First Brexit, now a Trump and Republican populist victory. What are the investment implications of the Republican sweep and its effect on the global populist movement?

SUMMARY

- Trump’s victory and Republican sweep make significant policy shifts more likely

- The growth outlook improves, as taxes and regulation are likely reduced

- Global populism in Germany, Italy, France gain momentum

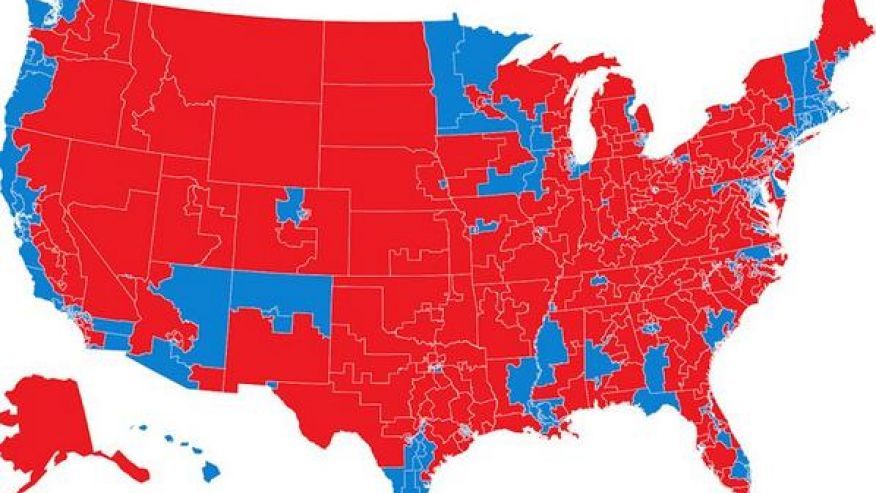

Defying nearly all prognostications, Donald Trump has beaten Hillary Clinton to be the next president of the United States. Importantly, the Republicans have also held control of the Senate and the House of Representatives — leading to one party control for the first time since the beginning of the Obama administration. Given the electoral dynamics of both the House and Senate races in 2018, the odds tilt toward the Republicans retaining this control for the full four-year term of Trump’s presidency. What might this mean for the U.S. economy and world financial markets? Single party control is a positive for legislative progress in Congress — an area sorely lacking in recent years. While the knee-jerk reaction in financial markets overnight was a selloff in equities, the intermediate term reaction will be dependent on how closely President-elect Trump hews to his populist rhetoric of the campaign trail. His acceptance speech was gracious toward Secretary Clinton, and he focused on accelerating economic growth and rebuilding infrastructure. He also promised to “always put America’s interests first,” touching on the key uncertainty about our geopolitical strategy under a Trump presidency. We think the growth outlook likely improves with the Republican sweep, as taxes and regulation are likely reduced. We would also not expect a major trade war as Trump is likely to prioritize economic growth. We are also likely facing some upward shift in the interest rate environment, due to both higher growth and Republican orthodoxy about monetary policy.

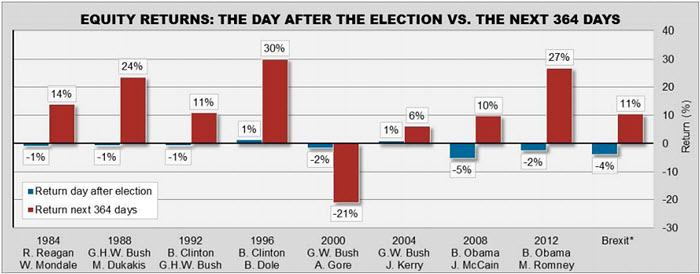

EXHIBIT 1: DAY AFTER RETURNS – NOT MUCH SIGNAL

Election-related returns fade as fundamentals take over.

Source: Northern Trust Asset Management, Bloomberg. Returns measured use the S&P 500 Index for election years and FTSE All-Share Index for Brexit. *Brexit only measures returns through the next 137 days through 11/8/2016.

