He told me MLPs (Master Limited Partnerships) are set up for a number of good years going forward and that the bad news is in the rearview mirror for the midstream and downstream MLPs.

The final meeting was with one of the best stock pickers on Wall Street, legendary investor Ron Baron (Baron Capital). Obviously we shared stock ideas that Andrew and I will be discussing in future musings. I also met with Michael Kass, PM for Baron International Growth Fund (BIGFX/$17.96), which is now covered by Raymond James’ mutual fund research team. Of the five major asset classes, emerging markets are the cheapest, according to Raymond James Asset Management Services.

The call for this week: As always before purchase of any of the aforementioned mutual funds they should be vetted by investors and their financial advisors. As for the equity markets, so far our models have been surprisingly accurate. On a VERY short-term basis our models looked for some kind of trading peak last week followed by either an attempt to sell stocks off, which doesn’t get very far, or a sideways pause. In either event we would try not to get too cute with portfolios here since we expect the markets to grind higher into late January/early February. As stated in last Friday’s Morning Tack:

Yes, we know the S&P 500 futures have rallied over 200 points from their November 8 overnight lows, and that is one heck of a rally, so a brief pullback is certainly not out of the question. Our work would target 2200 – 2230 as the maximum drawdown. In fact, a full retracement of the most recent leg to the upside works out to 2230. Yet, such a pullback only serves to rebuild the market’s internal energy and extend the rally. To be sure, our models called this rally and they continue to suggest stocks grind higher into late January or early February.

So, we will leave you with this sound advice from the “must have” service Bespoke Investment Group:

Already, there has been increasing chatter in the last several days that the rally since the November election is based on hype and sentiment and nothing concrete. We will be the first to admit that we have no idea how the next four, or possibly longer, years will ultimately turnout, but one thing we would stress is that if you are in the business of investing and haven’t realized that the market is forward looking, you are in the wrong business.

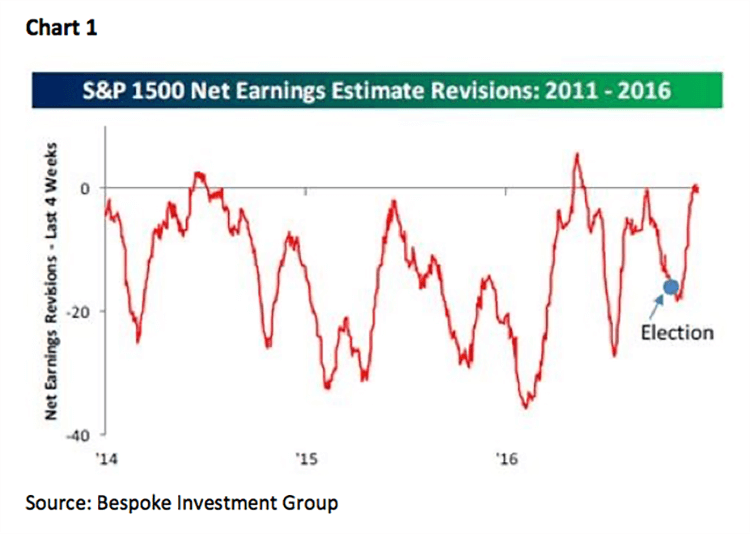

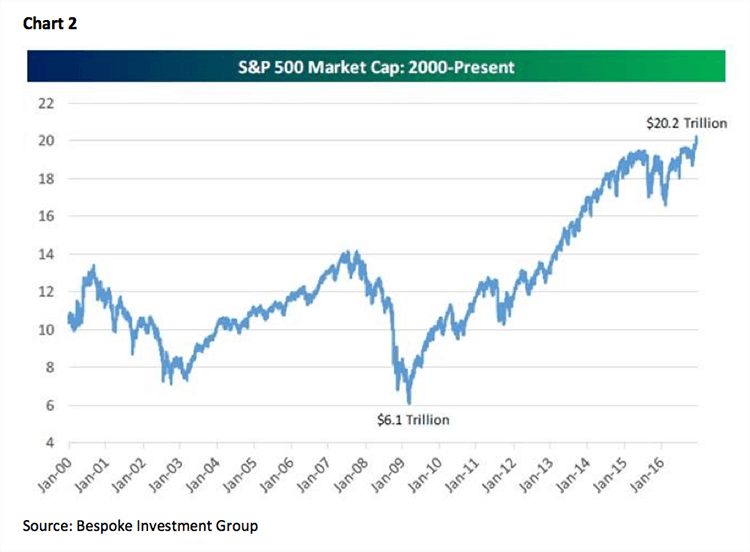

P.S. We continue to believe the markets are transitioning from an interest rate to an earnings-driven bull market, as reflected by analysts’ S&P 1500 Earnings Estimate Revisions (see chart 1 on page 3). And for those of you worried about consumer spending, since the March 2009 “lows” (we were bullish) the S&P 500 (SPX/2258.07) has added $14 trillion of wealth to investors’ balance sheets (chart 2).

Copyright © Raymond James