by Eric Bush, CFA , Gavekal Capital

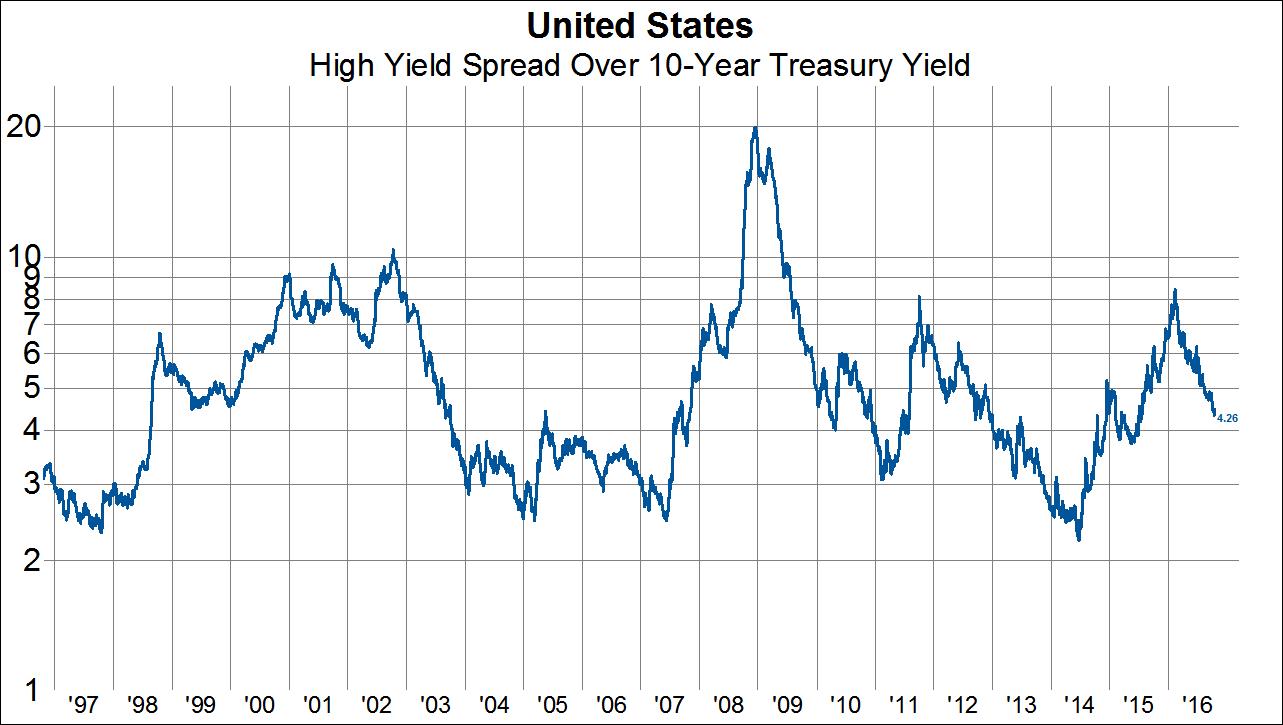

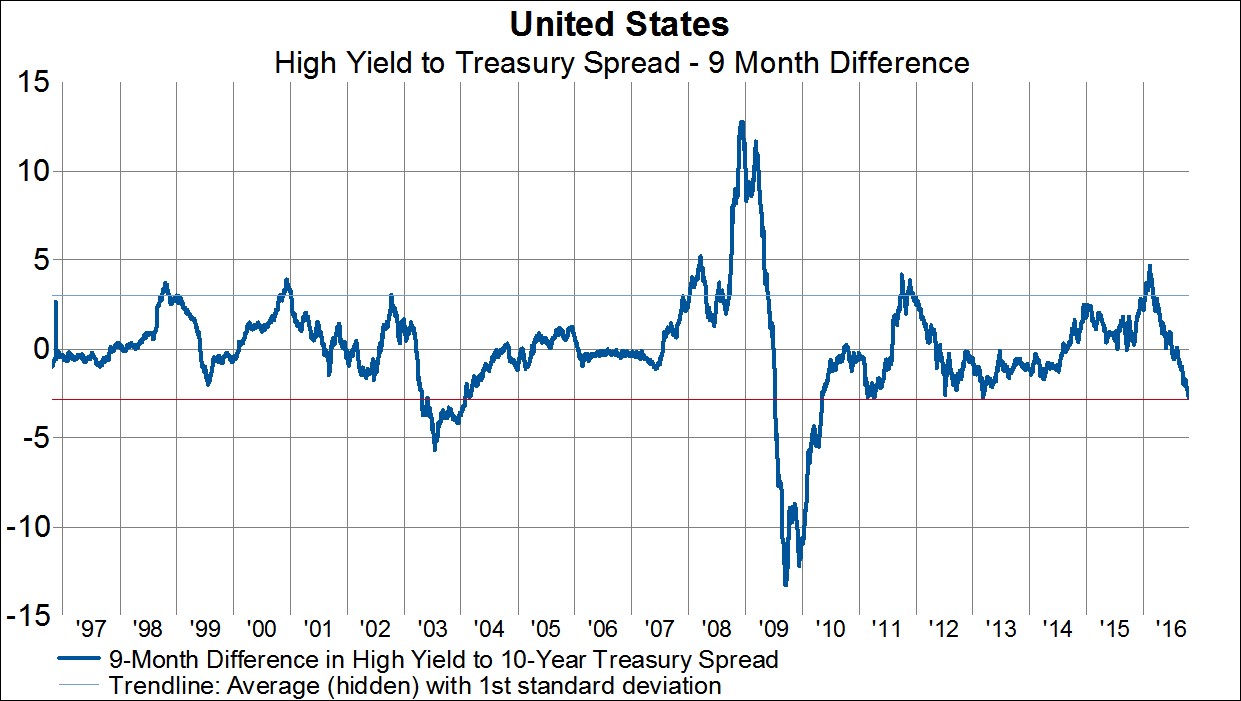

High yield investors have had a much different experience in 2016 than they did in 2015 (fortunately for them). The high yield spread over 10-year treasury yield blew out from 375 bps in June 2015 to 844 bps in February 2016. After peaking in February, the roller coaster turned back down and spreads today stand at just 426 bps, nearly retracing the entire move in 2015. Given this powerful move, spreads have compressed to a point where history suggests we may be at the end of this narrowing cycle. In the second chart below, we show the 9-month difference in the high yield spread over 10-year treasury yield. The light blue and red lines signify a 1-standard deviation from the mean going back 20 years. As you can see outside of a crisis period (i.e. 2008-2009), high yield spreads tend to widen out against US treasuries when this series reaches a 1-standard deviation from the mean. We are currently right at that level which is why we believe it will be tougher for high yield spreads to narrow further from here. Said differently, it seems to us that high yield bonds are overbought at the moment.

Copyright © Gavekal Capital