As we show in Exhibit 1, the stock market has sold off the day after election way in six of the last eight instances (and seven of nine instances if you include the Brexit vote). Our upcoming investment strategy discussions this week will focus not on this week’s trading, but on how much the outlook for the economy and risk taking has changed in the wake of the election results.

So where do we go from here? A first recommendation is to not put too much weight on the simple outcome of the election as a major determinant of the market outlook. While stocks have frequently sold off post-election, the returns over the next year are more greatly influenced by the business and financial market cycles. The U.S. economic expansion looks set to continue, and global purchasing manager data has been improving in recent months. It will also be important to see who Trump nominates to key administrative positions and what his key post-election messages are as a sign of how populist he will be once in office. Single-party control in Washington could prove to be pro-growth as the legislative log-jam should finally start to break. A second recommendation is to prepare for continued divisive politics in Washington, D.C. — but they will be more intra-party than inter-party. While the Republican sweep may imply greater stability in Washington, Trump was not elected by the traditional Republican base and his support from the establishment was very uneven. House leader Ryan’s position could be in jeopardy as he is the most prominent member of the Republican establishment, but the lack of an obvious successor may help him. We expect the Republican sweep to be positive for several sectors of the financial markets, including energy, infrastructure and financial firms. The final point is a reminder that the rise of populism is a global phenomenon — with Italy being the most at risk amongst developed countries while Japan is the most insulated.

Each new election raises the hope for improved governance, and the Republican sweep raises the possibility of greater progress than under divided government. We would expect both House Speaker Paul Ryan and Senate Majority Leader Mitch McConnell to weigh in with a positive message about a focus on economic growth and rolling back some of the most unpopular Obama administration initiatives. What legislation has the highest chance of passing in the new Congress? Congressional priorities may be as important as those of President-elect Trump, and the intersection is where the most progress will be made. Trump has focused on increasing economic growth — which will lead to negotiations on corporate tax rate cuts and a reduced tax on repatriated profits. A cut in the corporate tax rate from 35% to 20-25% will be under discussion, but the current deficit levels of 3.2% of gross domestic product may push this cut toward a revenue-neutral approach. A temporary reduction of tax on repatriated overseas profits looks to be a no-brainer, and the proceeds could go toward partially funding infrastructure spending. While Trump had floated a $500 billion target for infrastructure spending (an annual boost to GDP of approximately 0.6% with a 5-year plan), the actual amount will be subject to compromise with Congress. Additionally, serious change to the Affordable Care Act (Obamacare) is likely as this has been a political priority for both the Congressional Republicans and Trump.

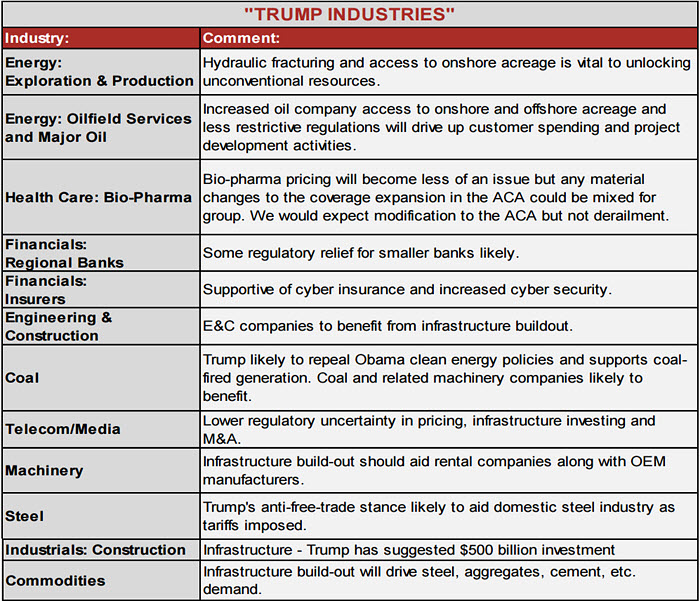

TRUMP’S IMPACT ON INDUSTRIES

In Exhibit 2, we assess the expected impact of a Trump presidency on the major industry groups likely to be affected. Further detail of each group follows on the subsequent pages — this is a summary of the more detailed analysis we presented in our September 30 report: Election 2016: Too Close to Call.

