by Lance Roberts, Clarity Financial

As I noted on Thursday, the Fed non-announcement gave the bulls a reason to charge back into the markets as “accommodative monetary policy” is once again extended through the end of the year.

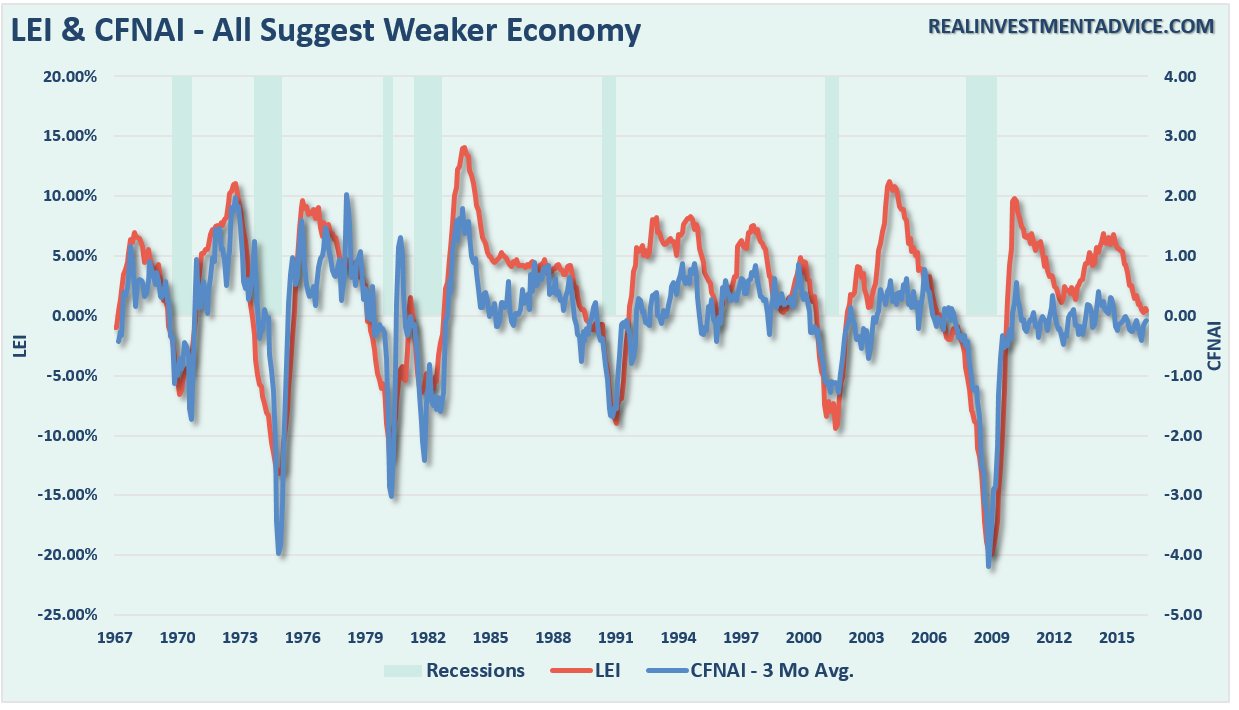

Of course, it is not surprising the Fed once again failed to take action as their expectations for economic growth were once again lowered. Simply, with an economy failing to gain traction there is little ability for the Fed to raise rates either now OR in December.

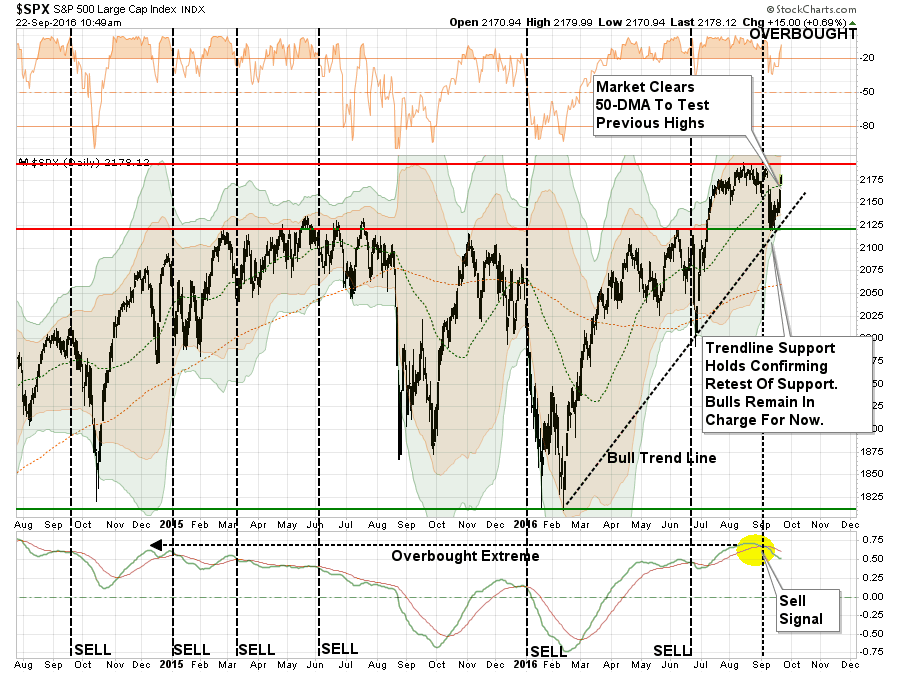

However, it was the docile tones of the once again “Dovish” Fed that saved market bulls from a “bearish” rout. The recent test of the bullish trend line from February lows combined with a move back of the 50-dma clears the way for the markets to retest, and potentially breakout, to new highs.

