by Jodie Gunzberg, Global Head of Commodities and Real Assets, S&P Dow Jones Indices

The S&P GSCI Total Return gained 4.1% in Sep., cutting the loss in the 3rd quarter to 4.2% and bring its year-to-date performance to 5.3%. 19 of 24 commodities were positive in Sep., from just 8 in Jul., the most to turn from negative to positive in two months since Jul. 2012. Energy gained 6.1%, making it the best performing sector and livestock performed worst of the sectors, losing 12.1%. The winning single commodity in Sep. was unleaded gasoline, gaining 11.4% and lean hogs lost 22.1%, the most of any commodity.

While the overall month was positive, the index was filled with extremes. Lean hogs and feeder cattle are having their 2nd worst months in history, the worst since Dec. 2003 and Aug. 2002, respectively. This drove livestock to return its 7th worst month ever since Dec. 2003 when it lost 15.8%. On the other hand, sugar and lead each posted 11.3% gains this month.

Adjusting for seasonality by looking only at historical months of Sep., while feeder cattle and lean hogs had their worst Sep. yet, it was the 3rd best ever for lead, 4th best for nickel and 5th best for aluminum, brent crude, gasoil, Kansas wheat and unleaded gasoline. It was also a strong Sep. in history for two sectors, agriculture posted its 6th best Sep. and industrial metals posted its 8th best Sep. Overall the S&P GSCI gained its first positive and best total return in Sep. since 2010, when it gained 8.5%.

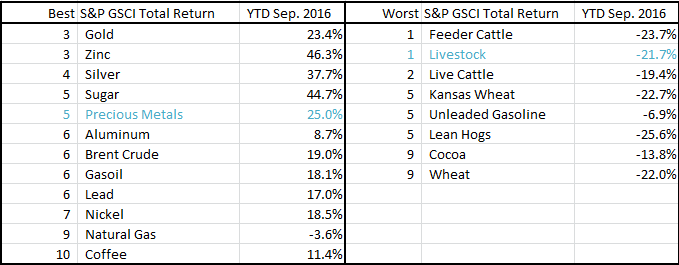

Commodities are on pace to have several big winners and losers this year. Thus far gold and zinc are set to have their 3rd best years in history while feeder cattle is set to post its worst year. Below is a table of commodities that are closest to be on pace for record setting years. Although natural gas is having one of its best years, it is still negative – it has only ever been positive six times through the year at this point.

Source: S&P Dow Jones Indices

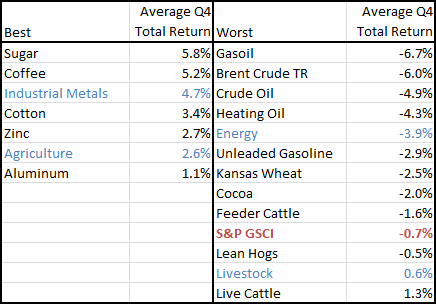

The S&P GSCI loses 74 basis points on average historically in the 4th quarter that is has been the worst performing quarter and is the only quarter that loses on average. Energy is known to have its worst quarter at the end of the year but some commodities in industrial metals and agriculture perform at their best in the last quarter. Since energy holds more weight and tends to drag other commodities down with it, only time (and fundamentals) will tell if commodities will end positive for the first year since 2012.

Source: S&P Dow Jones Indices

This article is a publication of S&P Dow Jones Indices LLC. © S&P Dow Jones Indices LLC 2016. S&P® is a registered trademark of S&P Financial Services LLC. Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. S&P Dow Jones Indices LLC is not an investment advisor. This publication is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold a security, nor is it considered to be investment advice.

Copyright © S&P Dow Jones Indices