EXHIBIT 2: TRUMP WINNERS

Source: Northern Trust Asset Management Equity Research

Consumer

Under a Republican White House, any plan to dismantle or place restrictions on the Affordable Care Act that subsequently lowers the population’s health care/drug coverage would likely dampen prescription volumes and negatively impact the drug retailers. On the flipside, Obamacare has been viewed as unfavorable for the restaurants and retailers since it has driven benefit costs for the hourly employee base higher. Any tax cuts/reforms that boost the wealth-effect would be constructive for certain areas within specialty retail (i.e. high-ticket discretionary categories such as jewelry). Trump is viewed more favorably for the labor costs of retailers and restaurants given his talk of letting the states set their own wage rates and keeping them largely intact, as well as limiting the federal minimum wage to $10 per hour. It is worth noting that most states are already set to be above or near this level in 2017 and most retailers and restaurants within our coverage universe have already talked about paying above state levels to remain competitive for desirable employees.

Health Care

The Affordable Care Act could be materially impacted by the election. We think that Trump has not shown detailed interest in health care and we believe a Republican White House would defer the health care agenda to party leadership in Congress. We anticipate the Republican leadership will seek to modify the Affordable Care Act but not derail the legislation since it has expanded healthcare coverage to over 25 million people. Rhetoric and sentiment remain mixed in health care due in large part to the elections. However, the underlying business environment appears to be relatively strong. Bio-pharma pipelines continue to progress through clinical trials in areas of high unmet need like oncology, psychiatry, and liver disease. Medical device companies, which sell into hospitals, have reported strong revenue growth with most companies pointing to strength in the United States.

Financials

We believe financial stocks will respond favorably to Trump. He has articulated polices that are supportive of smaller regional and community banks, including rolling back some of the more onerous regulatory requirements, and negative for larger banks. The Republican platform calls for a return of the Glass-Steagall Act, which would be a negative for the large banks. Ultimately, we would be surprised if Glass-Steagall was to become law once again, but it remains a risk case for the largest banks. Trump has publicly opposed the Dodd-Frank legislation, though we see modifications to Dodd-Frank as far more likely than wholesale removal. Trump’s opposition toward the Affordable Care Act is a negative for the insurance brokers/employee benefit consultants that established private health insurance exchanges.

Technology

The key election issues for the technology sector are the immigration reforms as they relate to the use of H1B visas, and the corporate tax reform, including a potential repatriation holiday for offshore cash. In terms of immigration and the use of H1B visas in IT services, both candidates talked about limiting the use of low earning foreign workers by requiring higher wages for visa holders in an effort to incentivize companies to hire U.S. workers first. Trump has also discussed requiring companies to hire American workers first before using H1B visas. From a corporate tax perspective, Trump’s policy includes lower corporate tax rates and a likely cut in the tax on repatriated overseas profits. We estimate the top five tech companies have over $500 billion in cash offshore (85%-90% of their respective total cash).

Energy

A win by Trump will be considered a positive for the oil and gas industry but his ability to work with Congress and his strategy on trade will determine the degree to which the industry benefits. Trump’s views on the oil and gas industry outside of his “America First Energy Policy” which places U.S. energy independence high on the agenda are not well known. Trump seems to take an “all of the above” strategy when it comes to energy sources but he is on record as favoring the Keystone XL pipeline, use of hydraulic fracturing techniques, supporting offshore exploration and development, and lifting or reducing regulations on oil and gas development on federal lands. He is also against the main renewable energy sources (wind and solar) and should be expected to come out against significant subsidies to support their use/expansion. In addition to Trump’s general support for hydrocarbon fuels over renewables, he also sees the development of the nation’s hydrocarbons as a source of job creation and economic growth. On the other hand, there are reservations about Trump’s views of current and future trade agreements and how they will impact the oil and gas industry. A pro-hydrocarbon agenda but a hawkish trade strategy could end up hurting the U.S. oil and gas industry. Trump is likely to seek repeal of several of Obama’s environmental/energy regulations including the Clean Power Plan and the ban on leasing federal land for coal mining. We would anticipate that Trump could be against natural gas exports given how vocal he has been regarding free-trade.