With economic data remaining extremely weak, and leading indicators continuing to roll over, the “bad news is good news as the Fed stays on hold” scenario continues to play to investor’s favor….for now.

The question that remains, of course, is when does the reality of the weak economic environment begin to impact the fantasy of stock prices.

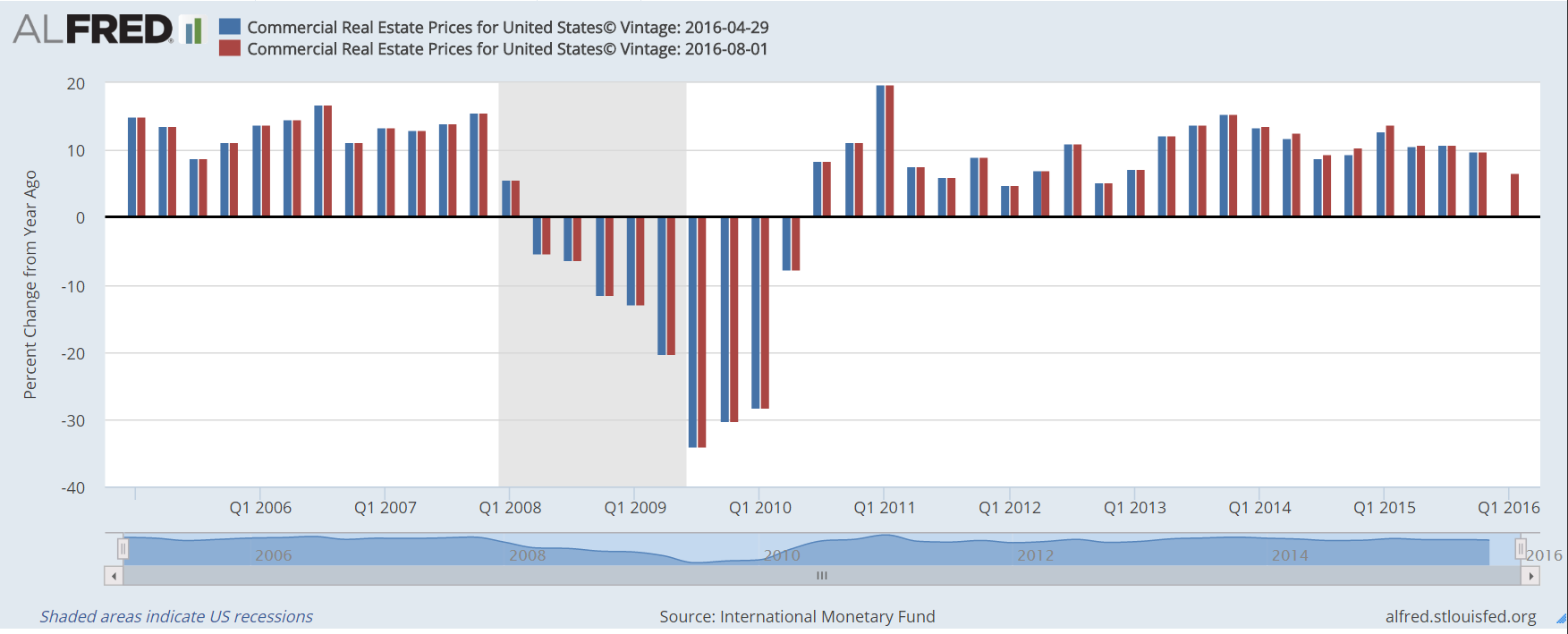

It was interesting that Janet Yellen mentioned “commercial real estate values” in her latest comments to the press. To wit:

“Yes. Of course, we are worried that bubbles will form in the economy and we routinely monitor asset valuations, while nobody can know for sure what type of valuation represents a bubble, that’s only something one can tell in hindsight, we are monitoring these measures of valuation and commercial real estate valuations are high. Rents have moved up over time, but still, valuations are high, relative to rents.”

However, for the moment, none of this matters. Global Central Banks continue to push assets into the market for now in the ongoing “chase for yield.” However, it is worth repeating that nothing last forever, but it can, and often does, last longer than you can imagine.

Unfortunately, so does the reversion to the mean.