by Benjamin Streed, CFA, Fixed Income, Raymond James

October 17, 2016

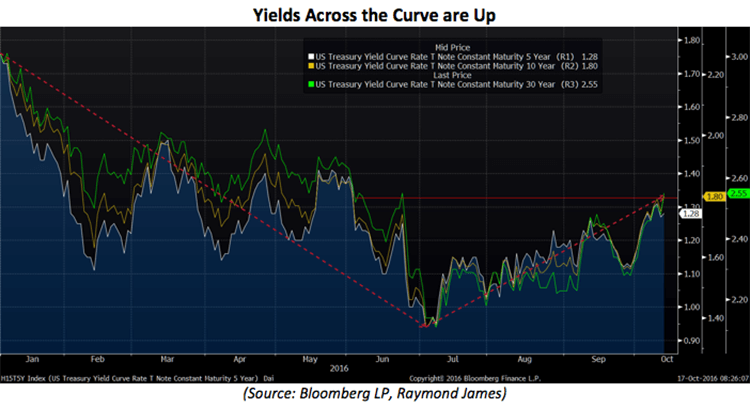

Over the last few weeks we’ve seen an uptick in volatility, helping push yields across the curve higher. Although there has been no real news or pinpoint catalyst for the sudden rise in yields, many in the markets point to a prevailing feeling that central banks are getting close to the end of their record stimulus. Although we’re clearly not there yet, markets are taking any indication from the major central banks, including the US Federal Reserve, European Central Bank (ECB), Bank of Japan (BOJ) as providing the proverbial “light at the end of the tunnel” for monetary stimulus in the post-recession era. Obviously, there’s still a very long way to go and it’s uncertain as to how close we really are to the end of the “unprecedented” stimulus regime we’ve seen since the Great Recession, but it does seems as if market sentiment is beginning to shift. Of course, as much as the markets have moved in the last month (see the chart below) it is always helpful to put current levels in context of where we’ve been historically. The 10y Treasury yield currently sits at ~1.80% having seen a sudden spike in yield from ~1.56% in late September, with 5y and 30y maturities seeing a similar pattern. However, we started the calendar year with a 5y yield of 1.76%, the 10y at 2.27% and the 30y bond at 3.01%.

We now find yields at their highest levels since June, before the summertime period in which some in the markets proclaimed volatility was “too low” and that yields were bound to head higher. Well, here we are in October and it seems to have played out exactly as this contingent had anticipated.

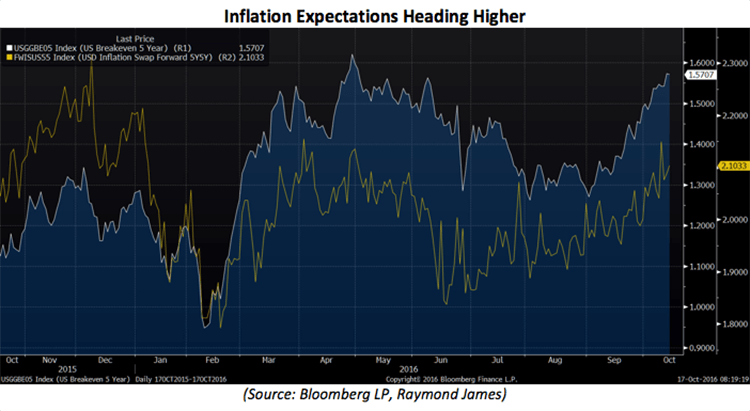

Meanwhile, inflation expectations are heading higher in the US as many take recent hawkish commentary from the Fed as an indication that the committee will raise rates for the second time in their December meeting. Additionally, some of the movement is the result of a mini “taper tantrum” brought on by the ECB when they hinted that if/when they decided to end their asset purchase program they would “taper” it down, even though they openly admitted they were likely to increase their stimulus in coming months. The market appears jittery and seemingly will hang on any and every hint of the end of monetary stimulus, even if it happens to be many months or years in the future.

Fed Chair Janet Yellen recently commented that they saw “plausible ways” that letting the US economy run hot, meaning above 2.00% inflation for a period of time, would help repair some of the damage done during the crisis. This comment, amongst others, sent markets back to work repricing the yield curve and pushing forward expectations for inflation higher. As always, it remains to be seen how this will all play out as the market has been known to get a little ahead of itself whenever sentiment from central bankers shifts even in the slightest. According to Bloomberg, the odds of a December rate hike stand at ~66%, close to the same level of certainty we saw ahead of last December’s hike. Stay tuned for more.

Copyright © Raymond James