Industrials

We believe that our general industrial coverage will see minimal impact due to the election. The diversified nature of the majority of our coverage means the most companies would see as many positives as negatives. Both candidates indicated that they would boost spending on infrastructure if elected. We anticipate little measureable impact for our non-defense coverage from any increase in government spending. Elections are often presumed to have a large impact on defense companies, but we do not anticipate a significant impact to the defense budget. Trump has professed to be supportive of continued spending on national defense, but he has not offered much in the way of support for specific programs or initiatives.

Infrastructure

Trump has suggested an infrastructure spending plan of roughly $500 billion, but of course Congress controls spending. Under Clinton or Trump we anticipated an increased spend on infrastructure including water and bridges. Key beneficiaries would be engineering and construction companies coupled with domestic producers of commodities including aggregates, steel and cement. Trump’s policy also favors U.S. producers of the commodities and related equipment. Rental companies would also likely be key beneficiaries.

Transportation

Trump has been vocal against free trade and has even suggested a 45% import tariff on Chinese imports. This would be a net negative for both global and U.S. transportation companies. The key beneficiary within the commodity complex would be U.S. steel producers and the broader domestic manufacturing industry. As rail and cross-border trucks are used to move both finished goods and raw materials between the U.S. and Mexico, rolling back free trade would be a net negative for the transport companies.

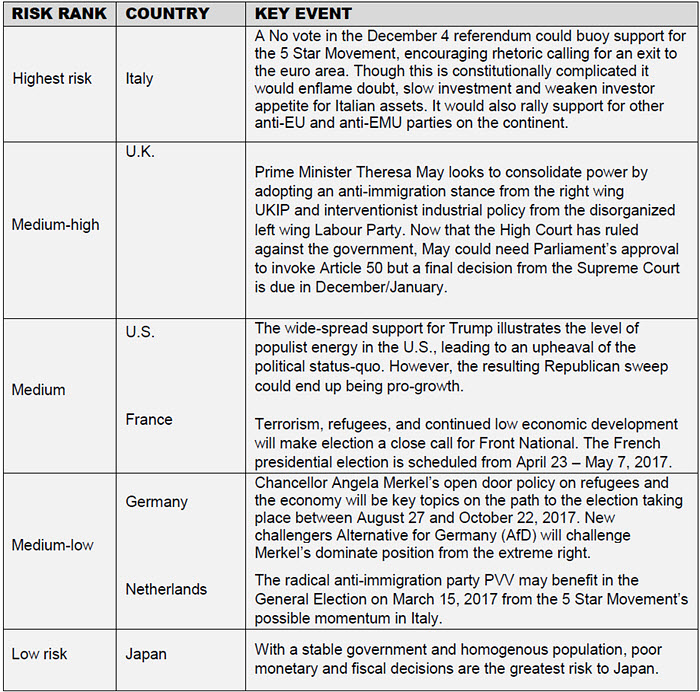

THE RISE OF GLOBAL POPULISM

The wide popularity of Trump (and Bernie Sanders on the Democratic side) is illustrative of the global phenomenon of populist politics, and is reflected in our Populist Roullete theme. Middle class families in the developed world have increasingly felt left behind during the rush to globalization, and real income growth has meaningfully lagged financial asset appreciation since the end of the global financial crisis in 2009. The increasing support to populist parties such as Syriza in Greece, Podemos in Spain and the Front Nacional in France are evidence of this, as was Britains vote to exit the European Union. In conjunction with our senior sovereign credit analyst, Claire Meier Underhill, we developed a ranking of populist risk across leading developed economies — as shown in Exhibit 3. In this exercise, risk was defined as the potential for the development of economic policies that would be negative for growth or inflation, leading to investors demanding increasing risk premiums for the representative country.

EXHIBIT 3: POPULISM RISKS FOR KEY COUNTRIES

Source: Northern Trust Asset Management

Italy

On December 4, Italy will vote on a national referendum to reform the Constitution in hopes of increasing governmental stability and functioning (Italy has had 63 governments in the 70 year history of the Republic). If the referendum were to fail, the populist 5 Star Movement would likely gain additional momentum and Prime Minister Matteo Renzi will be weakened. This could throw the Italian economy for a loop and it would be a catalyst to roil Europe as a whole. The referendum will not have an immediate effect on the economy, but would definitely give impetus to the 5 Star Movement’s quest for power and for another referendum on EU membership.

The Italian Treasury realizes Italy’s large borrowing program is only sustainable as members of the EMU, including the ECB backstop, but the voters don’t care and have shown globally that they are not responsive to Armageddon threats when voting against the status quo. Italian growth and inflation are already painfully low but could easily swing negative if the 5 Star Movement took power and threatened EMU membership.

The United Kingdom

The rise of populism in the U.K. is best illustrated by the Brexit vote which has thrown traditional U.K. politics into disarray. The Labour party is still in chaos as Jeremy Corbyn’s leadership swings the party to the far left — isolating moderate Labour members. Prime Minister Theresa May is trying to consolidate power and secure the right flank from UKIP by adopting anti-immigration stance and more inward industrial policy, and secure the left flank/moderate Labour Party with labour-driven and nationalistic/interventionist policies.

Brexit noise has hit the pound hard, which increases inflation but the Bank of England has been willing to look through this so far to support job creation and risks around Brexit. The FTSE is still in positive territory, while 10-yr Gilt yields are lower year-over-year but on a climb since the referendum (June 23). Inflation was creeping up before the move in the pound and is likely to continue moving higher. As the political landscape develops and Brexit becomes messier growth is likely to dip as well. Current U.K. policy is looking like French social democracy and this would not be constructive for growth longer-term. The recent court ruling requiring Parliamentary involvement in the invocation of Article 50 may somewhat constrain the hard-Brexit campaign, however.

Germany

The refugee crisis and Chancellor Angela Merkel’s Open Door Policy has stressed the middle and working class, increasing the populist pressure on traditional political parties. The emergence of the populist AfD party is significant, but Merkel’s CDU party is still number one or two with a diminished lead. We are still a long way from the September 2017 elections that could drive populist rhetoric either way. Germany’s hardline dealing with the European Sovereign Debt Crisis paints it into a corner when talking about expansionary policies despite its robust fiscal position. But if the SPD or CDU stay at the helm without having to compromise to the AfD, Germany will drive EU policy to best serve Germany and make it into what is best for Europe. ECB action inoculates market reaction and German borrowing needs and the ECB support a continuation of negative rates for Germany. Anti-trade and anti-globalization could hit Germany’s export business also if the trade weighted exchange rate appreciates. Political noise in 2017 may slow growth, but it is unlikely to make a big dent and inflation pressures remain constrained.

France

The risk of populism is rising in France, and the poor standing of the current president increases the focus. The election next year will be harder to call than any in memory. The Front Nacional (FN) has been around for a long time and only once made it to the second round where it was resolutely defeated but its message is resonating more with voters who are frustrated by terrorism, refugees and continued low economic development and growth. The short term outlook for growth may be higher under a FN government but we believe it would be detrimental to long term growth and further hinder the difficult private investment metric in France. Former Prime Minister Alain Juppe is leading the polls to gain the nomination for the center-right, and could be viewed as a centrist choice less likely to bow to populist pressures.

The Netherlands

Populism is not currently a growing threat in the Netherlands as it already has a wide and balanced spectrum of politics. The radical, anti-immigration party PVV (12 seats in current 150 seat house) always plays some part in government formation. The largest challenge is for the current PM Mark Rutte of the VVD to attract the anti-EU vote. The Netherlands alone voted against Ukraine becoming an associate member and Rutte will have to keep up that anti-EU sentiment without straying too far into anti-immigrant territory as to lose his liberal voters’ support. The last election was in 2012, and the resulting government has been the most stable in a long time due to the large coalition between the VVD and the PvDA with 76 seats.

The Dutch economy has fared very well since implementing significant banking and welfare system reform. Growth is slow but steady and there are no large contingent liabilities. Like Germany, it is a large exporting country, and will struggle if Germany struggles. Geert Wilders and the PVV will get a big boost if the 5 Star Movement makes headway in Italy and will provide a boost to France’s FN. However, we think the opportunity for populist policies in the Netherlands, in isolation, to disrupt growth is limited.

Spain

Spain seems to have passed the peak of populist threat for the time being. Podemos is stronger and more established after the Socialist’s (PSOE) deterioration but so is the Center-right PP. Podemos is likely to prove somewhat disruptive as the new leading opposition once a government is formally formed but the Spanish economy has been performing well and support for maintaining the status quo grows every day.

Japan

There is not a real populist movement to speak to in Japan because of the homogenous nature of the population. While the current growth/inflation dynamic is problematic and we expect to see more action on both the fiscal and monetary side, the government looks stable. PM Abe’s support is starting to wane but this is from a very high rating of 70%+ to the 50%+ level.

CONCLUSION

Populist politics has struck another nation, as the United States has now joined the United Kingdom in surprising the markets with a populist election outcome. The impact on the U.S. economy could actually be positive, however, as the legislative logjam that has existed for six years will be broken. We expect the Republican White House and Congress to focus on supply-side reforms like tax reduction and regulatory relief, with boosting economic growth as the primary focus. This may also lead to a change in the interest rate regime, with higher growth and Republican monetary policy orthodoxy changing the debate about interest rates. There may be some increase in risk premiums near-term, as investors won’t be confident in the outlook for trade or geopolitical engagement. The path of risk markets over the next year will be dependent on the outlook for economic growth, which we think is improving, and interest rates, which may now be biased to nudge upwards. While we view the economic risk of the Trump win as low, the geopolitical risk is considered medium as it is uncertain how Trump will deal with international engagement. The implications of the Republican sweep will be a key topic of discussion in November’s investment strategy meetings, which are being held this week. Our moderate overweight to risk assets has been underpinned by confidence in the economic outlook, which likely improves after the Republican sweep.

Special thanks to Claire Meier Underhill for her commentary on political risks, Sandeep Soorya for his commentary on health care ballot issues, and Tom O’Shea and Dan Ballantine for data research.

IMPORTANT INFORMATION: This material is provided for informational purposes only. Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Current or prospective clients should under no circumstances rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. Information is confidential and may not be duplicated in any form or disseminated without the prior consent of Northern Trust. Northern Trust and its affiliates may have positions in, and may affect transactions in, the markets, contracts and related investments described herein, which positions and transactions may be in addition to, or different from, those taken in connection with the investments described herein. All material has been obtained from sources believed to be reliable, but the accuracy, completeness and interpretation cannot be guaranteed. Information contained herein is current as of the date appearing in this material only and is subject to change without notice. Indices and trademarks are the property of their respective owners. All rights reserved.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. Periods greater than one year are annualized except where indicated. Returns reflect the reinvestment of dividends and other earnings and are shown before the deduction of investment management fees, unless indicated otherwise. Returns of the indexes also do not typically reflect the deduction of investment management fees, trading costs or other expenses. It is not possible to invest directly in an index. Indexes are the property of their respective owners, all rights reserved.

No bank guarantee | May lose value | NOT FDIC INSURED

© 2016 Northern Trust